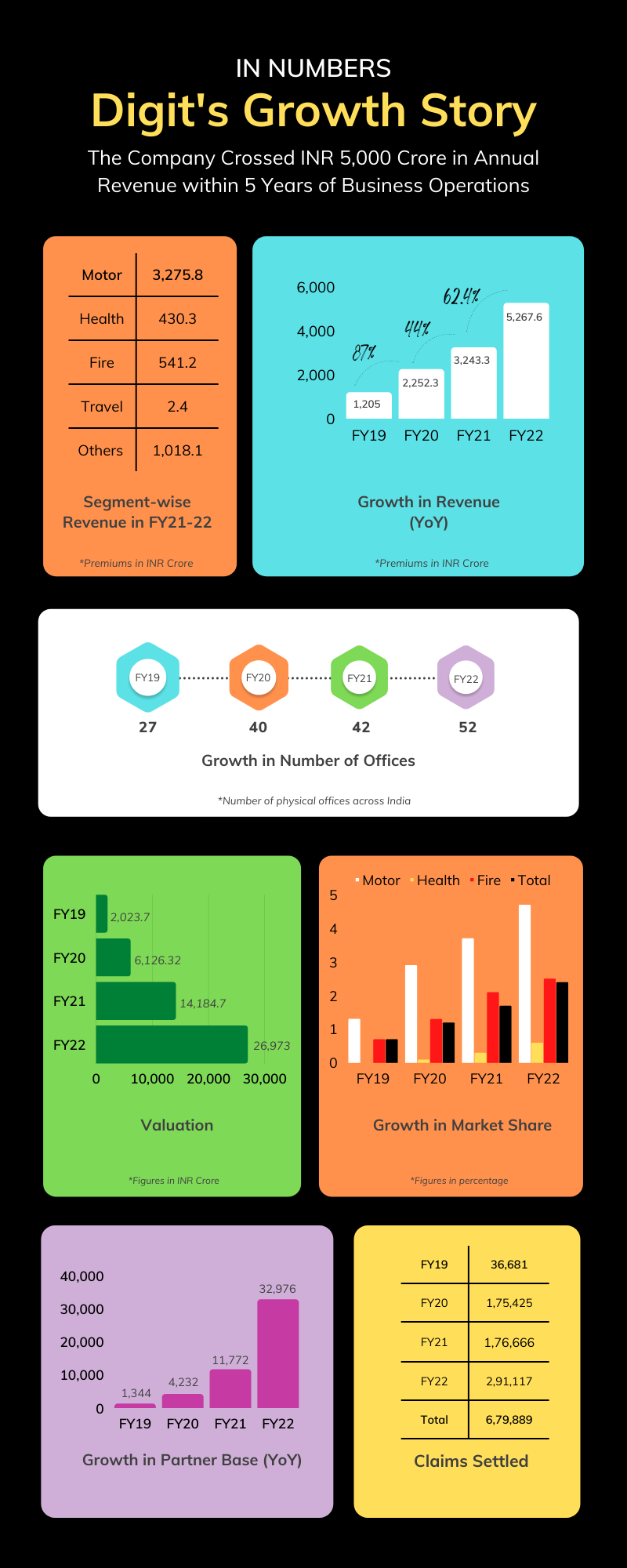

Digit Insurance is now one of the fastest-growing private general insurers in India, having recorded INR52.68bn (5,268 crore) in gross written premiums in FY21-22 after less than five years of operations.

Led by its motor, property, and health lines of business, the company also reported a growth of 62% in FY21-22 compared to the industry average growth of 10.9%, with its overall market share up 2.4% from 1.7% in the previous financial year. Its market share for motor business went up to 4.7% from 3.7% in the previous year, having raised INR32.76bn (3,276 crore) in premiums from its motor portfolio alone.

Across all products, Digit sold over 7.76 million (77.6 lakh) policies in FY21-22, a 40% increase from the previous year, and reported a solvency ratio at over 200% against the regulatory requirement of 150%.

Its ratio of losses to premiums earned decreased for both health and fire segments, a feat CEO Jasleen Kohli attributed to Digit’s improved underwriting models and claims management process.

“As a young insurer, this indeed is a moment of pride for us. But above all, it is a testament of our endeavours towards making insurance simple and more accessible. The collective efforts of our partners and employees have not only helped us accelerate our growth but [have] also ensured that more customers understand the importance of having adequate financial cushion,” Kohli said.

Motor, health, property, and travel insurance continue to be Digit’s top lines of business. in FY21-22, it insured over 385,000 (3.85 lakh) electric vehicles and 40,000 corporates under its group health business.