The United States excess and surplus (E&S) lines insurance industry has had a surge of premium flow into the channel over the past few years.

According to the 2021 Midyear Report of the US Surplus Lines Service and Stamping Offices, surplus lines premium exceeded $24 billion through the first half (H1) of 2021, marking a 21.9% increase over the same period in 2020. Premium bearing transactions also increased, exceeding 2.6 million in the first six months of 2021, up 7.2% over the prior year period.

Each of the 15 stamping offices, which collectively represent almost two-thirds of US premium volume, reported premium increases through midyear 2021, with particular areas of growth including: residential and commercial construction, excess liability, commercial property, management liability and cyber liability coverage lines.

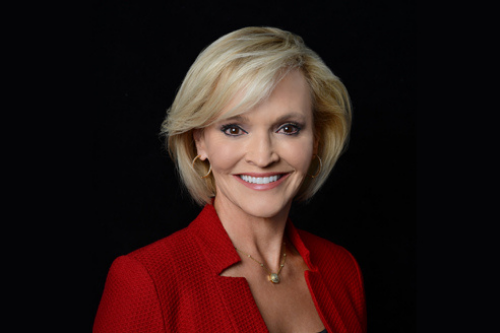

One reason why premium continues to flow into the non-admitted channel is the ability of E&S players to bring “creative solutions” to the table, said Brenda (Ballard) Austenfeld (pictured), managing director and president of the national property practice at RT Specialty and one of the Women Leaders in Insurance in the USA winners.

“In my view, the E&S lines segment continues to be an exciting space within the whole insurance industry,” she said. “I’m personally grateful to have been a broker my entire career, and to have been able to watch the shift of the flow into the wholesale channel firsthand. It’s really an exciting time to be in the E&S space.”

Read next: E&S is moving towards automation

Another factor influencing the rapid growth in the E&S market is the hardening in the standard commercial lines marketplace. Heavy natural catastrophe losses and ongoing challenges with social inflation across casualty lines have impacted commercial insurers’ underlying performance. As a result, many of the large commercial carriers are ditching ‘fringe’ risks, which are falling naturally into the specialty insurance market.

“Over the past several years, capital has continued to migrate into the E&S channel as capital providers have seized important opportunities [in] providing creative solutions,” said Austenfeld. “Many of those [solutions] are [delivered] through the wholesale-only delegated authority platforms; the number of new MGUs, MGAs and binding authority facilities has continued to increase in a significant way.

“The expansion into the non-admitted segment by capital providers has proven that more efficient and effective economies of scale can be gained. Capital deployed to those who are truly highly specialized and talented in a chosen industry class or coverage type is really the key to their success.”

The E&S market has also been helped along by its retail broker partners, according to Austenfeld. There was a trend a few years back where retail brokers were consolidating their use of wholesale brokers, and that had the effect of “elevating and strengthening” the E&S lines channel, she said, because every retail broker – regardless of size or geographic scope – started to “demand specialization” from their wholesale broker partners.

“Specialization is exactly what the E&S segment was built upon with ... the freedom of rate and form,” said the RT exec. “Very specialized talent with depth and breadth from the E&S sector not only helps strengthen offerings from our retail broker partners, or to our retail broker partners, but it also is a key to successful options delivered to insureds.

“The most important factor that has not changed with the expanded flow [of premium into the E&S sector], nor the COVID-19 pandemic, is speed. Retail brokers still expect and demand speed, speed, speed. And so, at RT, our team knows and understands the key differentiator is lightning-fast responses from all sides of our sector. Our retail broker partners require top talent and our job as leaders is to match the specialization with the opportunity.”

A general need to attract top talent is one of the challenges that the insurance industry – including the E&S sector – has felt acutely over the past few years, given the ageing population of the industry.

“At RT/RSG, we’re very fortunate to have anticipated the additional flow of business into our channel a few years ago, and we began a really strong recruiting and training program to truly build a deep bench of strength,” commented Austenfeld. “The E&S industry understands the need to develop top talent. We definitely bring a huge amount of value add to the equation. So with that, it’s all about finding those opportunities and the talent to train to capture those.

“But more than ever before, the price of top talent has really changed, and … many underwriters are currently moving around a lot because there’s so many more opportunities. There’s so much capital coming in with new entities being formed, and so that talent war continues and the price of hiring talent continues. I strongly believe that it’s important for … everybody within our great industry to really continue with a focused recruiting effort throughout all areas.”