As some counties demand he declares a statewide state of emergency to prevent carriers from dropping policyholders, California’s Insurance Commissioner Ricardo Lara has unveiled an effort to force insurers to resume writing policies in high-fire-risk areas — part of an overall plan to address the state’s insurance crisis.

It consists of three different ways insurers can meet minimum requirements for writing policies in areas deemed “high risk” or “very high risk” by Cal Fire. Insurance department regulators said this hybrid approach takes into account the state’s complex geography as well as the different risk levels that big and small insurers can afford to assume. Lara said this should help homeowners who have lost coverage or been forced to turn to the last-resort FAIR Plan.

Insurance companies would have these three options:

· Write 85% of their statewide market share in high-risk areas. The department explains it this way: “If a company writes 20 out of 100 homes statewide, it must write 17 out of 100 homes in a distressed area.”

· Achieve one-time 5% growth in the number of policies they write in high-risk areas.

· Expand their number of policies 5% by taking people out of the strained FAIR Plan, a pool of insurers the state requires to provide fire-insurance policies when property owners can’t obtain insurance elsewhere.

Insurers could meet these policy-writing quotas either at the county level or the ZIP code level.

Specifically, they could apply the 85% or 5% option in counties regulators have identified as distressed, or in ZIP codes regulators have deemed “undermarketed” and high risk — meaning the ZIP codes have at least 15% of policies in the FAIR Plan and have a certain percentage of residents who can’t afford their premiums. Insurers who already meet the 85% threshold would be required to maintain that for at least three years after a rate application.

Or they can choose the third option, reducing policies in the FAIR Plan statewide.

Regulators will update these areas at least once a year.

Gov. Gavin Newsom hailed Lara’s announcement as “critical” to fixing the state’s insurance crisis.

“As the climate crisis has rapidly intensified, the insurance system hasn’t been seriously reformed in 30 years – this is part of our strategy to strengthen our marketplace and get folks the coverage they need,” the governor said in a statement.

The statement comes as San Bernardino County supervisors have asked Newsome to announce a state of emergency that would prevent insurers from dropping any more policyholders.

“We’re trying to get the Legislature, the executive branch and the governor on board with the insurance commissioner to direct regulatory change,” Supervisor Dawn Rowe told the San Bernadino Sun.

“San Bernardino has a lot of mountain and desert communities, and both communities are struggling to get homeowners’ insurance,” she continued. “Buying a house and getting insurance is much more expensive and difficult if you live in an area considered to have a higher risk for fire and disaster.”

A growing number of property insurers have paused or stopped writing policies in California in recent years, citing increased fire risk and inflation. Others like State Farm have asked for substantial premium increases of over 50% for some lines.

If Lara’s proposal works as intended, homeowners could eventually find it easier to buy insurance with adequate coverage, as opposed to the expensive fire-only policies that many recently have been forced to buy from the FAIR Plan.

The proposed options aren’t technically requirements, because the state cannot legally require insurers to write either homeowner or commercial property policies. But the state expects insurers to comply because failure to do so would mean insurers would not be able to take advantage of something they’ve lobbied for long and hard: catastrophe modeling.

Lara unveiled the first part of his plan to allow for catastrophe modeling in March; this is the second part of that plan. Catastrophe modeling takes into account historical data and combines that with projected risk and losses — something insurers have been able to do in every other US state but California. Insurers will be able to use it there once Lara’s overall plan is active – although the regulations may not have effect until 2026 – commissioners want more immediate action.

Lara’s latest announcement made clear what he wants from insurers to allow them to model losses correctly – although the statement is aimed at the public, in reality the government knows that it is facing an insurance crisis.

“Insurance companies need to commit to writing more policies and my department will need to verify those commitments and hold them accountable,” Lara told reporters at the end of last week. When they submit rate reviews, insurers will state which of the pathways they choose. If they don’t fulfill the requirements of that pathway, “my department will use its law enforcement authority and reconsider rate reviews,” the commissioner said. That means possible lowering of rates and even refunds, according to his staff.

Lara’s staff said they established the requirements for minimum coverage in distressed areas after talking with different stakeholders, including insurance companies that said the requirements were achievable. But the draft regulations also include a possible out for insurers, who would be able to request “alternative commitments” because of changes in their size or scope of coverage, or the “frequency or severity of recent events” affecting them.

The draft regulation would give insurance companies two years after a rate filing to comply with the quasi-requirements — time regulators said the companies need to be able to write those policies. “We expect them to get started right away, but recognize they just can’t flip a switch,” said Michael Soller, deputy commissioner and spokesperson for the Insurance Department.

But Consumer Watchdog executive director Carmen Balber said in a statement that she sees those two years as a loophole that “lets insurance companies off the hook if they fail to meet their commitments.” Meanwhile, she said, consumers would have been paying higher premiums.

“The rest of the plan will still mean quick, massive rate hikes,” she told CalMatters. The group, however, has been accused of causing the very insurance crisis that is gripping the state now by getting California Proposition 103 narrowly passed in 1988 with Ralph Nader’s help.

The legislation required insurers to get the Insurance Commissioner’s approval before implementing insurance rates – The International Center for Law and Economics has calculated that prop.103 has cost Californians $25 billion – despite Consumer Watchdog’s claims to the contrary.

The legislation required insurers to get the Insurance Commissioner’s approval before implementing insurance rates – The International Center for Law and Economics has calculated that prop.103 has cost Californians $25 billion – despite Consumer Watchdog’s claims to the contrary.

One insurance industry group, the American Property Casualty Insurance Association, did not address any specifics of the plan released today, other than to say it “remains committed” to working with the Insurance Department.

Rex Frazier, president of the Personal Insurance Federation of California, called the proposal “complex, with many trade-offs,” but said his group also remains committed to working with Lara.

Lara has yet to release the other main parts of his overall plan, including making improvements to the FAIR plan and allowing insurers to include reinsurance costs in their premiums.

The Department of Insurance has released a list of ‘distressed counties’ that it requires insurers to commit to writing more policies for:

|

County |

Population |

|

Tuolumne |

54,531 |

|

Trinity |

14,768 |

|

Nevada |

104,666 |

|

Mariposa |

17,300 |

|

Plumas |

19,639 |

|

Alpine |

1,204 |

|

Calaveras |

44,708 |

|

Sierra |

3,226 |

|

Amador |

39,637 |

|

El Dorado |

191,385 |

|

Mono |

13,796 |

|

Lake |

65,417 |

|

Mendocino |

85,934 |

|

Siskiyou |

43,530 |

|

Butte |

220,200 |

|

Lassen |

30,999 |

|

Shasta |

182,029 |

|

Tehama |

66,219 |

|

Santa Cruz |

268,712 |

|

Humboldt |

136,779 |

|

Napa |

137,744 |

|

Del Norte |

27,860 |

|

Modoc |

8,910 |

|

Placer |

425,166 |

|

Monterey |

439,035 |

|

Marin |

264,353 |

|

San Luis Obispo |

284,010 |

|

Ventura |

847,504 |

Overview

The California FAIR Plan Association (FAIR Plan) is the Golden State’s safety net, offering property insurance to consumers who can’t secure coverage through standard insurance providers. It was introduced in 1968 following bushfires and the state’s riots.

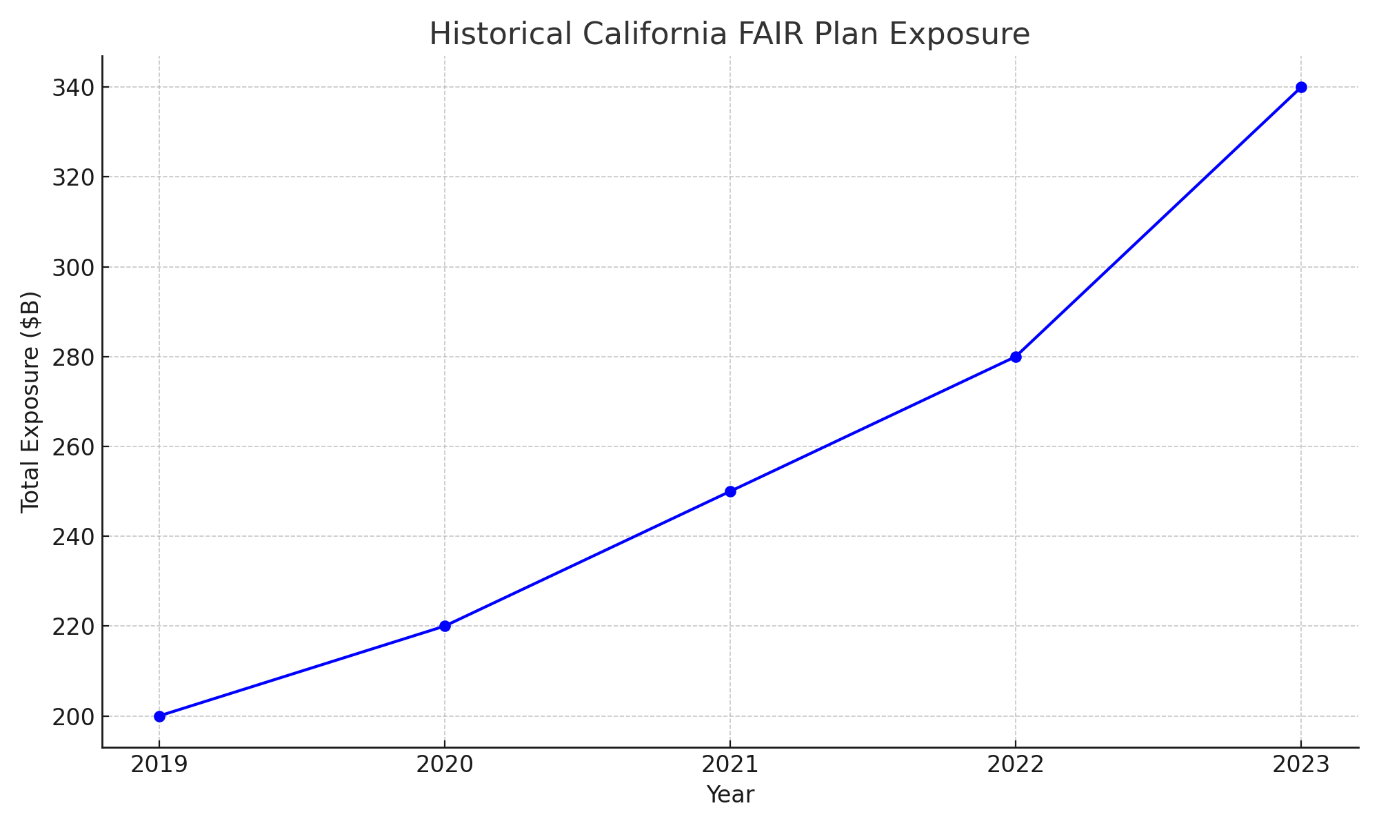

Total exposure

As of March 2024, the total exposure of the FAIR Plan has reached $340 billion. This marks a notable 20% increase from the previous year, highlighting the growing dependence on this insurance option which the President of the Personal Insurance Federation of California, Rex Frazier has called a “House of cards.”

Policy trends

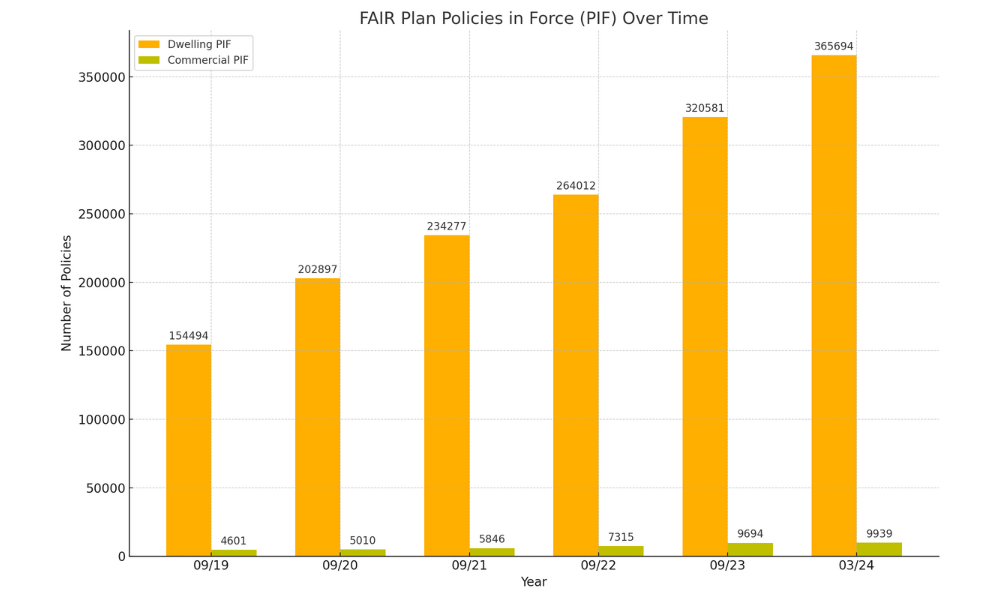

And even though the state government is keen to try to offload the risk of this state sponsored backstop, the issuance of policies by the FAIR Plan has experienced substantial growth in recent years:

Growth by policy type

Geographic coverage

The FAIR Plan provides coverage across diverse geographical areas, ensuring that property insurance is accessible to individuals in urban, suburban, and rural regions, including those in high-risk zones.

Future projections

Projections indicate continued growth in both total exposure and the number of policies issued by the FAIR Plan, given the increasing frequency and severity of natural disasters, coupled with shifts in the traditional insurance market.