With climate change making natural catastrophes more frequent and severe, it’s becoming more and more expensive for homeowners to get the property insurance they need to protect their investment.

This is especially true when it comes to homes that aren’t up to modern resilience standards. Currently, 38% of homes in the US were built before 1970, and the median age of homes in the country is 40 years, according to a report by Fortune Magazine.

Unfortunately, soaring property prices mean many people simply don’t have the option to move into a newer home that meets modern resilience standards. That’s why many insurers – and state governments in disaster-prone parts of the country – are recommending “home hardening” – bringing existing homes up to modern weather-resistance standards.

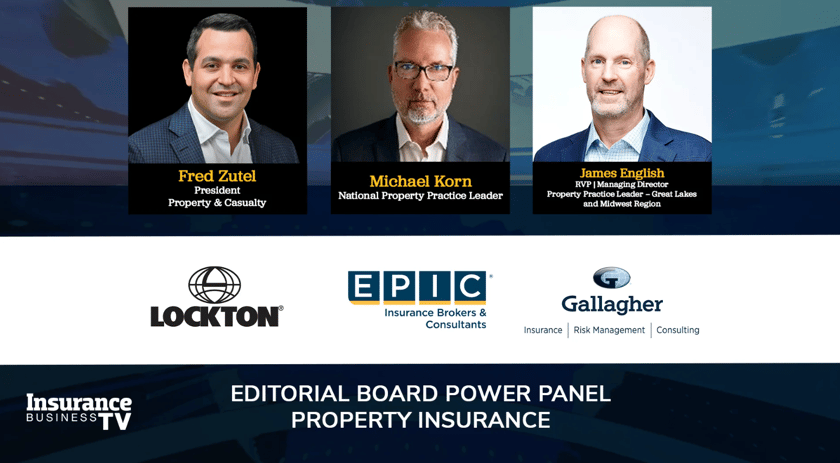

Hardened homes mean less monetary risk for both insurers and homeowners, according to Michael Korn, national property practice leader at EPIC Insurance Brokers & Consultants.

“If risks are better – more hardened – then they’re better risks for insurers,” Korn told IBA during a recent Power Panel roundtable discussion. “So I think insurers need to help their insureds before losses happen. So, getting out there and helping them harden properties that are in wildfire areas or hurricane areas or earthquake areas – all those things can be helped before losses ever happen.”

Korn said that by helping homeowners prepare for climate threats, insurers make them better risks.

“That’s going to improve the capacity available for those clients, as well as reduce pricing,” he said.

Some states are seeking ways to encourage residents to harden their homes. A recent legislative proposal in Mississippi would offer grants of up to $10,000 to homeowners seeking to reinforce their homes’ weather resistance. Alabama’s Fortified program, meanwhile, sets construction and retrofitting standards for weather resilience.

Fred Zutel, president of property and casualty at Lockton, told IBA that underwriters need to make sure they take home hardening into account when pricing.

“Oftentimes, underwriters are pricing off a statement of values and certain sets of data that are pretty myopic in nature and don’t capture the actual quality of the asset,” Zutel said during the roundtable discussion. “For example, if a building is from 1970 but the roof, the windows and other portions of it have been rehabbed, some of those buildings aren’t necessarily getting the commensurate credit and are being rated as an older structure – even though they might actually be more hardened than a newer building.”

Zutel said this kind of risk-based underwriting was “incredibly important.”

“I think that underwriting guidelines are fairly opaque, and I think more transparency in both directions, on both those issues, would create more accurate – and therefore better – outcomes for the entire industry,” he said.

Korn said that making sure their properties are weather-resilient should be homeowners’ number-one priority.

“When it comes to cat exposures and how to prepare for those things, I like to advise my clients to think of insurance as a last resort,” he said. “Take care of what you can take care of before you even think about insurance. So if you’re in a wildfire area, harden your properties. If you’re in a hurricane zone, take care of your roofs. If you’re in a seismic area, make sure your seismic structures are up to snuff. Do all those things – take care of the risk in a physical fashion as much as possible before you even think about insurance.”

Have something to say about this story? Let us know in the comments below.