With mortgage rates still at economy-slowing levels, homeowners locked in to low rates are reluctant to refinance, making the housing market grind to a halt. This may be bad news for homebuyers and mortgage bankers, but – there is a silver lining for insurance agencies amidst the property doom and gloom.

High mortgage rates, upwards of 7%, are making it a tough environment for home buyers. Home sales were at their lowest in almost 30 years in 2023, and a demand crunch has continued. The latest weekly figures, published April 24, showed mortgage loan applications down 2.7%.

For mortgage lenders, this hesitancy is bad for business. And some fed up mortgage professionals are looking for work opportunities elsewhere.

Enter, insurance.

Insurance agencies have been adding staff at pace over the past few years, even as mortgage and other loan broker staff numbers have undergone a slide. And with insurance facing its own talent challenge – 400,000 workers across the sector will age out by 2026 – businesses are looking to make hay from recruitment opportunities that do crop up.

Leaders at top American retail insurance agencies told IBA they are actively courting mortgage talent. And the good results they’ve seen from job switchers has encouraged them to keep up the pressure on tapping into this people market.

World Insurance Associates (World Insurance) is always on the hunt for outside sales talent. Amid sinking demand for housing loans, the mortgage industry is proving a “great feeding ground”, according to World Insurance CEO Rich Eknoian (pictured below).

“I'm not picking on the mortgage bankers, but it's hard to sell somebody a mortgage at whatever [rate] they are now… there's a lot of great guys out there that are selling mortgages that have the acumen to do [insurance],” Eknoian said.

World Insurance is not the only insurance broking business reaping the staffing rewards of mortgage market pain.

Mortgage talent transfers have proved a “win-win” for insurance agency Higginbotham and for switching staff, according to Mary Russell (pictured below), Higginbotham personal insurance chief operating officer.

Former mortgage professionals are seeing the insurance draw of renewals business.

“We get some great talent, and it’s a win for them because it gives them an opportunity to use some of the training and experience they've already had and transition it over to the insurance side,” Russell told IBA. “That then gives them opportunities for… renewal income, not just a one-time home closing.”

It’s a reciprocal arrangement. The insurance agency gets the benefit of new staff members who are familiar with vital components needed to advise clients and sell a home insurance policy.

“The customer service, the experience on information needed to close a home loan, all of that's going to carry over to your personal insurance homeowner's coverage,” Russell said.

Texas-headquartered Higginbotham didn’t start out with a strategy to target mortgage talent. However, recent wins have seen the insurance agency focus in on mortgage candidates.

Russell pointed to two recent joiners who have reshaped how Higginbotham thinks about potential recruits. Both found insurance roles with the business through conversations with friends and contacts at the agency. Since then, Russell said, they have hit the ground running.

So has Higginbotham.

“We have 123 offices across the south and southeast side of the United States, and we are telling our partner offices there to opportunistically look to some of the mortgage lenders that are referring business to us for insurance,” Russell said. “And if there's a good relationship there, and there's somebody that you feel is a personable person who might appreciate an opportunity in insurance, that’s a great resource to go look for candidates.”

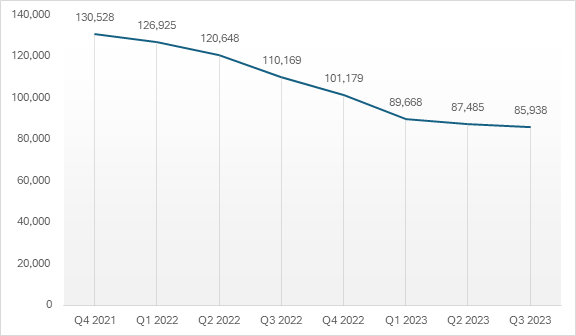

Mortgage and Non-mortgage loan brokers

(All Counties, All establishment sizes)

Quarterly Census of Employment and Wages, U.S. Bureau of Labor Statistics

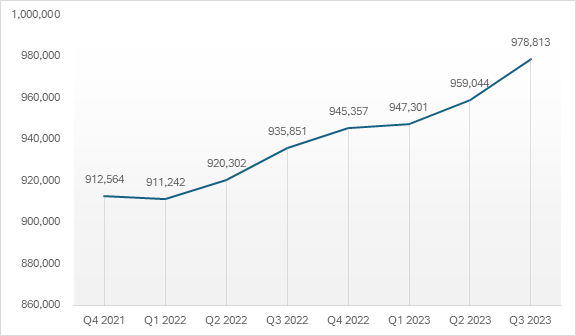

Insurance Agencies and Brokerages

(All Counties, All establishment sizes)

Quarterly Census of Employment and Wages, U.S. Bureau of Labor Statistics

It's not the first time that the insurance and mortgage businesses have traded talent. AJC Search Associates principal Jay Cohen, an insurance recruiter focused on the employee benefits side, told IBA he has seen moves the other way in times of real estate market boom.

“I’ve had some insurance folks who, when the real estate market was hot five or six years ago, transitioned to become mortgage brokers – and then when it died down, they came back,” Cohen said.

The specialist recruiter has in the past year seen an increase in enquiries from mortgage bankers looking to move to insurance – but for his largely employee benefits-focused clients, the need just hasn’t been there.

“There are people that are interested but I really can't help those folks to be honest,” Cohen said. “I'm looking for people with employee benefit backgrounds for my clients.”

Got a view on this insurance and mortgage talent story? Leave a comment below.