News of Donald Trump’s re-election as United States president has reverberated around the world, drawing concerns that his polarizing victory could plunge the global economy into deep uncertainty.

This time, Trump campaigned on a raft of economic proposals, including higher import tariffs, especially on Chinese goods, additional tax cuts, and an immigration clampdown. Some analysts have pointed out that while these actions could provide a short-term lift to the US economy, they could push up consumer prices and weaken the labor market down the line.

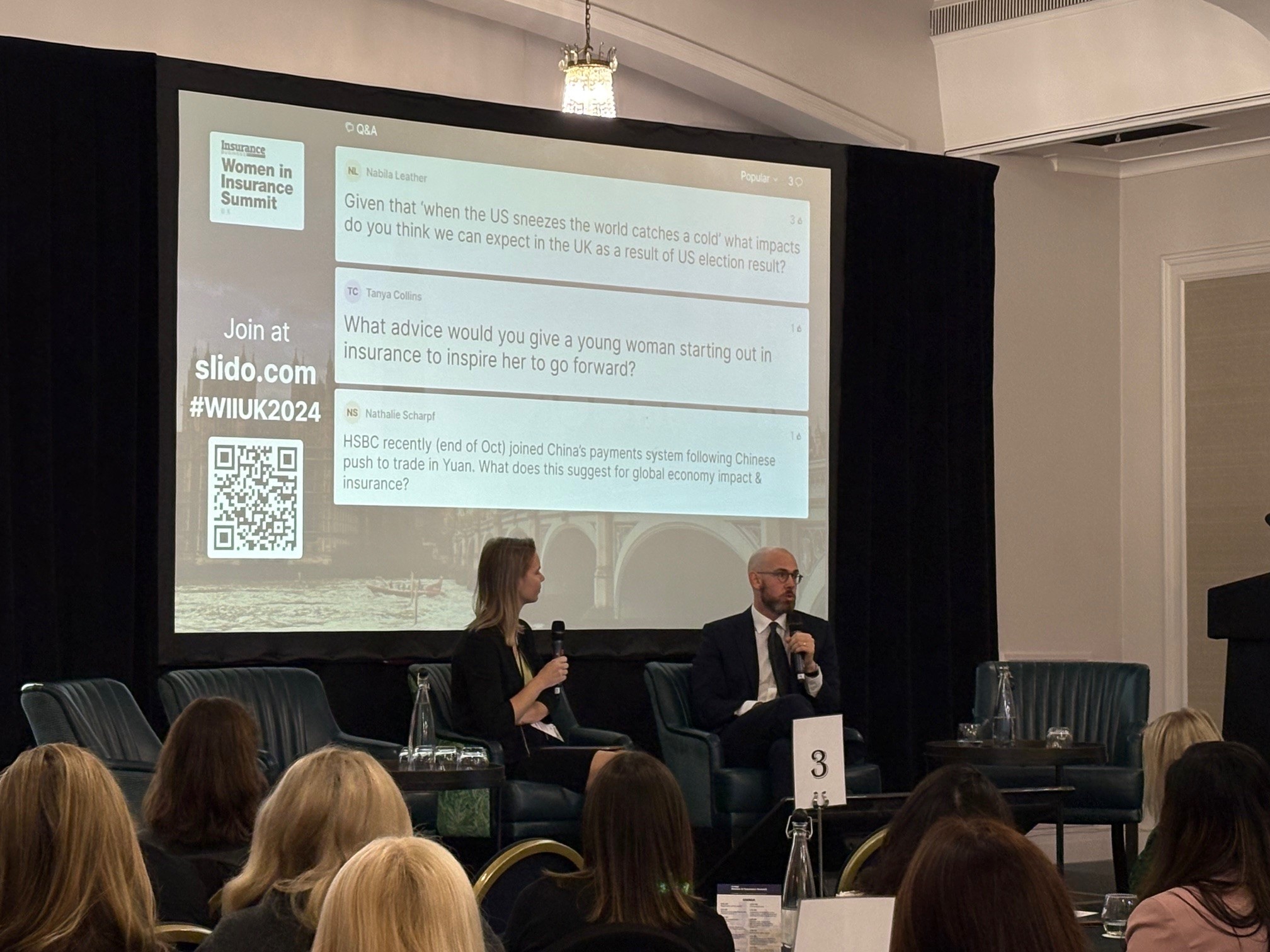

Across the pond, insurance professionals at Insurance Business’s Women in Insurance London Summit on Thursday (November 7) pondered potential scenarios for the UK economy and global markets. One question emerged: Given that “when the US sneezes, the world catches a cold,” what impact could another Trump presidency have?

Kallum Pickering (pictured on the right), chief economist at Peel Hunt LLP, a leading UK investment bank, suggested that if Trump were to pursue his aggressive trade policies, it could force central banks to drastically revise their expectations for interest rates and inflation. This would, indeed, lead to significant volatility in global markets.

However, the US itself may be somewhat insulated from the worst impacts due to its relative economic strength.

Pickering noted market reactions since the announcement of Trump’s win showed a broad dollar appreciation against most currencies, as investors shift to safe, liquid US assets. The Sterling, however, strengthened against the yen and euro, signaling that markets may expect trade uncertainty to impact East Asia and Europe more heavily.

This view makes sense, according to Pickering. “The UK, with a more domestically focused economy and a trade profile centered on services, is less vulnerable to tariffs,” he explained.

Additionally, the UK is less targeted by the US, as it meets NATO spending commitments and doesn’t fall within Trump’s key economic concerns like China containment or pressuring Europe on defense.

The US economy, the world’s largest, also benefits from the dollar's reserve status and energy independence, which gives it room for more aggressive policies, according to Pickering. Under Trump’s first presidency, the combination of US economic strength and policy flexibility kept markets favoring US assets.

But now, Trump’s policy mix appears “both anti-growth and inflationary,” Pickering said. He pointed out that the bond market could dictate fiscal policy more than a president, and if it turns against Trump’s policies, the Republican president could face challenges.

“A key test will be the dollar’s movement as interest rates rise: if the dollar strengthens, it signals confidence; if it weakens, capital may be leaving the US,” Pickering told insurance professionals gathered at the summit. “We saw this play out in the UK with the 2022 Truss budget, where interest rates rose but sterling dropped, reflecting a lack of market confidence.

“Over the next few years, I expect a weaker dollar as growth and political risk levels between the US and other regions stabilize, making parts of Europe and Asia more attractive on a risk-adjusted basis.

Despite global uncertainties and some lingering challenges, Pickering is cautiously optimistic about the UK economy and said there were “substantial opportunities for growth and investment” on the horizon.

One immediate topic of interest was the Bank of England's handling of interest rates, particularly in light of recent budgetary measures. "There's one more meeting before the end of the year, in December," said Pickering, “but I don't think they'll cut interest rates.”

Instead, he anticipated a more restrained approach, noting that the bank is carefully balancing growth with inflationary concerns. “We still [feel] a little bit worried about inflation," he said, adding that the recent budget would likely “add some momentum to economic activity over the next two to three years.”

Looking at the big picture, Pickering said the country has entered its best environment for taking investment risks since the pre-Brexit era, underscoring that investor sentiment is aligning with the UK’s improving fundamentals.

"I've [met] with investors...the best part of 10 years," he noted. "I can say for sure this is the best... environment to take on risk in the UK since before Brexit."

What are your thoughts on the potential impact of US president-elect Donald Trump’s economic policies on global markets? Please share your thoughts below.