Graham Company was one of the largest independent insurance agencies in the United States, but the top 100 agency recently ushered the start of a new era after being acquired by Marsh McLennan Agency (MMA), a subsidiary of Marsh and one of the most active mergers and acquisitions partners in the market.

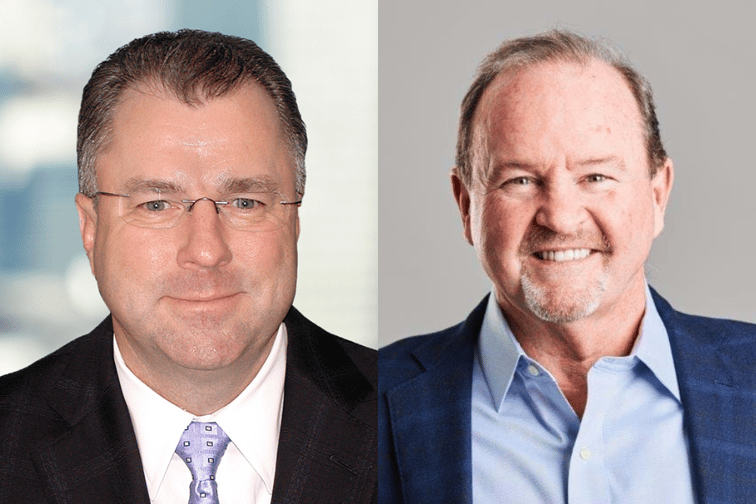

“It was quite a journey,” said Ken Ewell (pictured right), president and chief operating officer of Graham Company. “I could say right up front, if it wasn’t for Marsh McLennan Agency, we probably wouldn’t be having this interview.”

Selling to a much larger firm was never part of the vision for Graham Company, Ewell said. But joining MMA has unlocked greater resources for the firm, allowing it to face a “tsunami” of technology changes in the industry.

“We were well on our way to over six decades of building a strong culture from the inside-out, attracting the best people, and training and continuing to develop them,” said Ewell. “Simply put, we don’t have the scale, on a standalone basis, to face the tsunami of technology changes coming our way.”

The deal between MMA and Graham company closed on August 1, 2023. Terms of the acquisition were not disclosed.

Graham Company provides business insurance, employee benefits, and surety brokerage services to companies in high-risk industries, including construction, real estate, manufacturing and distribution, health and human services, and financial and professional services.

Founded in 1960 by William Graham III, the Philadelphia-based firm now commands more than $75 million in annual revenue following significant investments in technology to fuel its national growth.

It has 215 employees across its Philadelphia, New York and Washington DC offices, all of whom will be retained after the acquisition.

The decision to join MMA also allows Graham Company to offer clients a wider array of capabilities and access to highly specialized, advanced technologies, while preserving and strengthening its culture and values while providing new career development opportunities for employees.

“We were thinking 18 months ahead, three years ahead, [about] what would drive client choice,” Ewell continued. “That was a big question we asked. Our clients want technology solutions that improve their decision making, and what our clients want is what we want.”

Graham Company came into the sole ownership of William “Bill” Graham IV, in the 1970s. Bill served as president from 1970 to 1999, and currently serves as chairman.

In 2017, the brokerage converted to an employee-owned business through an Employee Stock Ownership Plan (ESOP), a move that aligned with Bill’s philosophy of investing in his people.

“Bill’s always been about what drives client choice,” said Ewell. “How do we grow a business? How can we sustain a high-performance culture? The ESOP was a fulfilment of his vision.”

But as Graham Company saw changes in the industry beginning to accelerate, it quickly realized that it needed to evolve with it.

“We came together, and Bill said, we have to look at this and plan for the future,” Ewell said. “Bill feels that while the ESOP was a great completion of his vision for his employees, our partnership with Marsh McLennan Agency is the fulfilment of his legacy to his employees, and to our clients and future clients.”

The acquisition also has significant personal and professional meaning for David Eslick (pictured left), chairman & CEO of MMA.

“Graham has been one of the most highly respected firms in the insurance brokerage industry for decades,” Eslick told Insurance Business. “Bill Graham is an icon and what he started with Graham has been one of the greatest successes in in our industry.

“Ken and I sat on the board of the Council of Insurance Agents & Brokers for a couple of decades together. We have been able to build both our personal and professional relationship [during that time], especially in the last 14 years since I started Marsh McLennan Agency.”

The CEO said MMA had been looking to build out its employee benefits expertise after it acquired Trion Group, a group disability and life benefits brokerage in 2010.

“We wanted to find the right partner for them because they’re middle-market to upper middle-market on benefits. We knew that Graham [Company] would be the right partner because Graham is in the middle-market to upper middle market space in the property and casualty area.”

“Over the last two years, Ken and I became more engaged and we both decided that each one of us would be better together than apart.”

White Plains, New York-headquartered MMA is the country’s eighth-largest insurance broker, with more than 10,000 employees in 170 offices.

Find out what licenses do I need to become an insurance agent or broker in New York in this article.

Share your thoughts on MMA and Graham Company’s partnership below.