Arbella Insurance, a regional property and casualty (P&C) insurer based in Quincy, Massachusetts, has partnered up with the Isenberg School of Management at UMass Amherst to launch an Insurance Academy for undergraduate students.

The Insurance Academy was pieced together by Arbella Insurance VP and UMass alumni, Jim Hyatt, and the Isenberg School of Management Dean, Anne Massey. While many insurance and risk management programs in the Northeast are geared towards graduates, the Insurance Academy exposes students to the industry from their freshman year, giving them more time to consider insurance as a career option.

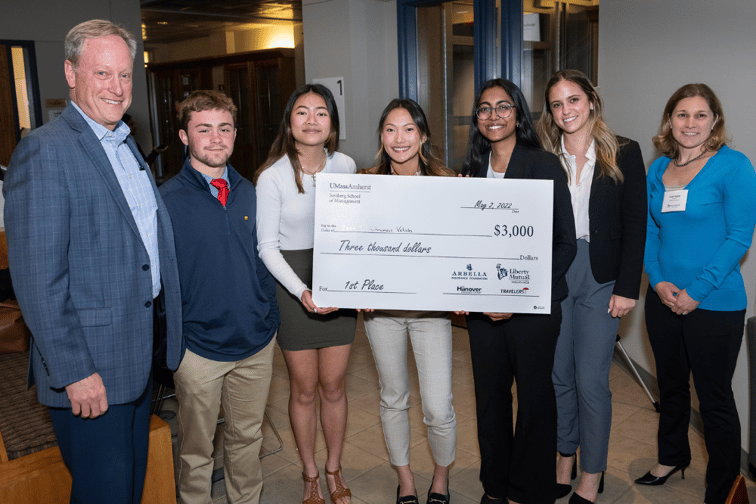

Step one for the program was “a really big step,” according to Hyatt. The Insurance Academy recently launched its first initiative, The 2022 Insurance Project Challenge, where all freshmen in the business school were split into small groups and asked to solve one of four real-life insurance challenges. Each group had to present their solution on-campus and then four finalists were selected to compete for prizes of up to $3,000, presented by the Arbella Insurance Foundation. The Hanover Insurance Group, Liberty Mutual and Travelers also supported the student competition and participated in judging.

The four challenges that students had to consider were: the use of smart devices to mitigate property damage from fires, storms, freeze-ups, intruders, and more; the threats and opportunities of the insurtech revolution; how to attract a younger generation of talent to insurance; and how the insurance industry should respond to the challenges posed by autonomous vehicles.

“Not only did we want to get the students interested in insurance, but we also wanted to attract young people with skills that the industry desperately needs – for example, around technology,” said Hyatt. “There were a number of students who demonstrated strong data and analytical skills, and we thought that was important.”

Beyond this initial Insurance Project Challenge, Hyatt hopes to expand the partnership with the Isenberg School of Management to come up with innovative ways to engage sophomores, juniors, and seniors by building insurance into their curriculum and providing co-op and internship opportunities, so that by the time they start interviewing for jobs, the insurance industry will be top of mind.

He also hopes to garner support from some local insurtechs, making the most of Boston’s reputation as a hotbed for insurance technology. In the second year of the program, Hyatt hopes to include insurtechs in some of the in-class experiences and panel discussions held by the Insurance Academy, so that students can understand how insurance is evolving and what exciting innovation is in the pipeline.

“All of this is important because there is a talent shortage in the insurance industry. Everyone is concerned about attracting and retaining talent. That’s why I’m interested in engaging with people like myself who want to get involved on the campuses and want to give back,” said Hyatt, who emphasized the importance of education and engaging with students around the moments that matter, such as a natural catastrophe.

“On the heels of a catastrophe, I plan to go back on to campus to educate students about the insurance industry’s role in helping rebuild people’s lives and rebuild businesses,” he said. “I think it is critical for us to demonstrate and show people what it means to be part of this industry, to help rebuild lives and rebuild businesses, so that we can then appeal directly to the people that are sitting in those chairs and going to those classes on campus, because this is a generation of people that very much wants to give back and have a community focus. We’ve got a compelling message as an industry, and we just need to get out there and tell it.”