What does it take to stay in the insurance business? Independent agency owners often grapple with questions of how to rapidly grow and scale their business. But longevity in a small and close-knit community is also a form of success, as Limestone Agency’s leaders know.

Limestone Agency is celebrating its 175th year in business this year. Kentucky’s oldest independent insurance agency, it was founded by William Hoffman as Hoffman’s Insurance Agency in downtown Mt. Sterling in 1847.

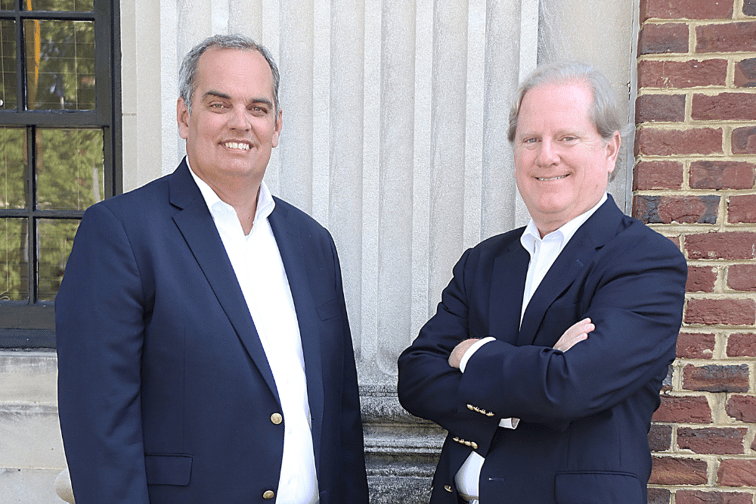

Today, Limestone is a homegrown independent agency backed by Keystone Insurers Group. It proudly offers personal insurance, business insurance, farm insurance, life and health insurance, and group benefits with a local, hometown touch. The agency is headed by the founder’s great-great grandson, J. Miller Hoffman (pictured on the right), and his business partner, Ray Robertson (pictured on the left).

“Limestone is very much an institution,” said Robertson, who specializes in personal and commercial lines. A native of Bethel, Kentucky, Robertson has been in the insurance industry for over 36 years. Even before joining Limestone in 1993, he already had a personal connection with the agency.

“I grew up on a farm 15 or so miles from here. My parents were insured with Lewis Greene, an agency that merged with Hoffman [Insurance Agency],” Robertson shared.

Robertson eventually bought Greene’s interest in the agency, while a third stakeholder sold his interest to Robertson and Hoffman. The partners formed Hoffman-Robertson, Inc. in 2006. Two years later, a merger with the McClure-Hill-Case agency in Paris, Kentucky was completed, creating a new entity: Limestone Agency.

A small operation allows Limestone to fully personalize their services and take care of their clients the way they want to be taken care of. “We try to be empathetic. No account is too small because it’s not small in [the client’s] eyes. You never know, with a small account, what it could turn into,” said Hoffman.

Over the years, the agency has nurtured long-running relationships with local businesses by pursuing its mission: to help protect their community through comprehensive insurance coverage and superior customer service.

“One account we’ve recently renewed is a business that started with two guys and a pickup truck. We’ve had that relationship for 21 years. Now it’s one of our top accounts,” Robertson shared. “We had some competition, but he stayed with us even though we charged a higher price because he knew he could trust our service. He knew we gave him good advice, and he likes the people that he's dealt with in our agency.”

Another key to Limestone’s success is its workforce. Between two locations – downtown Mt. Sterling and downtown Paris – Limestone averages 15 employees, many of whom have been employed for more than 10 years. But independent agencies have also been caught in the insurance industry’s fierce war for talent.

“We've always had good luck with our employees, even having one employee that stayed with us over 50 years. But it's changed a little bit,” Hoffman admitted. “There's a lot of competition for talent these days, and we've lost a couple of good employees last year. But we have a couple of new young superstars in training.”

For many insurance agencies today, consolidation has been the name of the game. Mergers and acquisitions (M&A) have accelerated globally in the last few years, with the US leading activity in the 2021.

But for agencies like Limestone that are deeply rooted in community, agency consolidation poses a challenge. Smaller agencies compete with larger ones that can offer better prices, and insurance buyers are different than they were a few years ago. Amid a hard market, clients have grown increasingly price sensitive.

“We try to be honest and straightforward with our clients about finding the right [insurance] company and coverage. Sometimes they get sold poor-quality products or don't get the protection that they need. People are pinching pennies, and we're feeling that a bit,” Robertson admitted.

For Hoffman, however, service rooted in care, integrity and empathy will always win loyal clients. “We don't treat insurance like a commodity. I always say that it's not our job to get you the best price. Our job to make sure your coverage is right, then we'll work on cost,” he told Insurance Business.

But Limestone Agency doesn’t intend to remain stuck in the past. “We're on Facebook, we have billboards, we’re doing some things that we weren't doing 15 or 20 years ago to keep our name and image in front of everybody,” Robertson said.

“We’re very involved in the insurance market in Kentucky, with Agents’ Association, as well as with our local communities. Hopefully, we're doing the right thing to keep attracting business.”