State Farm is among the industry’s most recognizable brands, being the largest property and casualty (P&C) insurer not just in the US but also in the world. The insurance giant is also the biggest provider of home and auto insurance in the country, controlling about a fifth of both markets. These reasons alone make the company an attractive partner for those aspiring to start an insurance business.

In this guide, we will give you a step-by-step walkthrough on starting a State Farm agency. We will also discuss the pros and cons of being a State Farm insurance agency owner. This is to give you an idea if this type of venture suits you.

If you’re wondering if launching a business under one of the biggest names in the industry is a great move careerwise, this guide can help. Read on and find out what it takes to start an insurance agency with the company that describes itself as “like a good neighbor.”

Before we go through the steps of starting a State Farm agency, let’s first delve deeper into why the company is among the industry’s leaders.

As the largest P&C insurer in the US, State Farm accounts for almost a tenth of the market with direct written premiums reaching around $94 billion. It boasts a network of over 65,000 employees in more than 19,000 agent offices. These agents service over 94 million policies and accounts. Around three million of these were added in the last financial year. Globally, the Bloomington, Illinois-headquartered insurer controls around 5% of the market.

State Farm is also the biggest auto and home insurance provider in the country. It controls almost a fifth – 17.8% (homeowners) and 18.3% (private auto) – of both markets. These figures are based on the latest data from the National Association of Insurance Commissioners (NAIC).

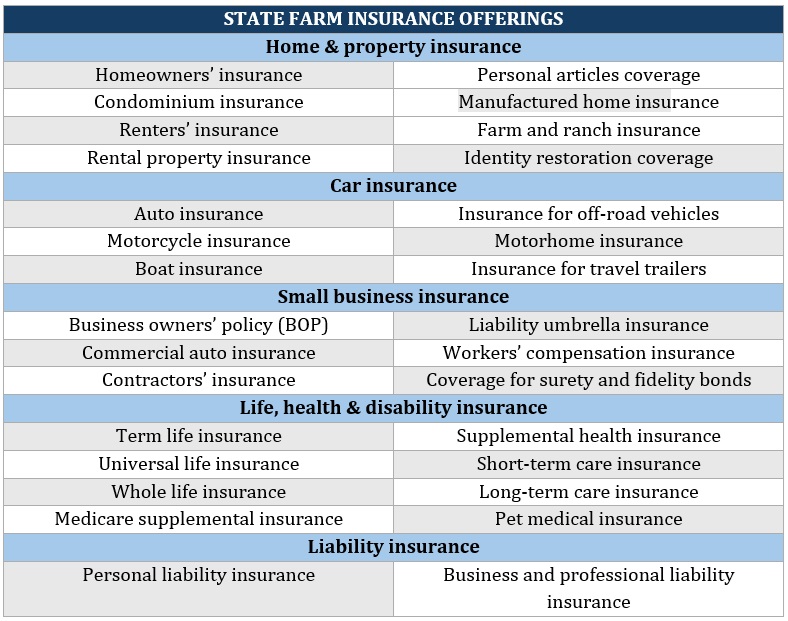

Apart from these lines, State Farm offers a range of small business, life and health, and liability insurance policies. State Farm is also included in Forbes’ list of best insurance companies for car, home, and life insurance. The company is financially strong, with a net worth of $134.8 billion.

State Farm also gives back to the community. Along with the State Farm Companies Foundation, it supports more than 8,000 charitable institutions. To date, the insurer has provided more than 20,000 grants to various organizations in the country. Its employees have also volunteered 147,000 hours for different causes.

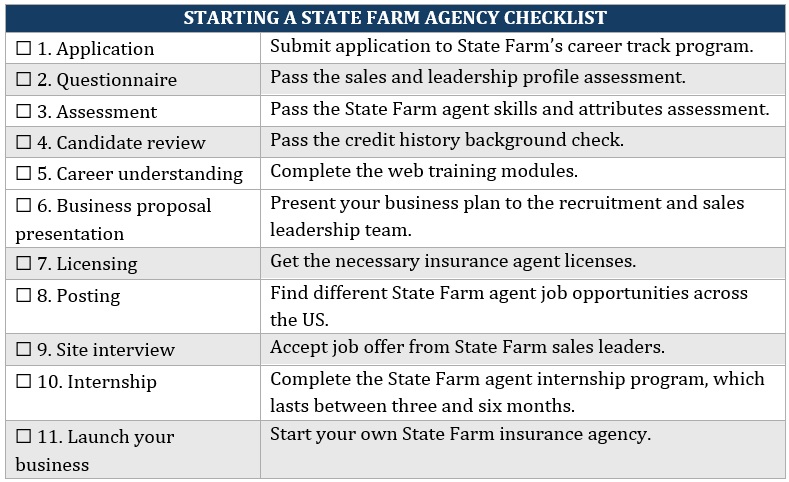

Before you start a State Farm agency, you must first pass a series of assessments designed to determine your suitability as a State Farm agent. This follows a 10-step process:

Inform the company that you want to become a State Farm agency owner by submitting an application to the insurer’s career track program.

State Farm uses a tool called the “sales and leadership profile” to predict your likelihood of succeeding in a sales and business leadership role. You will be asked to answer questions designed to gather information about your:

You need to get an “acceptable” score, meaning you have passed the initial assessment. Otherwise, you will need to wait 12 months to reapply.

You will then undergo an assessment designed to identify if you have the skills and attributes needed to become a successful State Farm agent. Just like in the previous step, you will need to get an “acceptable” rating to move on. A “not acceptable” score will require you to wait a year before you can try again.

State Farm will then review and evaluate your credit history to determine your fiduciary ability to meet the licensing and sponsorship requirements. Depending on the rules in your jurisdiction, this step may not be taken until after the site interview (step 9).

Because of this, it’s important that you’re familiar with your state’s regulations, so that you’re also aware of the timing. Bear in mind that your application may be denied based on the results of the background check.

This web-based seminar is designed to help you build a better understanding of your role as a State Farm agent. You will be able to access a series of training modules and videos. You can also connect with State Farm contacts and other candidates through email and messaging tools.

Once you have completed the modules, which include a final counseling conversation, you can move on to the next step.

At this stage, you will be asked to present your business proposal to the recruitment and sales leadership team. This gives you the opportunity to apply everything that you’ve learned in the career understanding program.

If you haven’t already, this is the time to get the necessary insurance licenses in your state. This step-by-step guide on getting an insurance agent license can point you to the right direction.

Once your state licenses and Securities Industry Essentials (SIE) exam results are confirmed, you can access a range of State Farm agent opportunities across the country.

Sales leaders may prefer to conduct interviews for new agents in their market area. If you’ve been selected, you will be offered a job as an agent intern, depending on the results of your background and licensing checks.

Successful candidates will enter State Farm’s internship program for leadership and product training. This includes field development experience with an established agent. State Farm internships last between 17 and 26 weeks.

After completing the program, you may be able to start your own State Farm agency. But this depends on your sales performance. If you’re among the high performers, you can be assigned to lead an agency or allowed to start your own. You can rent office space and hire your own staff. State Farm will provide operational support.

Here’s a checklist of the steps on starting a State Farm agency. You can download this and keep it for reference.

Find out the right way to launch your own insurance business in this step-by-step guide on how to start an insurance company.

State Farm is one of the top insurance brands in the country that work exclusively with captive agents. This means that the insurance agents and agencies it partners with are obligated to sell State Farm products only. Operating as a captive insurance sales professional or business comes with its share of benefits and drawbacks.

As an exclusive agent, you get extensive training on the different products and services State Farm offers. This helps you gain in-depth knowledge about the insurer’s policies and guidelines. Because of this, you can assist clients with choosing the right coverage and filing claims better.

State Farm provides operational backing for their partner agencies. This includes office space and administrative support. State Farm agents also receive ongoing training to help sharpen their sales skills and industry knowledge.

Lead generation

Captive agencies often receive referrals and leads on potential buyers from their parent companies. However, you will still need to generate your own leads to meet quotas.

As a State Farm agent, you will receive a regular salary on top of your commissions. As a salaried employee, you’re also entitled to regular employee benefits, including paid time off.

Find out how State Farm agent salaries stack up against those from rival insurers in this comparative analysis.

State Farm agencies are often restricted to the types of products they can offer. This can sometimes prevent your business from providing buyers with a policy that best fits their needs. Independent agencies that work with more partner carriers, on the other hand, can offer clients a broader range of insurance coverage.

State Farm agencies are obligated to follow the rules and guidelines set by the company. Because of this, you have less freedom when making business decisions, even if you’re running your own insurance agency.

Captive agents generally earn lower commissions than their independent counterparts. Independent agents, however, are responsible for their own business expenses, which offsets this benefit.

Learn more about the differences between captives and independents in this guide to the different types of insurance agents.

State Farm agencies can access a wide range of property and casualty insurance policies. Here’s a list of the different products the insurance giant offers:

The question of whether State Farm is a great company to partner with depends on the direction you want your insurance agency to go. If you’re looking for an insurer that is financially stable and provides job security, State Farm is a good option. It is among the largest insurers in the country and offers a wide range of coverage.

If you’re looking to earn an above-average salary, State Farm offers an amount that’s relatively lower than many of its industry rivals. The insurer, however, makes up for this by providing insurance agents with a comprehensive list of benefits. The company’s commission-based structure also gives agents the opportunity for higher earnings if they close more sales. This pressure to sell more, however, can lead to exhaustion and burnout.

All told, the best insurance companies are those that provide a work environment that allows employees to thrive and grow. These include our five-star awardees for the USA Insurance Companies with the Best Diversity and Inclusion Programs. Find out how these insurers built a positive culture in this special report.

Would you consider starting a State Farm agency? Why or why not? Let us know in the comments.