Assisted living facilities can be an attractive option for seniors who don’t need round-the-clock care and want to maintain some sense of freedom and independence as they age.

Assisted living costs, however, don’t come cheap. That’s why some aging adults and their families are quite disappointed once they find out that Medicare coverage for assisted living does little to ease the costs.

In this article, Insurance Business answers the question, “does Medicare cover assisted living expenses?” We will also give you a rundown of the different costs associated with assisted living and what your alternatives are when it comes to paying for these expenses.

Whether you’re planning for your own care or helping an older loved one, this guide can prove useful. Read on and get a deeper understanding of Medicare coverage and assisted living costs.

Assisted living is a term given to residential communities catering mostly to healthy and active seniors who need minimal support for daily living activities.

Assisted living facilities have various amenities, including common areas for dining and social gatherings, movie rooms, and libraries. Some come with luxurious features such as restaurants, spas, fitness centers, and nature trails.

Residents of assisted living communities don’t need the level of care provided in nursing homes. Just the same, staff are available 24/7 for those who may need help with daily tasks.

What makes assisted living facilities appealing for many older adults is the level of freedom and independence these venues provide – much like those in private apartments.

According to the latest figures from the National Center for Assisted Living (NCAL), there are around 30,600 assisted living communities across the US with nearly 1.2 million licensed beds.

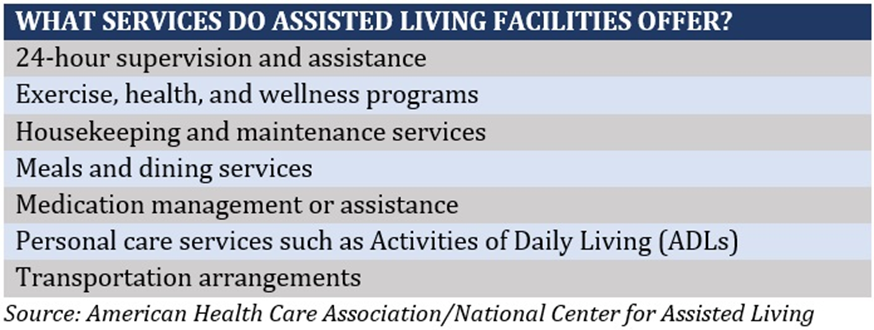

The table below lists the typical services offered in assisted living facilities.

Assisted living facilities are different from nursing homes, which provide skilled medical care for seniors with chronic health conditions. Nursing home residents often don’t require hospitalization but are unable to access the care they need at home.

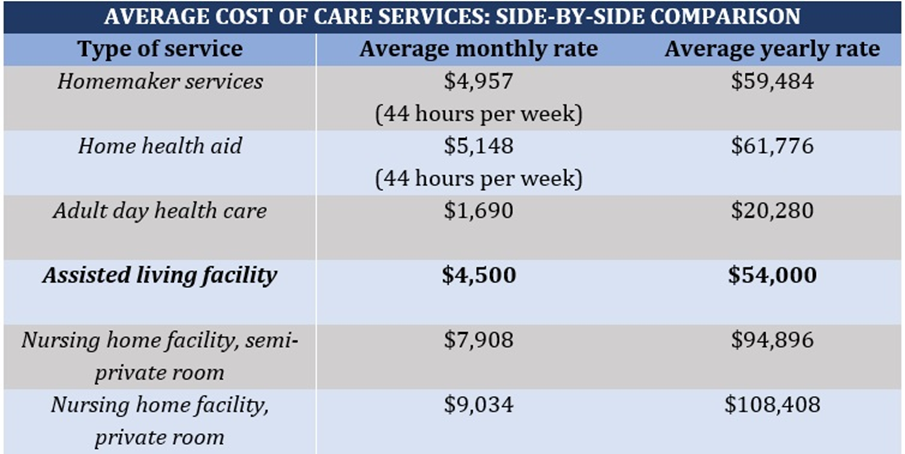

Assisted living facilities charge an average of $4,500 monthly, according to the latest cost of care survey from the global insurance holding firm Genworth. This is equivalent to $148 daily or $54,000 per year.

A major part of this amount is used to pay for:

Residents can also access a range of additional services at an extra charge. These add-ons include:

Assisted living facilities implement three cost structures:

To give you an idea of the differences in care costs between different facilities, here’s a side-by-side comparison from Genworth’s poll.

As you may have noticed, the cost of elderly care services can be prohibitive. Without proper coverage, these expenses can eat into your retirement funds very quickly.

Unfortunately, Medicare doesn’t provide coverage for assisted living costs. According to its website, among the exclusions from Medicare coverage is “custodial care.” This refers to services designed to assist with the six ADLs listed below:

As most care services given at an assisted living facility are considered custodial care, these are not covered under your Medicare plan.

Medicare is a government-funded program designed to provide US citizens and permanent residents 65 years old and older with affordable health insurance. The program is also accessible to younger people with certain disabilities and patients with end-stage renal disease (ESRD) or permanent kidney failure that requires dialysis or a transplant.

Medicare coverage consists of four parts:

Medicare Parts A and B are offered through the government. Medicare Parts C and D, meanwhile, are available through private health insurers. Regardless of which part, Medicare coverage for assisted living isn’t available.

While Medicare coverage for assisted living isn’t available, there are alternative ways for you to pay for such expenses. These include:

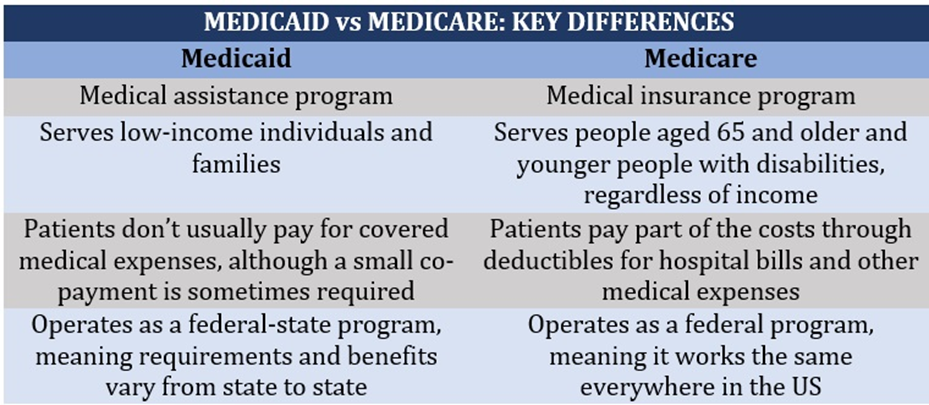

Medicaid is a joint federal and state program designed for low-income families. It covers the cost of medical care and some types of long-term care services. However, Medicaid comes with strict eligibility requirements, which vary from state-to-state.

Medicaid doesn’t pay for board and lodging expenses in assisted living facilities. But there are several states that offer Medicaid waiver programs that help cover on-site therapy, medication management, and other care services provided in a residential setting. These programs can help reduce the cost of assisted living.

Because of the programs' similar-sounding names, people are often confused about what Medicaid and Medicare covers. Another factor that may add to the confusion is that in certain situations, people may be able to apply for both.

To help provide some clarity, we summed up the key differences between these two government-administered programs in the table below.

Some military veterans and their spouses who receive pensions through the Veteran’s Administration (VA) may be eligible for aid and attendance benefits. These can help pay for care services in assisted living facilities, nursing homes, and at home.

Pensioners, however, must meet certain service, asset, and income requirements to qualify. They will also need certification from a reputable healthcare provider stating that they can no longer perform at least two of the six ADLs without “substantial assistance.”

Long-term care insurance covers services and support given to those who are unable to care for themselves because of age-related impairments. It pays for certain care services provided at home or in nursing homes, adult day care centers, and assisted living facilities.

Each policy, however, comes with varying terms and conditions. That’s why it’s best to read your policy document carefully to understand what types of services you’re covered for.

If you want to learn more about how this form of coverage works, you can check out our comprehensive guide to long-term care insurance.

A hybrid life insurance policy allows you to access long-term care benefits while guaranteeing that your family receives a death benefit after you pass on. You can use these long-term care benefits to pay for assisted living expenses.

Another option is to purchase a long-term care coverage rider for your life insurance policy. While doing so can raise your premiums, it gives you the benefit of tapping into your death benefit to pay for eligible long-term care costs.

Check out this guide if you want to get a deeper understanding of how life insurance works.

If you’re 62 years old and own a home that has built up enough equity, you can borrow funds against your property’s value without having to sell your house. This process is called reverse mortgage. You can use the funds – which you can access via monthly payments, a lump sum, or line of credit – to pay for assisted living costs.

However, certain rules apply. Talk to an experienced financial advisor before taking this route.

If your retirement savings are more than enough to cover assisted living expenses, then you can go without coverage. Same goes if you have a source of income or pensions that can pay for your care costs.

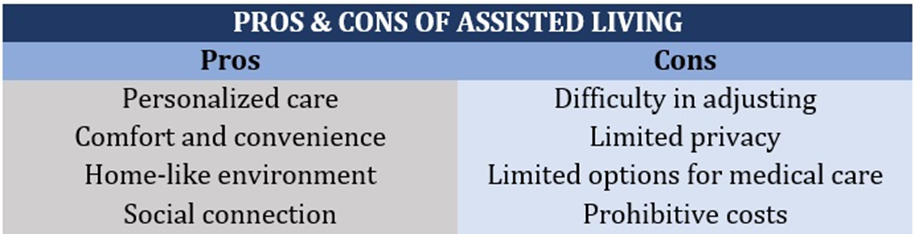

Assisted living is an attractive option for seniors who want to stay independent and active but require assistance with certain daily activities. But there are certain advantages and drawbacks to this type of living arrangement. Let’s go through them.

Assisted living facilities provide services tailored to the needs of each resident. This allows them to maintain their independence and privacy in a safe and secure environment.

Residing in an assisted living community means that you don’t have to worry about the chores that living in your home entails. These tasks, including housekeeping, will be taken care of. Most facilities also make transportation arrangements if you need to go shopping, attend community events, or visit your doctor.

Unlike nursing homes, assisted living facilities provide greater privacy and freedom to its residents, much like living in your own home.

One of the biggest issues many elderly people experience is the loneliness that comes with old age. This has a significant impact on their quality of life. Assisted living facilities help prevent loneliness and other mental issues that come with it by providing a venue for people to connect socially.

Some elderly people may have difficulty adjusting to a new environment. This is particularly challenging if assisted living is a result of unfortunate circumstances such as the loss of a partner or a progressive illness.

Although assisted living residences offer better privacy than nursing homes, this often has certain limits. You may need to get used to being checked by staff occasionally, or depending on your financial resources, share a room with others.

Another key difference between a nursing home and an assisted living facility is the level of medical care provided. Because communities are mostly intended for healthy and active seniors, they don’t have extensive health care options as those in nursing homes.

One of the biggest drawbacks of assisted living is the huge costs involved. These expenses can set you back tens of thousands of dollars each year, which can easily deplete your retirement fund. Remember, Medicare coverage for assisted living isn’t accessible.

Here’s a summary of the pros and cons of assisted living.

One way that may help you pay for assisted living expenses is by taking out extended care insurance. Find out how it works in this guide.

The tables below list the 10 least and most expensive states for assisted living based on the data gathered by this website.

|

Rank |

State |

Average monthly costs |

Average yearly costs |

|

1 |

New Hampshire |

$7,580 |

$90,960 |

|

2 |

Hawaii |

$6,907 |

$82,878 |

|

3 |

New Jersey |

$6,810 |

$81,720 |

|

4 |

District of Columbia |

$6,800 |

$81,600 |

|

5 |

Vermont |

$6,500 |

$78,000 |

|

6 |

Massachusetts |

$6,350 |

$76,200 |

|

7 |

Connecticut |

$6,088 |

$73,050 |

|

8 |

Maryland |

$5,800 |

$69,600 |

|

9 |

Maine |

$5,460 |

$65,520 |

|

10 |

New York |

$5,445 |

$65,340 |

|

Rank |

State |

Average monthly costs |

Average yearly costs |

|

1 |

Alabama |

$3,470 |

$41,640 |

|

2 |

Louisiana |

$3,595 |

$43,140 |

|

3 |

Wyoming |

$3,600 |

$43,200 |

|

4 |

North Dakota |

$3,650 |

$43,800 |

|

5 |

Mississippi |

$3,652 |

$43,824 |

|

6 |

Kentucky |

$3,837 |

$46,044 |

|

7 |

South Dakota |

$3,710 |

$44,520 |

|

8 |

Utah |

$3,740 |

$44,880 |

|

9 |

Georgia |

$3,875 |

$46,500 |

|

10 |

South Carolina |

$3,975 |

$47,700 |

Once you turn 65 years old, there’s a nearly 70% chance that you will eventually need long-term care support or services. This is according to the latest estimates from the Administration for Community Living (ACL).

But the high cost of these services can easily deplete your retirement savings, that’s why taking out the right coverage can be a smart decision. Medicare coverage for assisted living isn’t available but you have other viable options. You just need to take the best route that fits your care needs and financial resources.

Another way to ensure that you’re making the right decision is to stay updated on developments in elderly care insurance. Bookmark and visit our Life & Health News section to access breaking news and the latest industry updates.

What do you think are the best alternatives to Medicare coverage for assisted living? Feel free to share your comments below.