Farmers is among the industry’s most prominent brands that work with both captive and independent agents. It also ranks as one of the largest auto and home insurance providers in the country.

Another big reason that makes the industry giant an attractive partner for aspiring insurance business owners is the way the company treats its staff.

In this article, Insurance Business explores why partnering with the California-based insurer may be a good option if you want to become an insurance entrepreneur. We will also give you a walkthrough of how the process of starting a Farmers insurance agency goes.

If you’re planning to launch a business under one of the industry’s biggest names but don’t know where to begin, this guide can prove useful. Find out what it takes to start an agency with the company that “knows a thing or two” about helping new business owners.

Farmers has built a reputation as among the industry’s top employers. The company is known for prioritizing the health and wellbeing of its staff. It also implements programs to promote a diverse and inclusive workplace and provide employees opportunities to give back to their communities. Because of these efforts, the insurer has been recognized as a great place to work by several award-giving bodies.

These are just some of the many benefits Farmers employees, including insurance agents, are entitled to. Recently, the insurer released an interactive employer brand playbook. This details the benefits that Farmers’ team members have access to, including:

Apart from these benefits, the insurer runs the Farmers Family Fund. This allows the company to respond immediately when employees face financial hardship. Since its formation in 2012, the scheme has provided more than $4 million in grants to workers in need.

Farmers also shows its commitment to diversity and inclusion by sponsoring different employee groups, including:

These efforts are among the reasons why Farmers earns top marks consistently on the Corporate Equality Index from the Human Rights Campaigns Foundation.

Find out more about the benefits of working for the Los Angeles-headquartered insurer in this guide to how much Farmers insurance agents make.

Farmers boasts a network of 48,000 exclusive and independent agents and almost 21,000 employees across the US. These insurance professionals handle more than 19 million policies from around 10 million households.

This network keeps on expanding. Farmers offers aspiring insurance entrepreneurs three ways to start their agency ownership journey.

This option, according to the insurer, suits budding business owners with “a little capital and a lot of initiative.” Farmers assists new agency owners by providing professional mentors to help them craft a sound business plan.

The insurance giant also offers training and resources to help your business succeed. If your Farmers insurance agency exceeds sales targets, lucrative bonuses await.

If you have sufficient funding, purchasing an established Farmers insurance agency may be a good option. This allows you to run your own business and have the chance to transform it into a profitable asset.

If you’re planning to build or buy your own Farmers agency, the insurer has three programs that you can choose from:

This program is designed for insurance entrepreneurs who have capital and are looking for a startup opportunity. Minimum investable assets of $50,000 are required.

The program offers financial incentives to businesspeople who purchase service and commission rights from existing Farmers insurance agencies. Minimum investable assets of $50,000 are also required on top of the acquisition cost.

This program provides qualified candidates the opportunity to establish a Farmers agency with the benefit of being assigned service and commission rights on an existing business.

This recruiter locator tool can help you find a Farmers representative near your area to help you start or buy your own insurance agency.

If you don’t have enough resources or feel that you lack experience to start an insurance agency, then working as a Farmers agent can serve as your stepping-stone. Working for a Farmers agency owner gives you access to the insurer’s Protégé Agency Producer Program. The program is designed to help you build the skills necessary if you want to start a Farmers insurance agency in the future.

You can search for a Farmers agency to work for using this online tool.

Starting a Farmers insurance agency follows a step-by-step process:

Farmers has a dedicated online tool to help you find a district manager or recruiter who will discuss the different opportunities for starting your own agency. This initial step also follows a three-step process or what the insurer calls:

Your district manager or recruiter will guide you through the required background checks and the onboarding process. To be eligible to start your own Farmers insurance agency, you must meet the following:

It can also help if you can present a sound business plan and you have a proven track record of running a sales business.

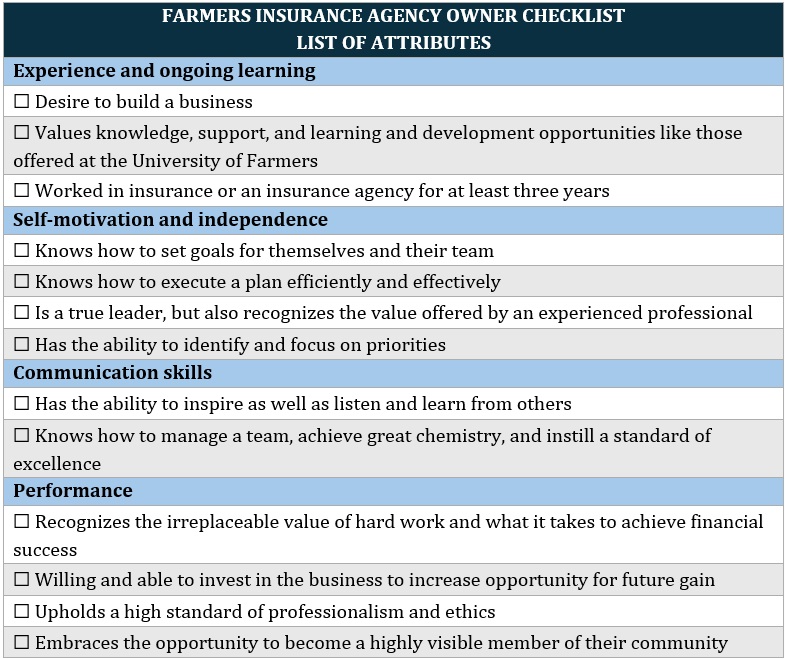

Farmers is also looking for specific skills and attributes for those wanting to start an agency under its brand. Here’s a checklist of the traits an aspiring agency owner must have to qualify. You can download the file and save it for future reference.

If you’re qualified to start a Farmers insurance agency, the insurer will provide you with the necessary training to help your business succeed. These programs are a combination of online and field training. Here are some of the areas where you will receive training and mentorship:

Insurance experts will help you develop a personalized business plan for your insurance agency.

Farmers will assist you in identifying an appropriate office location. The insurer will also work with you to ensure the chosen location complies with Farmers' brand standards.

The company will share practical tips and strategies to help you hire the right agency staff members.

The University of Farmers is the insurer’s flagship training program. It is designed to provide new agents with training in all aspects of insurance. These include the company’s various offerings, effective sales strategies, and building a successful insurance agency.

The University of Farmers program is available through the insurer’s regional training facilities across the country. It is conducted by several of the company’s leaders, industry experts, and accomplished district managers.

The length of the training program varies depending on the agency program you’re taking. Experienced insurance professionals can complete the training in as little as seven weeks. Throughout the program, an experienced Farmers representative will guide you. You’re also allowed to keep your current job while the training is ongoing.

After completing all Farmers-provided training, you’re ready to open the doors of your business. As a Farmers insurance agency owner, you represent one of the industry’s biggest and most respected players.

Farmers also offers new agency owners a range of financial support services to help them succeed. Here are some of them, although the type of assistance may vary depending on the agency ownership program you enter:

The process of starting an insurance agency varies depending on a range of factors. These include where the business is located and the insurer you’re partnering with. This step-by-step guide on how to start an insurance company can help steer you in the right direction.

Farmers is one of the largest insurance brands in the country that partners with both captive and independent insurance agencies. Just like with other insurance companies, working with Farmers comes with its share of benefits and drawbacks:

Farmers doesn’t charge startup fees, reducing the initial capital needed to start an agency under the brand. This also makes the company more accessible than insurers that require significant upfront investments.

The University of Farmers program provides new agents and agency owners with comprehensive training to help prepare them for their roles. It also imparts the skills and knowledge necessary for these industry professionals to thrive and grow.

Farmers agencies have the benefit of carrying products and services from an established brand with a strong market presence. This helps attract clients who may be searching for coverage from recognized brands.

Farmers allows agency owners to make key decisions regarding their business operations. This, in turn, gives business owners the freedom to implement personalized strategies and adapt to local market changes quickly.

Insurance premiums for Farmers policies are generally higher compared to those of industry rivals. This may turn off clients who may be looking for cheaper coverage.

While Farmers doesn’t charge startup fees, starting your own insurance agency often entails heavy financing. You will need to have sufficient funds to sustain your business’ operations, especially if you choose to run an independent business. Farmers, however, has financial assistance programs to help reduce the cost.

If you’re wondering how much it costs to start your own insurance company, this guide breaks down the numbers.

While starting a Farmers insurance agency offers a high potential for growth, there are several factors that can impact your business’ profitability that may be out of your control. These include market fluctuations, claims volume, and changes in consumer preferences.

One of the biggest benefits of running a Farmers insurance agency is carrying a brand that is considered among the most trusted and respected in the industry. But in a highly competitive market like insurance, achieving and maintaining profitability takes a lot of hard work, commitment, and dedication.

The success of your insurance agency will still depend on how well you manage it and how quickly you adjust to market changes.

If you want to find industry players to model success from, our Best in Insurance Special Reports page is the place to go. Recently, we unveiled the five-star winners of the Fastest-growing Insurance Companies in the USA awards. Learn more about how these firms devised innovative and entrepreneurial processes to grow despite challenging market conditions.

Is starting a Farmers insurance agency something you’re considering? Tell us about it in the comments.