Launching an insurance sales business is a tough venture, more so in Florida where the industry faces unique challenges.

In this article, Insurance Business will give you a step-by-step walkthrough on how to start an insurance agency in Florida. We will provide a rundown of the different requirements. We will also give you an overview of the factors that make the state’s insurance market unique.

If you’re an aspiring insurance entrepreneur wondering whether opening a business in the Sunshine State is a good idea, this guide can help you make an informed decision. Read on and find out if opening an insurance agency in Florida is for you.

The strong growth potential that comes with owning an insurance sales business makes it an attractive venture. But starting an insurance agency in one of the most challenging markets in the country requires a lot of hard work, planning, and dedication.

If you think you’re up to the task, you can follow this step-by-step process taken from the Florida Department of Financial Services’ (FLDFS) website.

If you’re opening any type of business in Florida, the first step you need to take is to register its name with the Florida Department of State’s (DOS) Division of Corporations. During the filing, you will also be asked to disclose your agency’s business structure.

Florida laws prevent business owners from using certain terms to avoid misleading the public. For insurance agencies, you’re prohibited from choosing any word that implies that your business is:

You also cannot apply for names that are too similar to those of already registered insurers or agencies. You’re also not allowed to use the words Medicare and Medicaid.

If you’re confused about the difference between an insurance company and an insurance agency, this guide on how to start an insurance company can help clear up the distinction.

Once you have registered your business name, you need to apply for an Employer Identification Number (EIN) with the Internal Revenue Service (IRS). You must also register with the Florida Department of Revenue to access the department’s three main programs. These are general tax administration, property tax oversight, and child support.

All Florida businesses involved in selling insurance products and services must have the proper licenses to operate legally. For starters, you will need to get a 21-05 insurance agency license. This license is required for all resident and non-resident insurance agencies operating in Florida.

You can apply for the necessary licenses through the MyProfile portal on the FLDFS’ website. You will need to create an account to log in and submit your application.

You can check the status of your license application through the account. If there are any requirements that you failed to meet, you can find them under pending license type.

You can also use the MyProfile account to update your business information. This can include changes in the registered name, officers involved in running the operations, and the agent-in-charge.

This guide to Florida insurance agency licenses gives a breakdown of the different licensing requirements if you want to start an insurance sales business in the state.

All insurance agencies are required to designate an agent-in-charge. These professionals are tasked to supervise insurance sales transactions. The person you appoint must be licensed in the line the business specializes in. If you plan on selling insurance policies in multiple lines, your agent-in-charge must hold licenses in all those lines.

Here’s a list of the different licenses your agent-in-charge may need to get:

|

Line of authority |

Type of insurance license |

|

|

|

Resident |

Non-resident |

|

General lines |

||

|

Life |

2-16 |

8-16 |

|

Health and life, including variable annuity |

||

|

Health |

||

|

Health and life |

2-18 |

8-18 |

|

Life, including variable annuity |

||

|

Personal lines |

||

If an agent carries only a limited-lines insurance license or any other license not on the list, they aren’t eligible to be appointed as the agent-in-charge of your business.

The FLDFS requires insurance agencies to submit fingerprints of all officers and members who will be involved in the management and control of the business. These include the:

Licensed insurance agents, including the agent-in-charge, don’t need to be fingerprinted. This is because they already had their fingerprints taken prior to getting their licenses.

The fingerprinting fee costs $50.75 per person. This is paid directly to the vendor. The FLDFS provides additional instructions on how you can submit the fingerprints for your insurance agency on its website.

You can also find out if your insurance agency license has been approved through your MyProfile account. Once approved, you can download a copy of the license for printing. The agency license contains information that consumers need, so they can verify your license status. You’re required to display your license where it’s clearly visible to customers visiting your office.

Unlike insurance agent licenses, which must be renewed every two years, agency licenses are valid for as long as your business has a designated agent-in-charge. Without one, your Florida insurance agency license will expire after 90 days.

If your insurance agency is incorporated in another state, you will need to apply for a certificate of authority in Florida. By doing so, your business will be registered as a foreign entity. This, however, eliminates the need for you to incorporate a new entity.

The fees and requirements differ depending on the structure of your business. The FLDFS provides a checklist of the required documents, along with instructions on how these can be submitted. Once completed, all requirements must be forwarded to the Florida DOS Division of Corporations.

The good news about starting an insurance agency in Florida is that your market isn’t limited to within the state’s borders. Florida has reciprocity agreements with other states and countries. This means that insurance agents can take these jurisdictions’ licensure examinations without having to complete any pre-licensing coursework. These agents, however, still need to pass the local licensure test to get a license to sell insurance outside Florida.

Life and health insurance agency license reciprocity

The following states have full reciprocity agreements with Florida for the life and health line, including variable annuity:

Insurance agents with valid licenses in the past four years are exempt from taking pre-licensing coursework in these states. They must still pass the state licensure exam to get their non-resident agent license.

The states listed below have conditional reciprocity agreements with Florida. This means that insurance agents must meet additional requirements to get a non-resident license. They also don’t have to take pre-licensing education but need to pass the state licensure test.

Insurance agents with Florida resident licenses who passed the surplus lines examination are exempted from taking the test in these states:

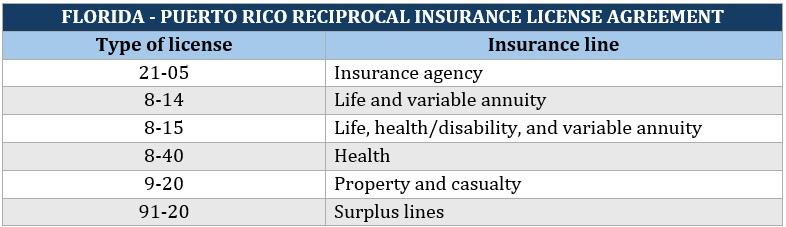

Florida has a reciprocal agreement with the US territory of Puerto Rico for the following lines:

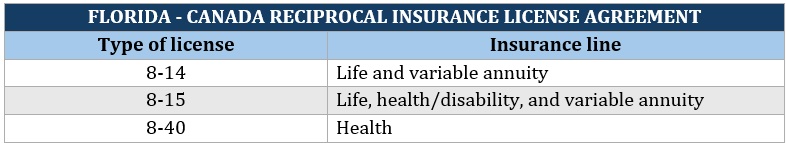

Florida has reciprocal agreements with all Canadian provinces and territories, except Québec, for the following insurance lines:

Texas is another state with reciprocal agreements with almost all states, making it another attractive area to launch an insurance sales business. Here’s a step-by-step guide on how to start an insurance agency in Texas.

Florida ranks as one of the costliest, if not the most expensive, states for insurance. Still, Florida insurance rates continue to go up because of a range of factors. These include:

Florida’s geographic location places it in the direct path of many destructive hurricanes. These weather-related events play a huge role in driving up insurance costs.

Storms, cyclones, and hurricanes have become stronger in recent years, primarily due to climate change. Among these was 2022’s Hurricane Ian, which caused almost $118 billion in inflation-adjusted losses. This makes Hurricane Ian the second costliest storm in the country, trailing only Hurricane Katrina in 2005.

With global warming causing more frequent and devastating weather-related events, Florida homeowners are facing increased risks. As more destructive storms are expected to hit the state in the future, home insurers are forced to raise premiums to cover potential claims.

Another factor that makes Florida’s insurance market unique is its over-dependence on reinsurance.

The state’s insurance sector consists primarily of small and medium-sized insurers that operate exclusively within state borders. These local companies fill the gap left by large national insurers that opt to restrict their business in Florida because of the higher risks. For these local insurers, reinsurance acts as a “shock absorber,” taking on the risks that are beyond what larger insurers are willing to assume.

Because of the state’s high exposure to natural catastrophes, reinsurance plays an important part in helping local insurers manage risks and pay out claims.

Soaring litigation costs are another big challenge Florida insurance companies face that push premiums up. A recent analysis by the Insurance Information Institute (Triple-I) has found that Florida takes up just 9% of all homeowners’ claims in the country. Despite this, the state leads the nation in insurance-related litigation, accounting for 79% of the total.

Triple-I attributes the situation to a “legal system that invites litigation.” Previously, the state allowed a “one-way attorney fees” system for property insurance claims. This required insurers to cover the attorney fees of policyholders who sued over claims successfully. At the same time, the system also shielded the policyholders from footing the bill when they lose.

While this practice was repealed during Florida’s late 2022 special session, the change isn’t retroactive. This means that all policies in force before January 1, 2023, will still fall under the previous rules.

Despite the challenges, Florida’s insurance industry continues to grow. This presents an opportunity for entrepreneurs who want to venture into the state’s insurance business. Insurance products and services will always be in high demand for as long as people need financial protection.

Just like with any type of business, starting your own insurance agency in Florida requires careful planning and preparation. If you’re an aspiring insurance business owner and in search of industry leaders to model success from, our Best in Insurance Special Reports page is the place to go.

Recently, we unveiled the five-star winners of the Fastest-Growing Insurance Companies in the USA awards. Find out how these firms came up with innovative and entrepreneurial processes to thrive and grow despite challenging market conditions.

Is starting an insurance agency in Florida a good idea? Share your thoughts in the comments.