The first and most important step to becoming an insurance agent is obtaining the proper license. All industry professionals who plan on selling policies are legally required to get one. Securing an insurance agent license, however, is no simple feat.

To guide you through the process, Insurance Business will give you a step-by-step walkthrough on how to get your insurance license. We will also explain the pros and cons of the profession and what it takes to be successful.

If you feel like being an insurance agent is the best move for your career but don’t know where to start, you’ve come to the right place. Read on and find out what you need to do to obtain an insurance agent license.

All aspiring insurance agents must first secure a license from the insurance regulation department of the state where they intend to sell policies. Here’s a step-by-step guide on the whole process.

Each state imposes varying minimum requirements for those who want to get an insurance agent license, but there are some similarities. To be eligible for a license, all aspiring agents must:

There are also states that require insurance agents to not have any past-due child support to qualify for a license. If you meet all the abovementioned criteria, then you’re ready for the next step.

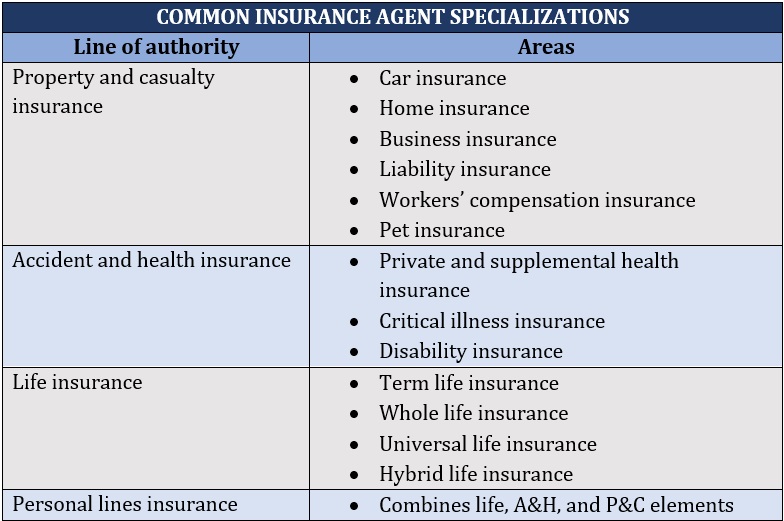

To prepare for the state licensure examinations, you will need to complete a pre-licensing course. This often entails picking an insurance line, also called line of authority, to specialize in. Here’s a list of the most common specializations:

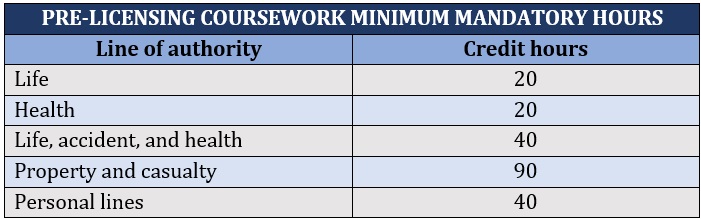

Depending on your preference, you can take the course online or in a classroom setting. Each course comes with minimum mandatory hours.

The pre-licensing coursework covers a range of topics, including:

You can also take courses in more than one line of authority. This will allow you to branch out and sell policies in other insurance lines.

Not every aspiring insurance agent, however, is required to complete pre-licensing education to get an insurance license.

If you already hold a Chartered Life Underwriter (CLU) designation, you can skip other parts of the test and take only the Life & Health Laws and Regulations exam.

If you’re a Chartered Property Casualty Underwriter (CPCU), you’re only required to take the Property & Casualty Laws and Regulations exam.

Once you’ve completed the pre-licensing coursework, you’re all set for your state’s licensure examination. The tests are divided into two categories:

Each test has between 50 and 200 items. Depending on how long the exam is, it must be completed within two to three hours.

The tests are proctored, meaning you will be taking them in a classroom setting under the supervision of someone called a proctor. If you’re not used to being in such situations, it’s best that you work on calming your nerves before taking the test.

You’re only required to take the test for the insurance line that you plan on specializing in. If you wish to sell policies in both, then you also need to pass both exams.

The passing scores differ depending on the state. In most states, however, you will need to get at least 70% of your answers correctly to pass.

The test results are valid for two years. You must apply for your insurance agent license within this time. If you fail to do so, you will need to take and pass the licensure exam again.

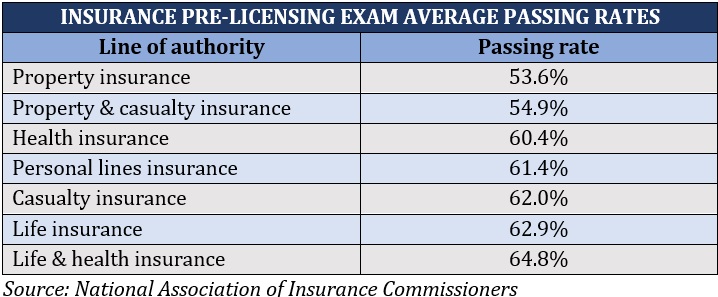

The state insurance licensure exam is among the hardest to pass because of the range of topics covered. According to the latest data gathered by the National Association of Insurance Commissioners (NAIC), the test has a passing rate of around 60%.

Here’s a breakdown of the passing rates per line of authority from the industry association:

Each attempt of the insurance licensure exam can cost you between $40 and $150, depending on where you’re taking it. You must show one valid signature-bearing ID with your photo and the original copy of your pre-licensing education certificate before you can take the test.

Here’s a list of valid identification documents:

You will not be permitted to take the licensure exam if you’re unable to present any of these documents. This also means that you have effectively forfeited your payment.

Once you’ve passed the licensure test, you’re eligible to apply for an insurance agent license. You can do so in your state insurance regulation department. Wait at least 48 hours after the scores have been released to give the department enough time to process the test results.

You will also need to pay a licensing fee, which varies between states. If you’re applying for a license in multiple lines, you will need to get a license for each and pay the corresponding fees.

The insurance regulation department will review your application. There’s no set timeframe for this as the department treats each license application differently. If something comes up from the background check, the department may contact you to clear things up. This can also delay the process.

You can find out if your application has been approved or denied through the department’s website. Once approved, you can request a copy of your insurance agent license. Some states don’t mail printed licenses for security reasons. So, you may need to download your license and print it yourself.

If you feel that there’s a delay in processing or your application has been mistakenly rejected, you can also contact the department to provide clarity.

The whole process of getting an insurance agent license can take from two to eight weeks, depending on your pace. A huge chunk of this time will be spent on finishing your pre-licensing coursework and studying for the state licensure exam.

Once you get your insurance license, you’re required to take a minimum of 24 hours of continuing education (CE) credits during a two-year term to keep your skills updated. These include three hours of ethics training.

If you want to learn more about how long it takes to get an insurance license if you’re planning to become an agent, broker, or claims adjuster, check out this guide.

Insurance agents serve as an intermediary between the insurer and potential clients. They represent one or several insurance companies, providing customers with information about their partner carriers and their products and services.

These sales professionals have contracts with insurance companies detailing what policies they’re allowed to sell and the amount they can expect to make from closing a sale.

Insurance agents come in two types:

Captive agents represent just a single insurance carrier. They can work either full-time for an insurance agency or as an independent contractor.

Captive insurance agents may receive operational backing from their partner insurers. This includes office space and administrative support. They may also get referrals and leads on potential buyers.

Independent agents work with multiple partner insurers. Therefore, they’re not tied down to one insurance company, allowing them to offer customers a wider selection of policies.

Independent insurance agents often earn higher commissions than their captive counterparts. But they also shoulder their own business expenses, including rent, office equipment and supplies, and marketing and advertising cost.

Regardless of whether they’re captive or independent, all insurance agents have the power to bind coverage. This means they have the authority to confirm that coverage is in place even if the policy hasn’t been finalized yet. This is something that separates them from most insurance brokers.

You can learn more about the key differences between an insurance broker and an insurance agent in this guide.

Many insurance agents, particularly those working in insurance agencies, receive regular salaries. However, as an insurance sales professional, you can also earn an income in different ways, including:

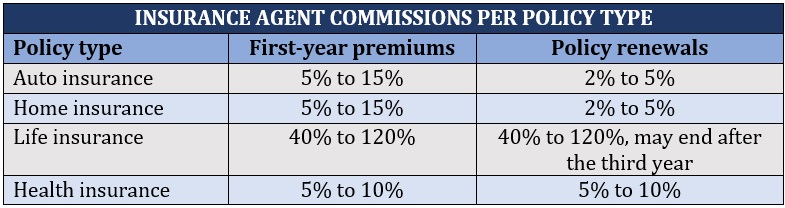

Insurers pay insurance agents a portion of the policy’s annual premiums. The rate ranges from 2% to 15% depending on the line of business and state regulations.

Here’s a summary of the average commissions insurance agents receive for the different types of policies.

Many insurance agents also offer consultative and advisory services. These come with corresponding fees. Just like insurance commissions, insurance agent fees are mostly state regulated.

Some insurance companies implement profit-sharing programs for their partner agencies. If you’re part of an insurance agency that has achieved certain revenue targets, you may receive a percentage of either written or earned premiums as a bonus.

You can learn more about how much insurance agents make in this comprehensive guide.

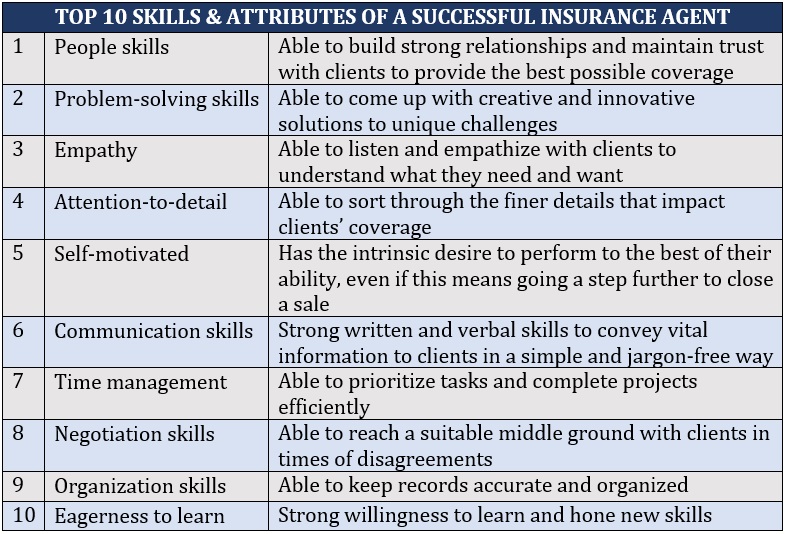

To be a successful insurance agent, you must have a combination of hard and soft skills that allow you to build relationships with clients and offer them the best coverage possible. Here are some of the most important skills and attributes that you should possess to be among the best in the field.

Being an insurance agent can be an exciting and rewarding profession - it’s not surprising that many want to pursue this career path. If you believe that it’s the best move for you careerwise, this step-by-step guide on how to become an insurance agent can help.

Do you think there’s an easier way to get an insurance agent license? Is going through the entire process worth it? Share your thoughts in the comments section below.