Insurance agents can make a decent living selling policies – this one’s common knowledge. But what’s not obvious is what goes behind the earning process.

So, how do insurance agents make money?

This is what Insurance Business will shed light on in this guide. We will give you a rundown of the different ways agents can get paid, which factors influence their earning potential, and whether selling insurance is a good career path.

If you’re an insurance buyer wondering how much of your premiums go to your agent, then this piece can help satisfy your curiosity. Insurance professionals can also share this article with their clients to educate them on the entire insurance agent earning process.

Insurance agents usually make money through commissions, but there are several other ways they can earn an income. We’ll go through each of these methods in this section.

Most insurance agents get paid through commissions, with the commission amount dependent on a range of factors, including:

For auto and home policies, captive insurance agents earn about 5% to 10% of the entire premiums paid for the first year, while independent agents receive about 15%. Commission rates for renewals range between 2% and 15%, averaging around 2% to 5%, regardless of the type of agent. We will discuss the difference between captive and independent insurance agents in the succeeding section.

Life insurance agents, meanwhile, get front-loaded commissions of 40% to up to 120% of a policy’s first-year premiums – the highest in the industry – although the rates for renewals drop significantly to 1% to 2%. There are also some agents that no longer receive commissions after the third year. You can learn more in our guide on how much life insurance agents make.

For health insurance agents, commission rates vary depending on their partner insurance providers. The average is between 5% and 10% of the policy’s total premiums in the first year. Agents selling group policies earn slightly lower commissions at around 3% to 6%. Group plans are often purchased by businesses for their staff so agents can generate up to four- or even five-figure earnings per company, depending on the number of employees. Read all the details in this article on how much health insurance agents make.

The table below sums up the commission rates insurance agents receive for the different types of insurance products.

|

HOW MUCH DO INSURANCE AGENTS MAKE IN COMMISSIONS PER POLICY TYPE? |

||

|---|---|---|

|

Policy type |

First-year premiums |

Policy renewals |

|

5% to 15% |

2% to 5% |

|

|

Home insurance |

5% to 15% |

2% to 5% |

|

Health insurance |

5% to 10% |

1% to 2% |

|

Life insurance |

40% to 120% |

1% to 2%, may end after the third year |

The rates above are also referred to as base commissions.

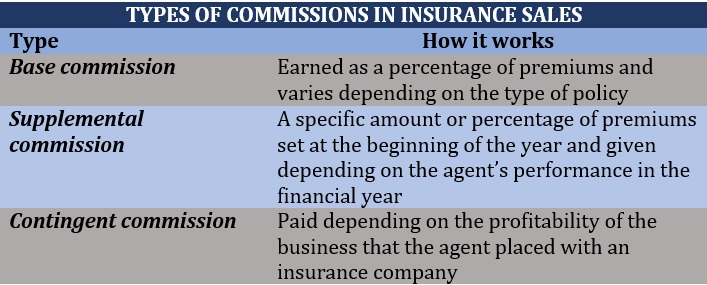

Some insurers also offer insurance agents supplemental and contingent commissions, which are intended as incentives for agents who help them achieve certain business targets.

Here are the main differences between these types of commissions.

Many captive insurance agents work as full-time salaried employees for insurance companies. But depending on their contract, they may receive commissions apart from their fixed wages. Salaried insurance agents only make the amount they have agreed to with the insurer or their agency for that given year. Their performance, however, is still dependent on how many policies they can sell.

Some insurance companies implement profit-sharing programs for their partner agencies. Once these agencies have achieved certain revenue targets, insurers typically reward them with a percentage of either written or earned premiums as a bonus.

While commission structures have the biggest impact on how insurance agents make money, there are other factors that have a major influence on their earning potential. These are:

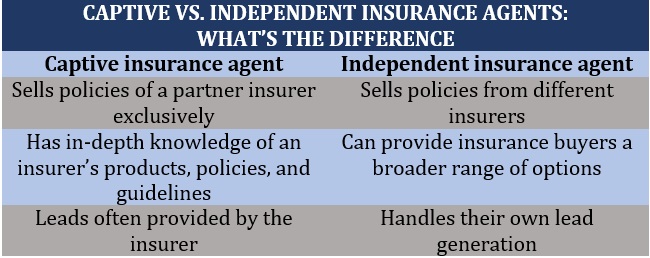

As mentioned earlier, there are two types of insurance agents:

The table below sums up the key differences between these two types of agents.

In addition, independent agents typically earn higher commissions than their captive counterparts, but there’s a catch. They are often responsible for their own business expenses, including rent, office supplies, and advertising and marketing costs.

Insurance agents are free to choose their specialization, which can be one or several lines. Agents of home insurance, for example, can opt to sell auto insurance policies. Life insurance agents can expand their portfolio to health insurance. What’s important is that they meet the licensing requirements of the jurisdiction where they plan to sell policies in.

Where they sell policies also play an important role in how insurance agents make money. A large city with a dense population, for example, gives agents plenty of opportunities to sell insurance compared to a small town with fewer residents. Other factors that can affect how much insurance agents earn in a particular location include:

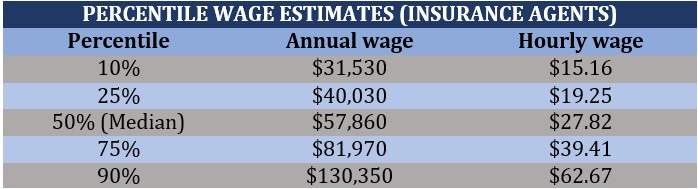

The latest data from the Bureau of Labor Statistics (BLS) shows that insurance agents earn a mean annual salary of $79,650 or an hourly rate of $37. While wages for entry-level professionals can be significantly lower, industry veterans with an established customer network can earn salaries that can reach six-figures.

In coming up with the average, the bureau factored in all types of insurance agents, including those that specialize in property and casualty, life and health, and other kinds of insurance policies for an employment estimate of 455,540. The table below shows the percentile wage estimates for insurance agents based on BLS’ most recent Occupational Employment and Wage Statistics (OEWS).

You can find more information about how much insurance agents make, including the top-paying states and cities, in our comprehensive insurance agent salary guide.

Generally, insurance agents don’t lose money if clients make a claim. The responsibility of determining whether a claim is valid and paying out the benefits falls on the shoulders of the insurance companies. Agents, however, may lose more than just money if they are found to have engaged in unethical and fraudulent activities. At the end of the day, among the duties of an insurance agent is to help insurance buyers find the best coverage for their needs and help them navigate the insurance claims process.

What makes being an insurance agent an attractive career path is the strong earning potential that comes with it. Because many insurance agents make money through commissions, this also means that those who have a great work ethic and are willing to go above and beyond to forge strong relationships with clients are rewarded handsomely in the form of higher income.

But the advantages of choosing a career in insurance sales go beyond just the monetary aspect. Here are some of the other benefits of being an insurance agent.

Being an insurance agent doesn’t require a college degree, although having one can be an advantage. Most insurance companies provide mentorship and training programs for new agents to help them learn the ropes of the job. All insurance agents, however, must comply with the licensing requirements in the jurisdiction where they plan to sell insurance in.

Most agents enjoy the freedom to set their work schedules. Those who choose to become an independent insurance agent will also have plenty of opportunities to work from home.

The BLS predicts employment of insurance agents to increase about 6% in the next decade, opening an estimated 52,700 new jobs annually. These figures indicate strong demand for insurance products.

Being an insurance agent gives you the opportunity to make a positive impact on people’s lives – something that makes the job both exciting and rewarding. Agents often act as expert resource persons, helping clients make informed decisions about what types of coverage suit their needs.

Being an insurance agent also has its drawbacks. These include:

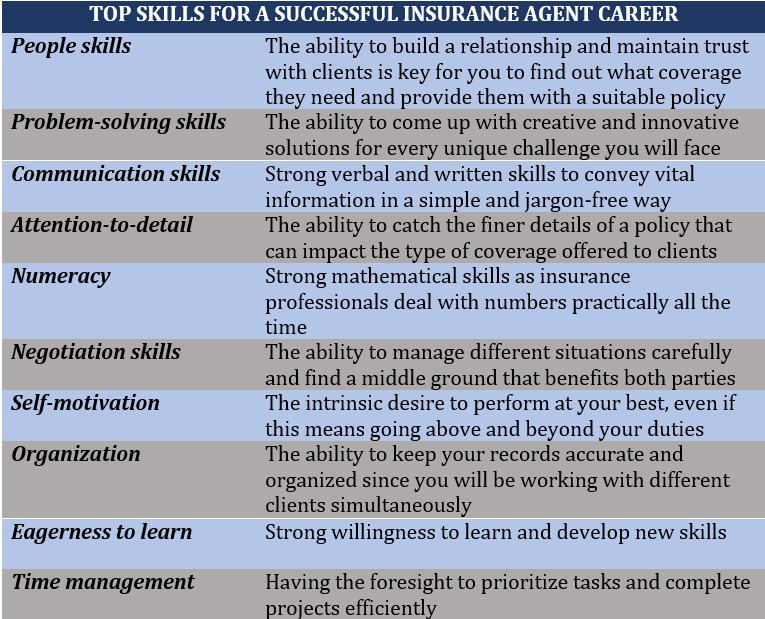

A combination of certain hard and soft skills can help you succeed if you choose to become an insurance agent. The table below lists some of the most important skills and attributes that will enable you to connect with clients and provide them with the best coverage possible.

Possessing these skills can also help you land a job in some of the country’s largest insurance brands. If you want to know how insurance agents make money in insurance giants like Farmers and State Farm, you can check out these guides on how much State Farm insurance agents make and how much Farmers insurance agents make.

Were you surprised to learn how insurance agents make money? Do you think being an insurance agent is a good career path? Share your thoughts in the comments section below.