As an insurance agent, you’re required to take continuing education (CE) courses to maintain your license. The goal is to keep you updated with the latest trends and developments in the constantly evolving insurance sector.

CE requirements vary by state, but generally, you will need to complete a certain number of credits every two years. There are several continuing education providers you can choose from, each offering a range of courses and training services.

To help you in your search, Insurance Business lists our picks for the top providers of continuing education for insurance agents in this guide. Read on and find the right CE provider for your needs.

In a fast-changing industry, the learning never stops once you obtain your insurance agent license. Continuing education helps you serve your clients better by keeping you abreast of new products and regulations.

The internet is filled with CE providers offering courses for different lines and specializations. To find the right one, check your state’s requirements and assess your training needs. The companies on our list provide a broad range of courses and services. There’s no clear-cut number one choice, so we arranged the list alphabetically.

Here are our picks for the 10 best providers of continuing education for insurance agents.

With more than 11 million users, 360training is among the biggest regulatory compliance online training and certification providers in the world. It offers courses in a range of industries, including real estate, healthcare, and human resources.

The company has more than 800 continuing education packages and individual courses for insurance agents. These cover a range of topics, from ethics and consumer protection law to general liability and flood insurance.

360training provides a free 14-day trial, giving you full access to all course features. This allows you to try the service first before committing to a paid subscription. After the trial period, you can subscribe to a monthly or annual plan. The courses are accessible 24/7, so you can study at your own pace.

A.D. Banker provides a range of pre-licensing and continuing education courses for insurance and securities professionals. The courses can be taken online in most states; some states, including California, offer only in-person classes. You can buy the courses individually or in bundles.

One of the popular features of its online continuing education courses for insurance agents is the note-taking function. This enables you to take notes on the course dashboard that you can access on different devices. All courses come with a 60-day access period.

BetterCE specializes in continuing education for insurance agents. The company markets its CE offerings as “designed for the busy insurance agent.” All courses are self-study and available only online. This allows you to complete them at your own pace.

You can choose from the website’s easy-to-navigate course catalog, which you can filter by state. Here, you can view the course description, along with the credit hours and pricing.

Users like that the materials are easy to read, well-organized, and interesting. BetterCE notifies you a month before your license expires, reminding you to complete the necessary CE training. Users also commend the company for delivering great customer service.

CEAuthority offers online self-study continuing education courses for insurance agents, adjusters, and financial advisers. You can choose from over 200 topics, including cybersecurity, DE&I, ethics, and anti-money laundering.

The company also provides printable electronic certificates. These e-certs are stored in CEAuthority’s system for at least seven years. This saves you from the hassle of storing and gathering your certificates come license renewal time.

CEU offers a library of more than 150 continuing education courses for insurance agents and adjusters. By subscribing to its CEU Unlimited package, you can enjoy year-long access to its approved L&H and P&C courses. You can also get a 50% discount on all live webinars.

CEU markets its courses as having “no state reporting fees and no hidden fees,” although they’re a bit pricier than CE offerings from other providers. The company, however, allows unlimited exam retakes for on-demand courses. It also reports CE credit hours within two business days.

CEU’s continuing education courses are available in all 50 states, the District of Columbia, Puerto Rico, and Guam.

ExamFX offers online continuing education courses for insurance and securities professionals. Its programs are customizable, allowing you to create a study plan that suits your learning style and meets state requirements.

You can take the courses individually or subscribe to the all-access library. The subscription option gives you year-long access to online CE classes and practice exams. You can also enjoy unlimited exam retakes and automated certification reporting.

ExamFX is a partner of the National Association of Professional Agents (NAPA).

Kaplan is a popular choice for insurance agents because of its range of continuing education programs. You can take the CE courses online or in person in some states. The provider, however, doesn’t conduct live online sessions.

Kaplan’s continuing education programs use its tried-and-tested three-phase strategy:

Instructors are available to answer your questions. Each program also comes with a dedicated email support team to address issues and concerns.

NobleCE offers state-approved continuing education for insurance agents. You can access the courses in two ways:

NobleCE boasts a compliance check system to ensure that you’re taking the right courses. It also carries out daily certification reporting, so you can avoid the penalties from delayed completion.

The main drawback, however, is that NobleCE offers continuing education for insurance agents in just 38 states.

StateCE provides online continuing education programs for a range of industries, including real estate, securities, mortgage, and insurance. It offers among the most affordable and user-friendly CE courses out of all featured providers.

StateCE courses cover a range of topics, including annuities, home, auto, long-term care, and disability insurance. All courses are self-directed, meaning you control the pace. Once you’ve met all course requirements, the company submits your course credits to your state regulator within 24 hours.

WebCE provides continuing education and exam preparation courses in various sectors, including insurance, real estate, and financial services. Like most companies on our list, it provides year-long access to its CE programs. This gives you more than enough time to finish the 20 to 40 hours of study materials.

WebCE also allows you to download an unlimited number of practice exams. This helps if you want to practice in realistic conditions. If you want to access flashcards and workbooks, however, you will need to buy them separately.

You can also check out our picks for the best websites to get insurance sales training if you want to sharpen your selling and negotiating skills.

Continuing education is a key part of maintaining your insurance producer license. States require CE as it helps build your expertise by keeping you up to date with current industry trends. This, in turn, enables you to provide the best service to your clients.

Most insurance agent licenses are up for renewal every two years, but there are some states where licenses are valid up to three or four years.

Each state has guidelines on how you can earn continuing education credits. Many allow online and self-study courses. A few require certain hours of classroom training.

The bulk of courses you need to take cover the line you’re specializing in. Most states also require three hours of ethics training. Some require certain hours of insurance law and regulatory changes. Depending on your specialization, you may also need to take flood insurance courses.

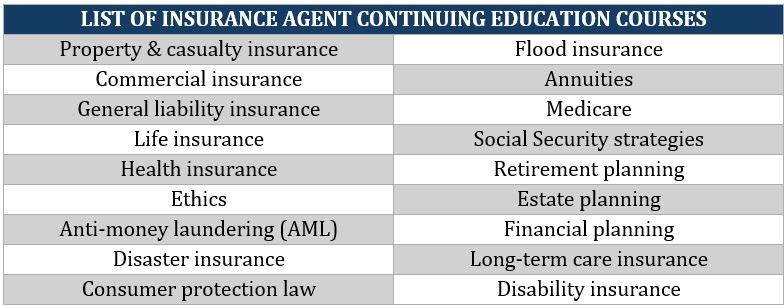

Here’s a list of the different continuing education courses insurance agents can take.

You often don’t need to take non-resident CE courses, unless you’re carrying a Florida insurance license. All other states have signed up for NAIC’s continuing education reciprocity (CER) agreement, which means they recognize CE courses taken from member states.

Different states have different requirements when it comes to credit hours for continuing education for insurance agents. Generally, you will need to complete 24 hours of training every two years. The table below details each state’s requirements. Click on the links to check the full CE requirements in your state.

|

State |

CE requirements |

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics Not more than 8 hours of management, marketing, sales, and training

Resident agents selling federal flood policies must complete 3 hours of flood insurance training as a one-time requirement |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

48 credit hours every 4 years, including 6 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics, which include 1 hour of anti-fraud training |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics, regulation, or law |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics

3 hours of flood insurance training for P&C agents on first renewal |

|

|

24 credit hours every 2 years, including 4 hours of law and ethics |

|

|

15 credit hours every year, including 3 hours of ethics for resident agents with less than 20 years

10 credit hours every year, including 3 hours of ethics for resident agents with more than 20 years |

|

|

20 credit hours every 2 years, including 3 hours of law for L&H or P&C agents

30 credit hours every 2 years for L&H and P&C agents, consisting of 12 hours of L&H, 18 hours of P&C, including 2 hours each of law |

|

|

24 credit hours every 2 years, including 3 hours of ethics or law |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

36 credit hours every 3 years, including 3 hours of ethics |

|

|

18 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics

Resident P&C or personal lines agents must complete 3 hours of flood insurance training as one-time requirement |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

45 credit hours every 3 years, including 3 hours of ethics

60 credit hours, including 3 hours of ethics for newly licensed agents on first renewal |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

16 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics and 1 hours of legislative changes |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

30 credit hours every 3 years |

|

|

24 credit hours every 2 years, including 3 to 10 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics and 3 hours of classroom training |

|

|

15 credit hours every 2 years, including:

|

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics and 2 hours of legislative updates |

|

|

24 credit hours every 2 years, including 3 hours of ethics and 3 hours of law |

|

|

24 credit hours every 2 years |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

10 credit hours every 2 years for L&H or P&C agents

20 credit hours every 2 years for L&H and P&C agents |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics and 12 hours of classroom training |

|

|

24 credit hours every 2 years, including 3 hours of ethics and no more than 6 hours of agency management, 3 hours of flood insurance as a one-time requirement |

|

|

16 credit hours every 2 years, including 2 hours of ethics and law |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

|

|

24 credit hours every 2 years, including 3 hours of ethics |

There are several factors that you need to consider when searching for the right CE provider, including:

A career as an insurance agent has many benefits. If you want to pursue this profession, this step-by-step guide on how to become an insurance agent can help.

Did you find our guide to continuing education for insurance agents useful? Are there CE providers that you felt we missed? Chat us up in the comments section below.