The US has endured many natural calamities over the years, the destructive effects of which have been felt across the country. With climate change in full swing, the risk of even more devastating catastrophes has since increased.

In this article, Insurance Business ranks the 10 worst natural disasters to hit the nation based on insured losses. The goal is to give you a picture of how much impact these calamities have had on the insurance sector.

The list is arranged by inflation-adjusted figures to show how much the damage would have been worth today. Here are the worst natural disasters in US history that have caused the biggest losses in industry.

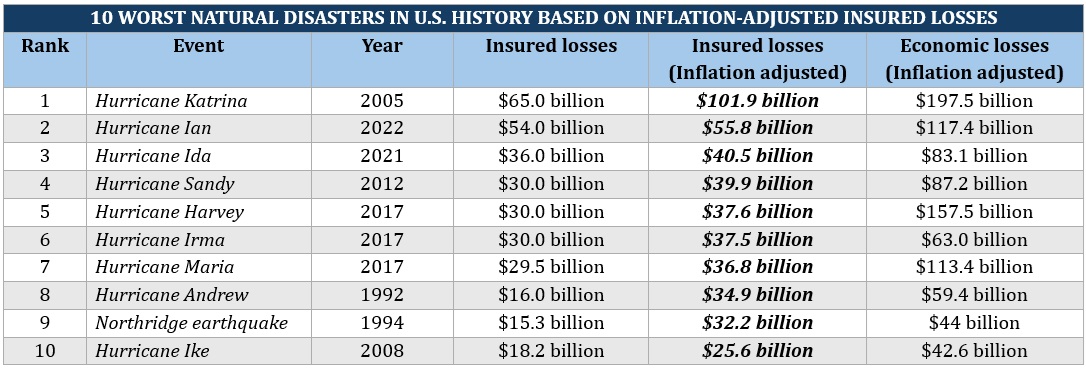

The 10 worst natural disasters in the country have resulted in a combined $324.1 billion in estimated insured property losses. This is according to data compiled by the Insurance Information Institute (Triple-I) from consulting giant Aon’s latest annual catastrophe report. Inflation-adjusted, the total reached $442.7 billion.

The figures below include losses sustained by private insurers and government-sponsored programs such as the National Flood Insurance Program (NFIP). The numbers were inflation-adjusted using the US Consumer Price Index (CPI).

Data for economic losses, meanwhile, came from the National Oceanic and Atmospheric Administration (NOAA). The figures were also adjusted to account for inflation.

Year: 2005

Location: Gulf Coast

Estimated insured property losses: $65 billion

Inflation-adjusted insured property losses: $101.9 billion

Estimated economic losses: $197.5 billion

Deaths: 1,800+

What began as a category 1 hurricane as it blew across the Gulf Coast wound up becoming the country’s costliest natural disaster. Hurricane Katrina ravaged the southeastern US with maximum sustained winds of 125mph. The resulting storm surge broke levees that protected New Orleans from surrounding coastal waters. This left almost 80% of the city under water.

The aftermath is an estimated $197.5 billion in economic losses. Only around $65 billion of these were insured. Inflation-adjusted, the property damage was worth more than $101 billion, or almost a quarter of the top 10’s total. Katrina is also one of the country’s deadliest disasters, claiming over 1,800 lives.

Year: 2022

Location: Southeast

Estimated insured property losses: $54 billion

Inflation-adjusted insured property losses: $55.8 billion

Estimated economic losses: $117.4 billion

Deaths: 150+

Hurricane Ian made landfall in Florida in September 2022 before ravaging across the Carolinas. It ranks as one of the most powerful hurricanes to hit the US in decades, with maximum sustained winds of 155mph. Ian trails only Katrina and Harvey in terms of economic losses.

Insurers paid around $54 billion in property damage – the second largest in the list. This pushed 2022 global catastrophe insured losses to $115 billion.

Year: 2021

Location: Southeast, Northeast

Estimated insured property losses: $36 billion

Inflation-adjusted insured property losses: $40.5 billion

Estimated economic losses: $83.1 billion

Deaths: 90+

Hurricane Ida was the most intense tropical cyclone to strike the US in 2021. It made landfall in Louisiana with maximum wind speeds reaching 150mph. The storm's remnants later caused severe flooding in the Northeast, resulting in $75 billion in damages. Of these, only less than half were insured. Still, Ida sits as the third-costliest disaster on record for insurers, with inflation-adjusted damage exceeding $40 billion.

Year: 2012

Location: Mid-Atlantic

Estimated insured property losses: $30 billion

Inflation-adjusted insured property losses: $39.9 billion

Estimated economic losses: $87.2 billion

Deaths: 230+

Hurricane Sandy ravaged the coastal Mid-Atlantic region in late October 2012. It remains the largest Atlantic hurricane on record, with tropical-storm-force winds spanning 1,150 miles in diameter and wind speeds reaching 115mph.

Sandy’s scale has made it one of the country’s worst natural disasters, causing more than $70 billion in economic losses, or $87 billion inflation adjusted. Only less than half of the damage was insured.

Year: 2017

Location: Texas Gulf Coast

Estimated insured property losses: $30 billion

Inflation-adjusted insured property losses: $37.6 billion

Estimated economic losses: $157.5 billion

Deaths: 100+

Hurricane Harvey remains the wettest tropical cyclone on record in the US, dumping 60.48 inches of rain on the Texas Gulf Coast in 2017. The unprecedented rainfall caused extensive flooding, destroying property and infrastructure across the area. Thousands of families were also displaced. Rapidly rising water levels left many people trapped in their homes and vehicles, needing rescue.

Harvey ranks second in terms of inflation-adjusted economic losses. Just a quarter of these, however, were insured.

Year: 2017

Location: Southeast, Northeast

Estimated insured property losses: $30 billion

Inflation-adjusted insured property losses: $37.5 billion

Estimated economic losses: $63 billion

Deaths: 130+

Hurricane Irma made landfall on Florida as a category 4 storm in September 2017. It quickly peaked to category 5, packing maximum sustained winds of 177mph. Its sheer strength ripped off roofs, flooded coastal cities, and knocked out power to over 6.8 million people.

Irma caused around $63 billion in economic losses, about 60% of which were insured. It remains among the worst natural disasters in the US, with more than 100 fatalities.

Year: 2017

Location: Puerto Rico

Estimated insured property losses: $29.5 billion

Inflation-adjusted insured property losses: $36.8 billion

Estimated economic losses: 113.4 billion

Deaths: Around 3,000

A few days after Irma ravaged the southeastern part of the country, Hurricane Maria struck Puerto Rico. The storm caused unprecedented damage to the US territory, resulting in more than $113 billion in economic losses. Only a third of these were insured.

Maria was the strongest tropical cyclone to hit Puerto Rico in more than eight decades. With maximum sustained winds of 155mph, the hurricane destroyed homes, roads, and bridges. It also knocked out power across the entire island and triggered heavy flooding. Many institutions – including hospitals, schools, and banks – closed due to extensive damage. Residents also had to live through food and water shortages, and disease outbreaks.

Year: 1992

Location: South Florida, South-Central Louisiana

Estimated insured property losses: $16 billion

Inflation-adjusted insured property losses: $34.9 billion

Estimated economic losses: $59.4 billion

Deaths: 65

Hurricane Andrew was a compact but very powerful tropical cyclone that struck Florida and Louisiana in August 1992. Despite its relatively small size, it packed maximum sustained winds reaching 174mph.

Andrew destroyed tens of thousands of homes and left hundreds of thousands of families homeless, making it one of the worst natural disasters in the US. Of the nearly $60 billion worth of damage, almost 60% were insured.

Year: 1994

Location: Southern California

Estimated insured property losses: $15.3 billion

Inflation-adjusted insured property losses: $32.2 billion

Estimated economic losses: $44 billion

Deaths: 57

In the early morning of January 1994, a 6.7-magnitude earthquake struck the San Fernando region in Los Angeles. The tremors, however, were felt throughout Southern California.

Known as the Northridge earthquake, it destroyed 50,000 homes and displaced around 20,000 people. Its force caused building and freeway overpasses to collapse. It also snapped water, power, and gas lines. These resulted in widespread power outages and started around 500 fires. In total, property damage was around $20 billion, inflation-adjusted $44 billion. About three-fourths of these were insured losses.

Year: 2008

Location: Atlantic region

Estimated insured property losses: $18.2 billion

Inflation-adjusted insured property losses: $25.6 billion

Estimated economic losses: $42.6 billion

Deaths: 110+

Hurricane Ike made landfall at Galveston Island in Texas as a category 2 tropical cyclone with 110mph sustained winds. The storm, however, had a category 4 to 5 surge, causing extreme flooding and wind damage. Storm force winds also covered 425 miles in diameter, causing devastation in several states. These include Louisiana, Tennessee, Kentucky, Indiana, Missouri, Illinois, Michigan, Ohio, and Pennsylvania.

Ike’s destruction left almost $43 billion in property damage. Insurers covered around 60%, or $26 billion, of the losses.

Here’s a summary of the country’s 10 worst natural disasters when it comes to insured losses.

Although hurricanes dominate our list of worst natural disasters, there are other types of calamities that the insurance industry provides coverage for. Here, we list the most common types of natural disasters in the US. We also rank the costliest catastrophes based on insured losses for each category. The figures below are the latest from Triple-I.

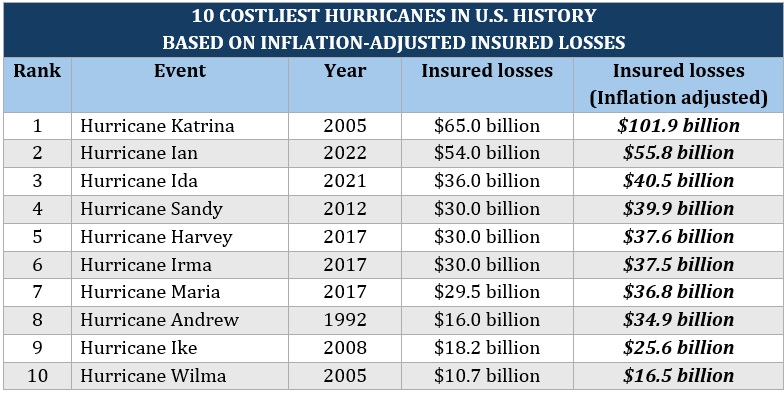

The 10 costliest hurricanes in the US have resulted in $319.5 billion in combined insured losses. Inflation-adjusted, the figure goes up to $427 billion. Hurricane Katrina accounts for almost a quarter of all covered losses. Here are the top 10 hurricanes in the country that cost insurers the most.

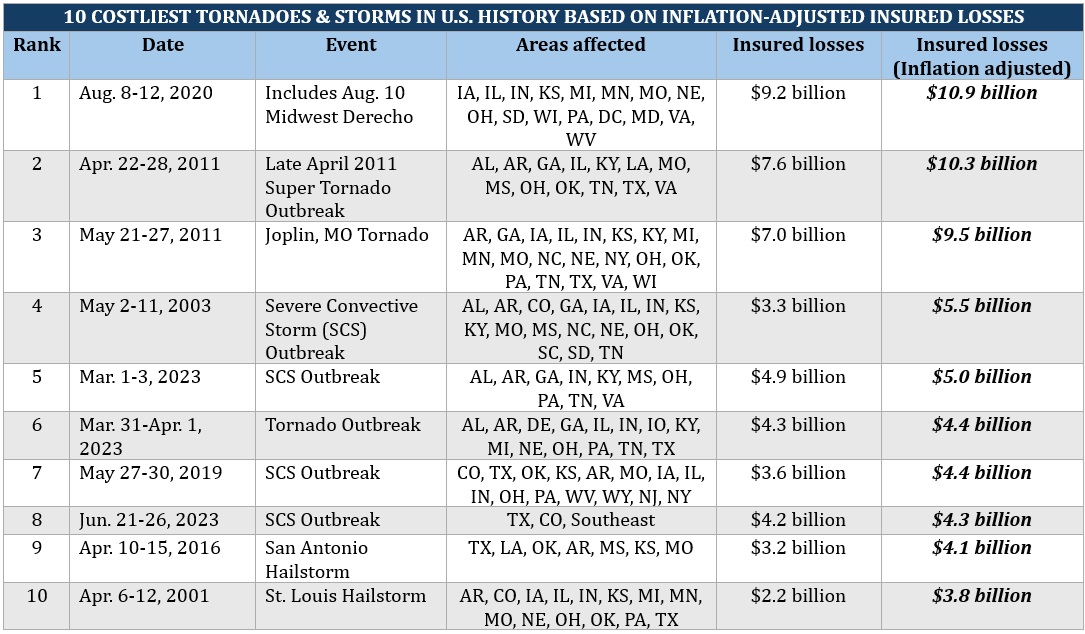

These weather-related events include hail, straight-line winds or derechos, and flash flood impacts. The country’s 10 costliest tornadoes and thunderstorms have cost insurers around $49.6 billion in losses. Factoring in inflation, the worth of covered damage reaches $111.8 billion. The Midwest Derecho in August 2020 tops the list, costing insurance companies around $9.2 billion.

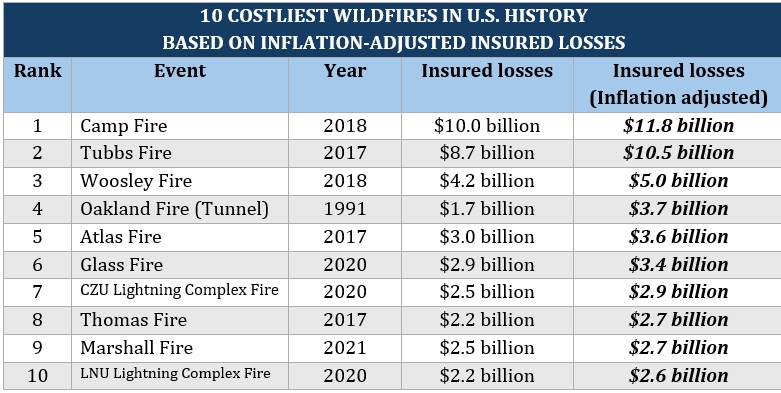

Wildfires are often considered one of the worst natural disasters, but according to government data, 85% of these events are caused by humans. California is the most at-risk state with almost 1.3 million housing units exposed based on Triple-I’s figures. Colorado and Texas follow with around 333,000 and 233,000 at-risk homes, respectively.

The 10 costliest wildfires in the US have resulted in about $40 billion in insured losses. Inflation-adjusted, the number hits $48.9 billion.

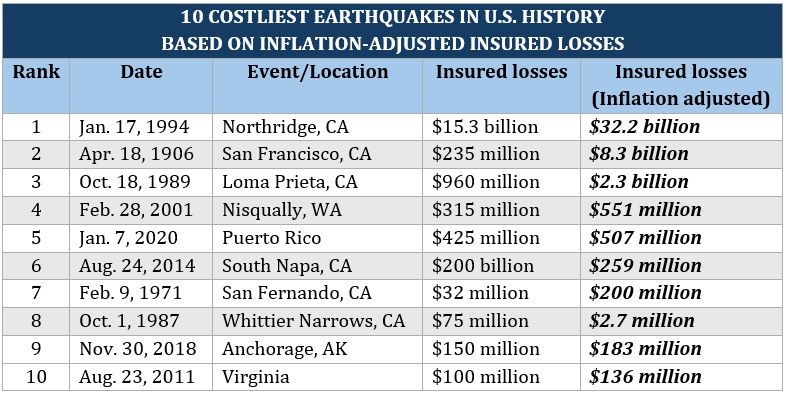

The 10 largest earthquakes in the US have cost insurers around $17.8 billion. The Northridge earthquake in Southern California accounts for almost 86% of the covered losses. If taken today, the combined insured losses are worth $44.9 billion.

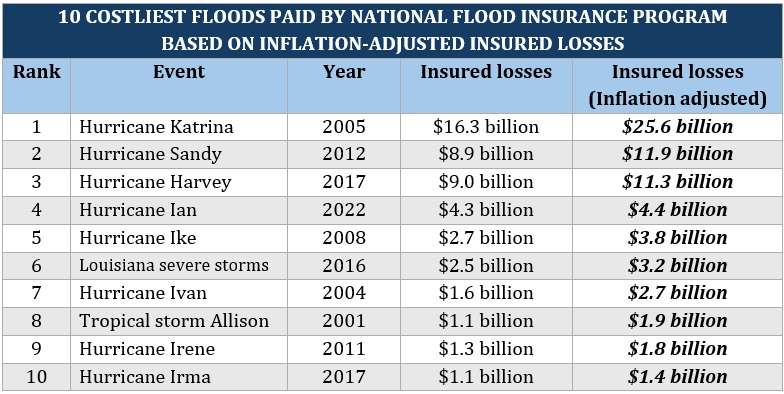

Flood insurance isn’t included in a standard home insurance policy. Flood coverage is usually provided through the NFIP. The program is administered by the Federal Emergency Management Agency (FEMA). The NFIP has paid a combined $49 billion in insurance coverage for the top 10 costliest flood events. Inflation-adjusted, the total rises to $68.1 billion.

Natural disasters impact both insurance buyers and industry professionals. That’s why in the face of calamities, it pays to be prepared. One way of keeping you and your clients protected is keeping abreast of the industry developments. You can do so by visiting our Catastrophe & Flood News Section. Be sure to bookmark this page to access breaking news and the latest industry updates.

What do you think is the biggest impact of the country’s worst natural disasters in the insurance industry? Do these events necessarily lead to an increase in insurance premiums? Feel free to share your thoughts below.