The Best Insurance Networks and Alliances in the USA |

5-Star Networks and Alliances

Jump to winners | Jump to methodology

Strength in numbers

Unprecedented is the resounding verdict on the status quo in the networks and alliances space.

“I don’t think there are many agents that have ever seen a market like this,” says CEO of Fortified, Joe Craven. “It’s been a long time since it’s been this hard. Premiums are going up and there are significant challenges from a policy condition standpoint.”

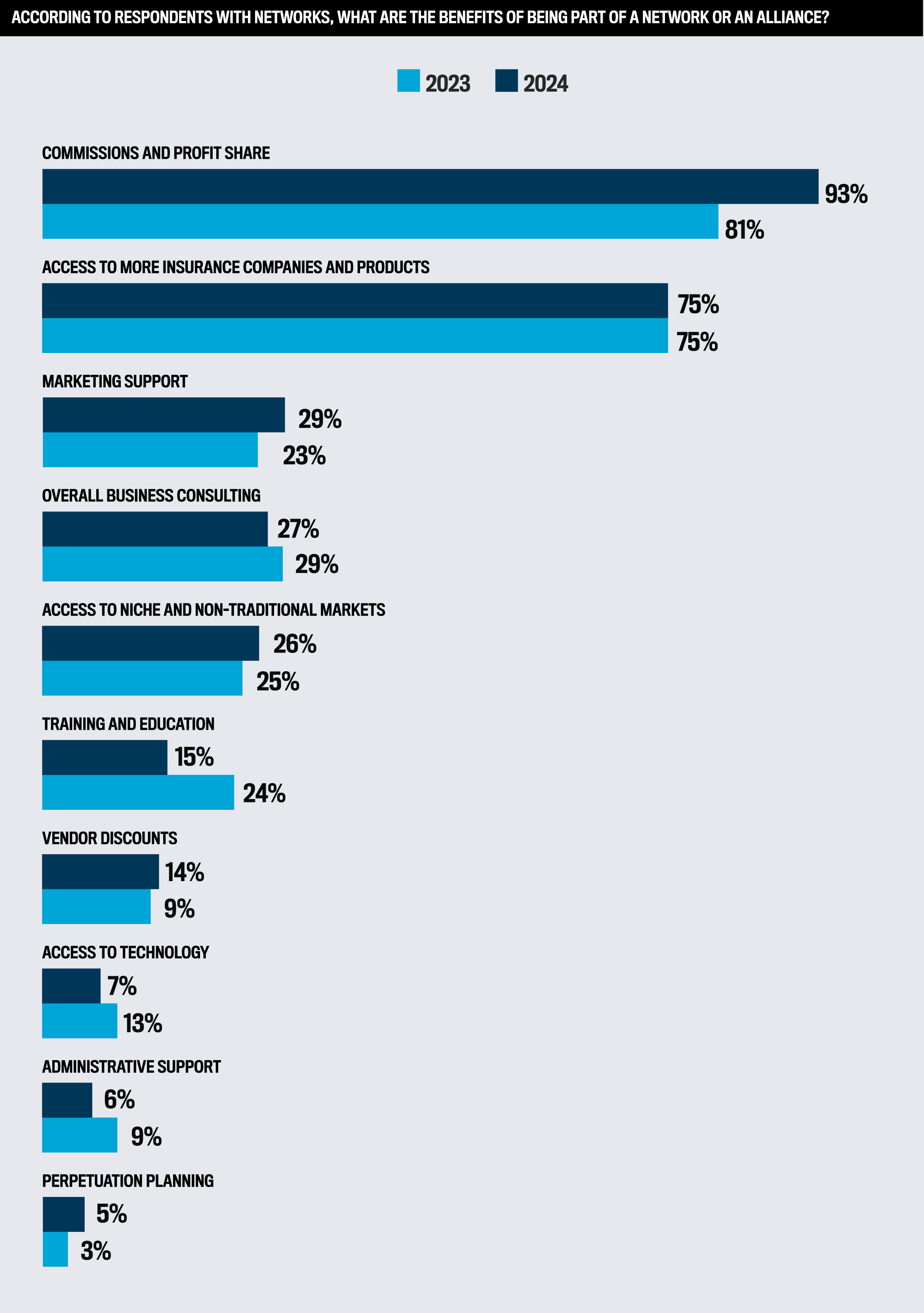

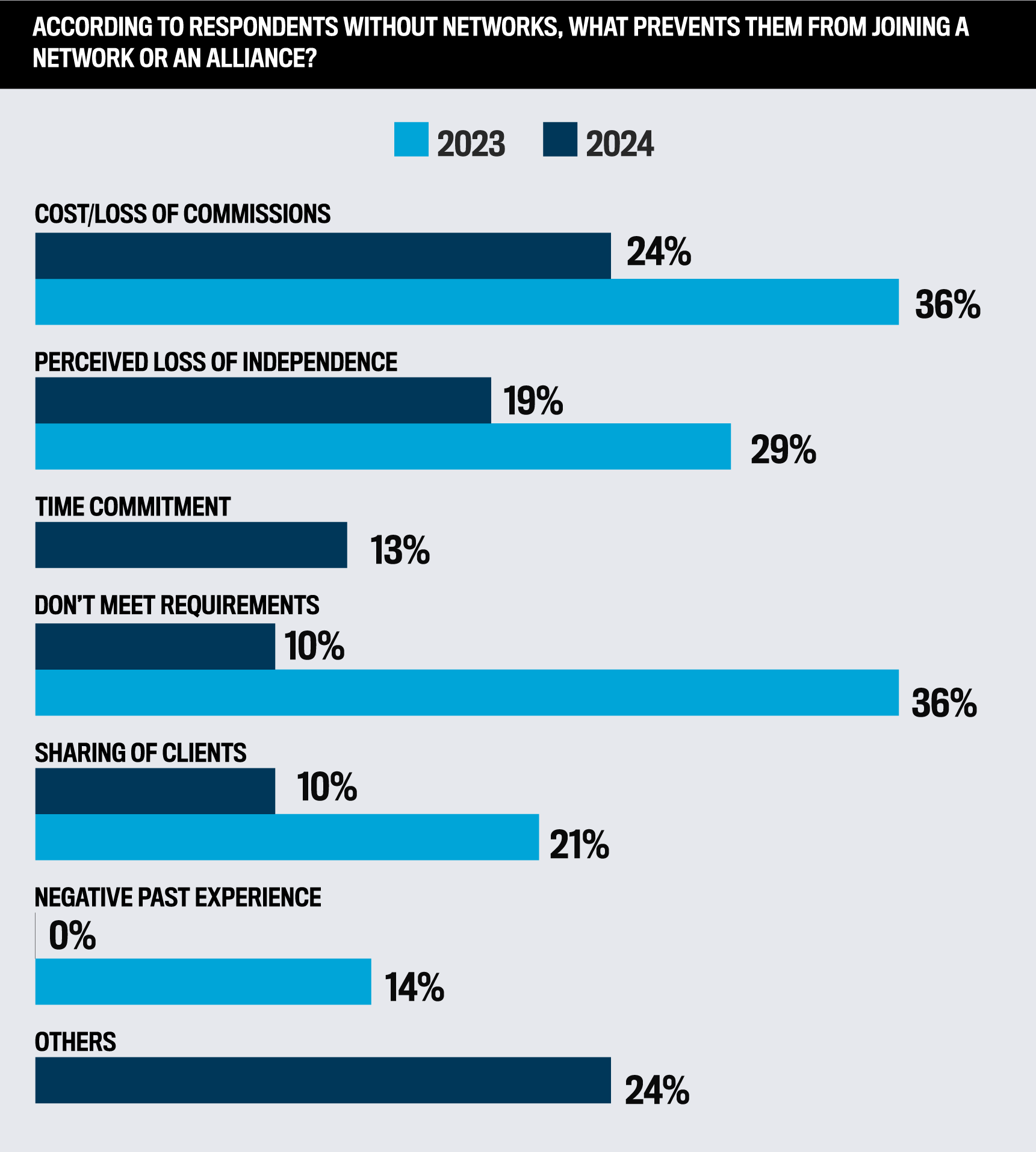

This is reflected in Insurance Business America’s data, where agents across the US stated commissions and profit share were their top reasons to be part of a network. This is the same as 2023, although there has been a sizeable jump from 81 percent to 93 percent.

Joe Craven Fortified

“This does not surprise me, I have said for the 20+ years I have spent in the network space that the reason many agencies join a network is in their minds to get to insurance carrier contracts, the reason they should join a network is to get to revenue they cannot earn on their own,” explains Diane Wagner, vice president, education and strategic planning at Marshberry.

Also sharing expert insight on the jump is Elizabeth Schenk, regional executive vice president of Renaissance.

“The reason for the increase is the challenge they are facing, carriers decreasing commission, cutting compensation, setting higher thresholds,” she says.

These sentiments are echoed by Steve Pearson, president of ISU International, who is also not surprised to see the jump in brokers’ preferences.

He says, “Commission and profit sharing for individual agencies has been under stress due to carrier profitability issues. Networks have clout to maintain higher compensation than most individual agencies.”

The challenging times are expanded upon by Craven.

“Companies are forcing mandatory higher deductibles in addition to the rates they’re taking. They are restricting their appetite significantly with what they want to write,” he shares. “There are some companies that have completely shut down and are not accepting any new business. So, it’s making it more difficult for our members and agents across the country to be able to find good markets and to write.”

An issue is for retail agents to find solutions for their insureds.

Joe StankowichDirect Access Insurance Solutions

“While commercial property and auto are challenged, there are still solutions in the specialty market and E&S space where product is available. Depending on location, options for personal lines have been even more limited,” reveals senior vice president of Direct Access Insurance Services (DAIS), Joe Stankowich.

“Through this hard market, we have worked closely with our national carrier partners around personal lines, and state by state we are seeing some initial indications of softening. These strong carrier relationships are allowing our retail agency partners to begin accessing newly available products as the market slowly softens.”

Like agents, carriers also value the 5-Star Networks and Alliances for alleviating pressure in this competitive space.

“They view networks like ours as a valuable resource to help them more effectively manage their relationships with independent agents through improved engagement, promoting healthy profitable books of business,” notes Stankowich.

Difference makers

When picking their top three reasons to be part of a network, agents reported to IBA in 2023 that ‘vendor discounts’ accounted for 8 percent, but by 2024 this had almost doubled.

“Many networks are placing a greater emphasis on formalizing their vendor relationships and offering. There is also a strong focus on promoting each vendor and highlighting the discount as this provides the agent with significant savings,” says Schenk.

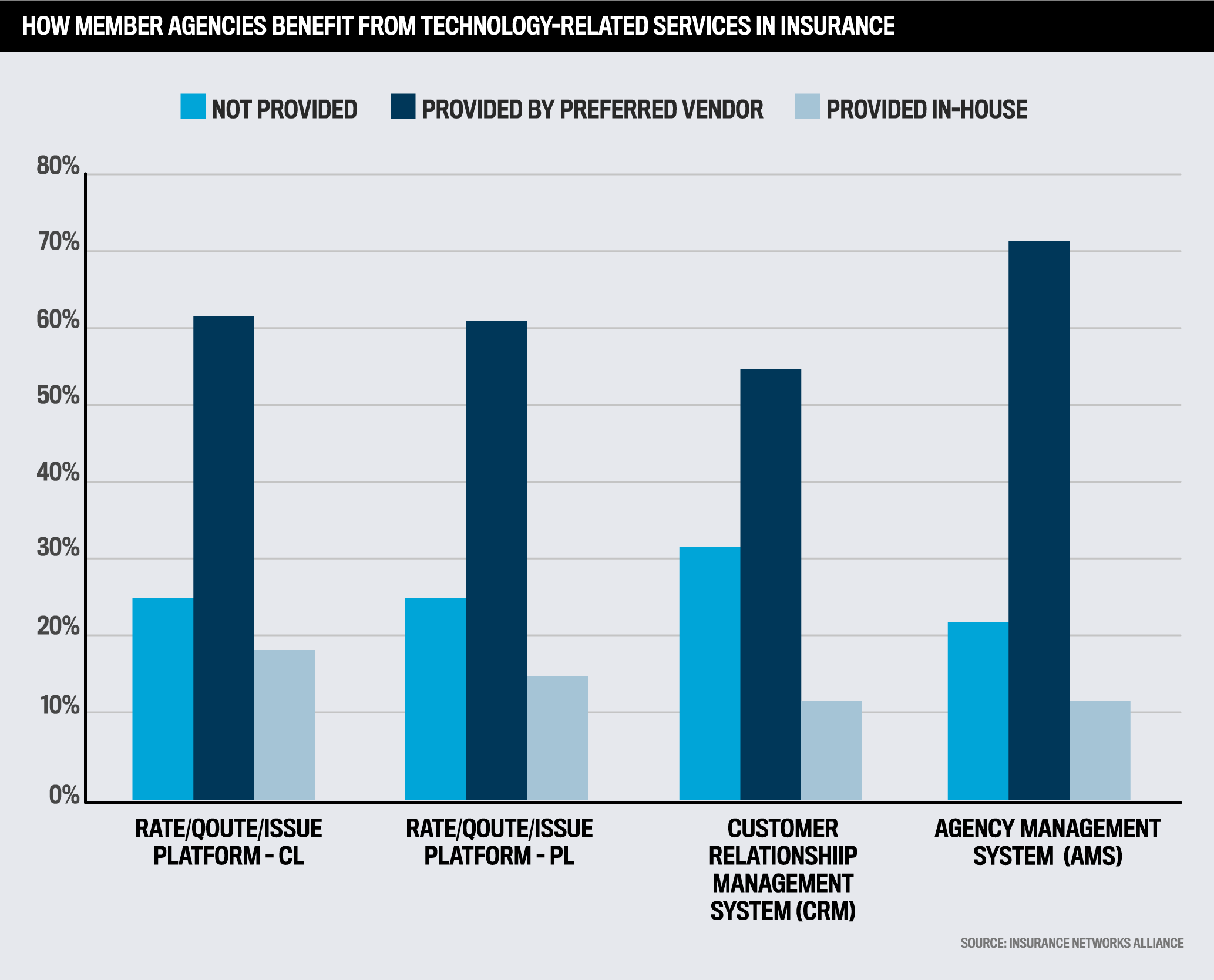

This is shown in the 2022 Insurance Networks Survey, where member agencies benefit from various technology-related services such as agency management system (AMS), rate/quote/issue platform – CL, rate/quote/issue platform – PL, and customer relationship management system (CRM).

Wagner comments, “My goal for member agencies has always been to offer additional revenue for every dollar of business written in a member’s agency and to help them save on the overall expenses through strategic vendor relationships.”

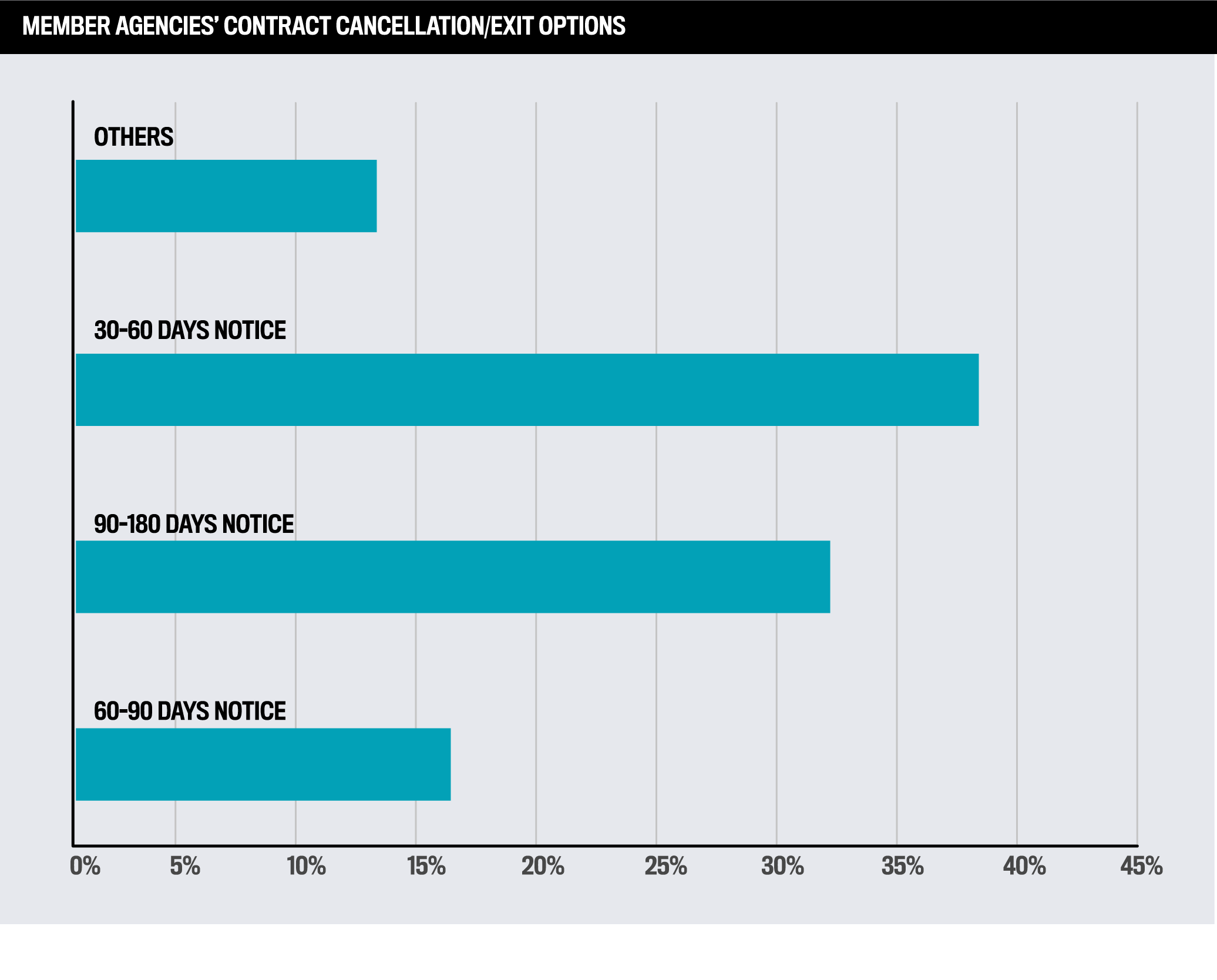

The survey also shows how the range of ways in which agents commit to a network vary:

-

39 percent must provide 30–60 days’ notice prior to exit.

-

32 percent are required to notify their networks 90–180 days before their planned exit.

-

16 percent must give 60–90 days’ notice, which is required prior to a member agency’s exit.

-

Others said they could exit anytime, while some said they could do so in 10 days. Another respondent said their network requires a minimum of 180 days’ notice.

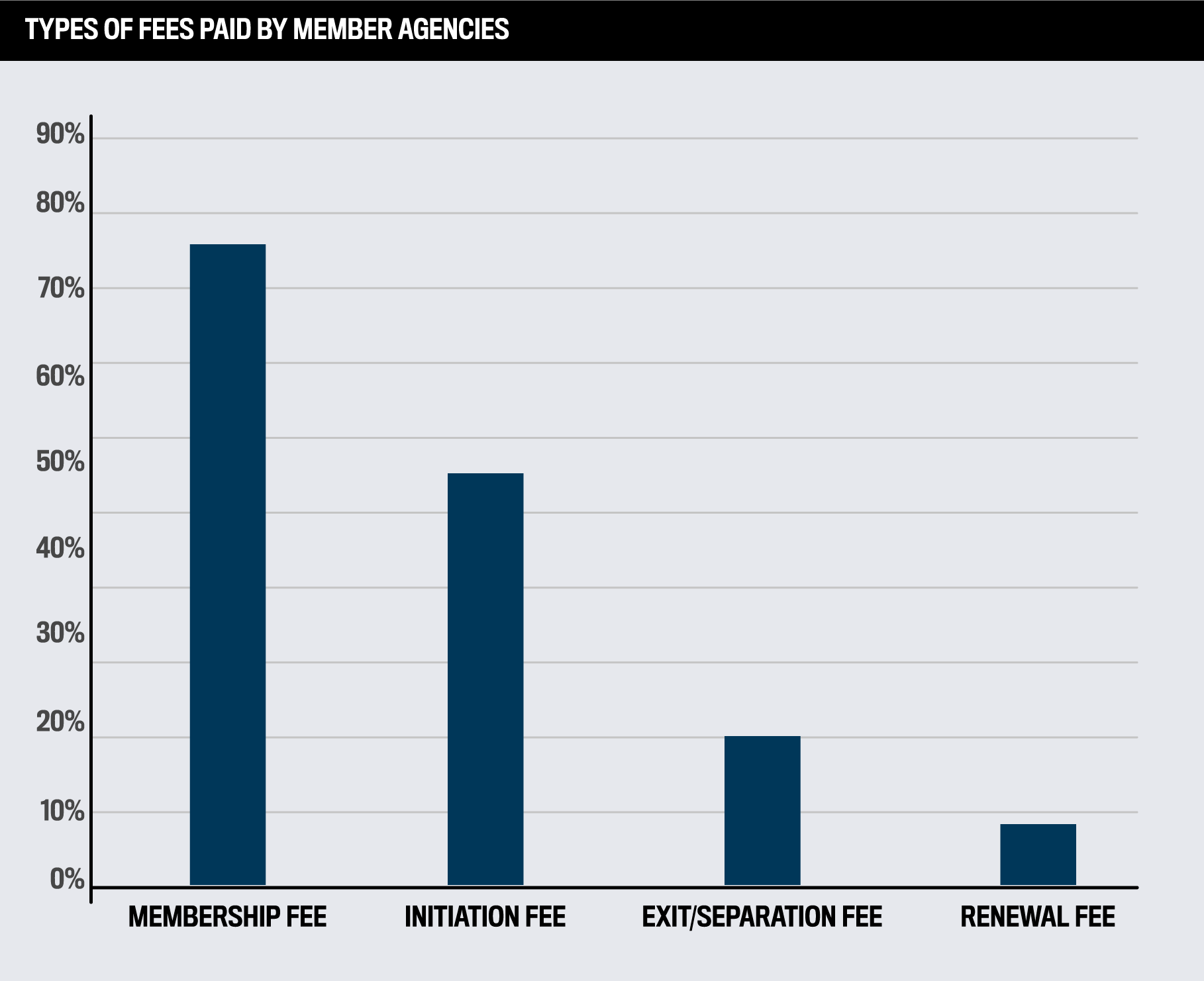

A similar picture was also drawn in the membership fee structure:

-

81 percent pay membership fees

-

52 percent have initiation fees

-

7 percent are committed to renewal fees

-

A fifth of those polled reported that their networks require agencies to pay exit or separation fees when they decide to leave the network.

Offering access to a niche market is another reason that attracts agents to networks.

“It is critical to offer access and resources, as well as additional revenue for niche and non-traditional markets,” shares Wagner. “As important is to help members define and build a niche market strategy as well. The most successful agencies I have worked with in my career have niche marketing verticals in the agencies.”

While Pearson adds, “As vendor costs increase, the ability to obtain discounts has become more important. The scale of a network can reduce agents’ costs and sometimes use a product or service that was otherwise unaffordable.”

IBA asked agents nationwide to rate how their network exceeds expectations in areas such as:

-

access to insurance companies and products

-

commissions and profit share

-

marketing support and overall business consultation

-

training and education and perpetuation planning

The networks that made the prestigious winners’ list have delivered across a range of criteria and are trusted partners to their agents.

Executive director of the Insurance Networks Alliance Ray Scotto adds, "To stay future-ready, networks must equip their agents with essential insights into market trends and ensure they leverage available technologies to enhance efficiency, grow their businesses, and increase value. This focus will take center stage at the 8th Annual INA Meeting, held January 27-29 in Phoenix, AZ, through targeted education and, most importantly, peer-to-peer learning—an integral part of INA’s mission."

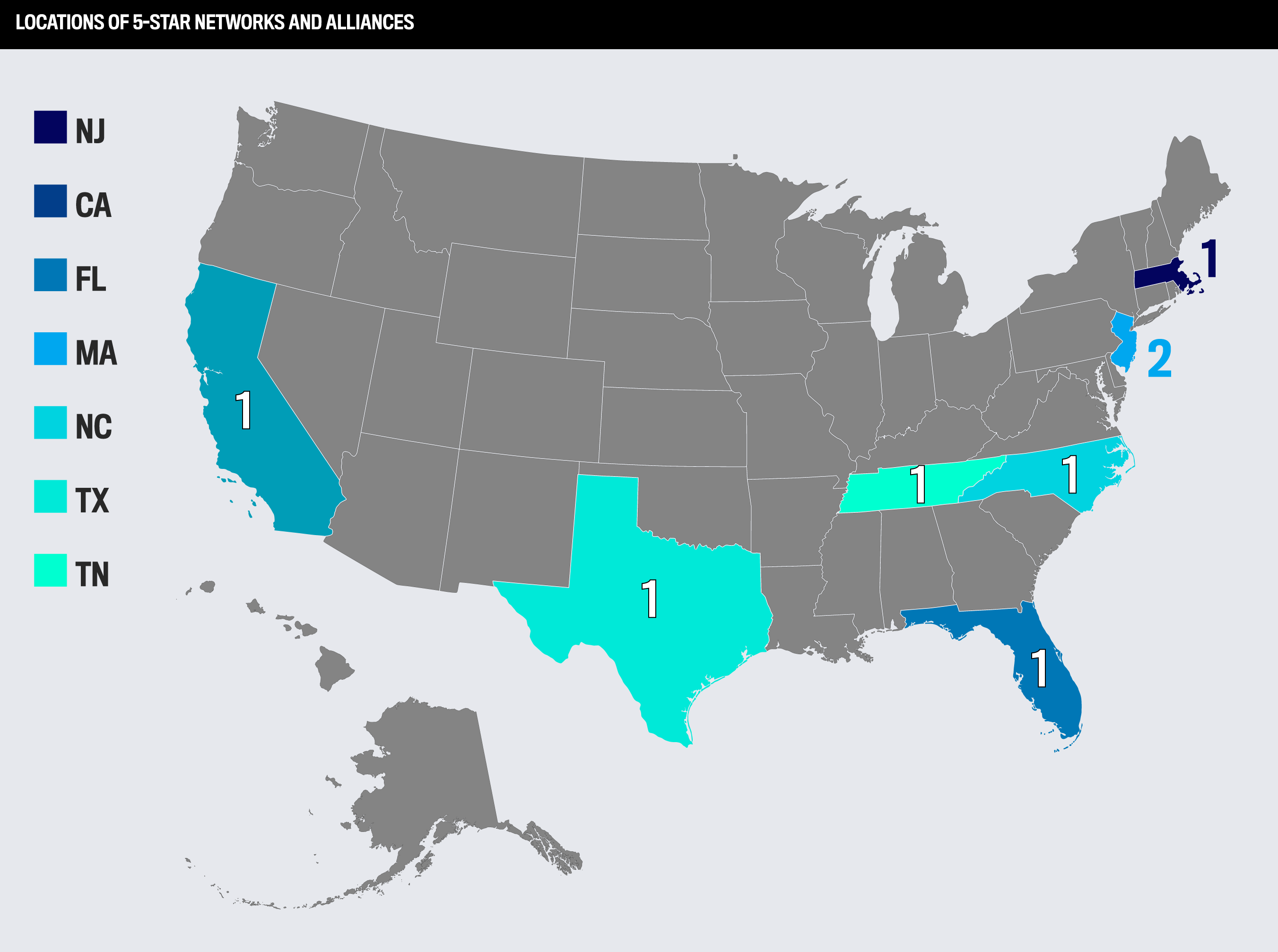

Established in January 2023, Fortified serves 70 member agencies in 10 states with over 270 locations.

Based in Tennessee, the network is primarily comprised of second and third generation agency owners with over $1.5 million in revenue, focusing on collaboration and wealth of expertise.

Unlike other networks, the Fortified model is not based on provisioning access to markets but giving agents a commanding foothold within the industry.

“By joining us, they have the size and scope to be able to compete with any of the large brokers and insulate themselves against selling,” says Craven.

The collaboration within their network enables members to help each other with their varied expertise and provide agents with a robust profit-share with a collective approach.

“If an agent has done $1 million of business with a larger company, but we have $40 million with the company as a whole, it gets them into a profit-sharing factor that they wouldn’t be able to get,” he says. “They’re going to earn significantly more profit-sharing dollars by being with us as opposed to being on their own.”

The network offers agents a wide suite of technology to aid efficiency by negotiating favourable agreements with vendors.

“We have an agreement with a comparative rating company that allows us to view the data from all the commercial lines quotes that our members do. It’s helpful because I can show them where they stand against the competition,” Craven explains.

Amwins Direct Access Insurance Services (DAIS) is a cluster group of independent property and casualty agencies, founded in 2008, aggregating more than $400 million in premium.

With over 125 retail agency partners nationally, DAIS supports members to stay independent by providing broad direct market access to national carriers, while also partnering with regional and niche markets based on the group’s needs.

DAIS collaborates with established and experienced P&C agencies.

“Beyond fostering regular engagement with our carrier partners through agent forums and webinars, we also work closely on individual engagement. We connect our agency partners with the correct carrier underwriting and leadership resources and advocate on their behalf,” adds Stankowich.

Their skilled team is key to delivering the DAIS value proposition to their agency partners.

“When you are aggregating premium and managing relationships at volume for this many agency partners, tight operational practices and a clear approach to agency communication are critical,” comments Stankowich. “They each bring decades of experience in their respective areas of expertise and have close relationships with our agency partners.”

Created in 2020, Strategic Agency Partners caters for 27 agencies across New Jersey and eastern Pennsylvania. The network accounts for:

-

$250 million in aggregated premium

-

$30 million in new business to carriers in 2023

Their model is consultative, and agents pay a low fee, while benefitting from full commission.

“We work with our care for agents to help them improve and grow,” explains managing director, John Tiene. “We help them develop deeper relationships with key carriers so that they can align what they’re doing and write more new business.”

John TieneStrategic Agency Partners

He continues, “We’ve got relationships with a number of national vendors and other experts that our agents can take advantage of to enhance the experience for their individual clients.”

The network, through their partnerships, empowers agents to provide high-quality service with the latest technologies:

-

Vertafore – an agency management system

-

Z-Wave – robust technology to help agents

-

Lula Technologies – an AI platform helping independent agents

“We try to find the right technologies that can truly add value to an agency and help them determine whether it’s right for them. It is very specialized for each agency, depending on what their needs are,” he explains.

Tiene also empathizes the current challenging marketplace for agents.

“Not only because of the nuclear verdicts, but what’s being driven by this third-party funding of litigation, is starting to bubble up to the top, with significant increased costs to carriers.”

Going against the grain means Strategic Agency Partners stand out.

“We’re not trying to sign every single agent or give market access to every single carrier,” he says. “Rather than using a one-size fits all approach, which doesn’t work, we are an organization that is focused on the success of our individual agencies because no two agencies are alike.”

Smart Choice is a mammoth in the network sector. Headquartered in North Carolina, it serves over 10,000 independent agents along with over 100 carriers.

Having written over $2 billion in premiums for operating across 45 states, Smart Choice provides agents:

-

access to top-rated markets

-

product training

-

sales and marketing support

There are no joining or monthly fees, and no long-term commitments, and Smart Choice also does not take an equity position in the agency.

Carol DrakeSmart Choice

“Our contract is unique in that we operate off a 70/30 split up until a capped amount,” explains senior vice president of personal lines, Carol Drake. “Once they reach that amount, they get 100 percent of that commission, and then they start earning in profit sharing with us.”

She continues, “It’s very important to have that alignment for the agent so they can continue to grow.”

Smart Choice continues to grow, bringing on 975 new agents from January 2024 to August 2024, while giving them autonomy to conduct business however they see fit.

“We help you, but we don’t control it, nor do we take a piece of that sale,” reveals chief marketing officer, Daniel Bruck. “When people are thinking about going independent, the last thing they want is an organization telling them what to do, and we don’t do that.”

ISU Insurance Agency Network grew to become one of the US’s largest independent insurance agency networks since its inception in 1979.

In October 2023, the acquisition by Steadfast Group combined the strengths of the two organizations — the local heritage of ISU and the international expertise of Steadfast Group, the largest insurance broker network in Australasia.

It is a network of independent agencies, leveraging the network’s strength to grow and succeeding together. Their members are across more than 40 states and write business in all 50, collectively generating $7 billion in premium.

“We’re a group of just 250 people networking with each other and many networks have thousands of people. They are strangers on the same highway, but it’s not the same as being part of a community,” says the Group’s president, Steve Pearson.

Steve PearsonISU Steadfast

Some of their agents have up to two decades of experience and benefit from gaining full commission.

“Our model is pure,” comments Pearson. “We don’t take any of our agents’ commission, which works especially with larger members. We have higher monthly fees, but that goes together with getting full commission.”

Retention of agencies through friendly contracts is part of ISU Steadfast’s ethos and it also allows members to leave without penalty.

“We develop our agents and give them direct carrier contracts, which most networks won’t do because you’re empowering the agent,” says Pearson. “They could leave and take that contract with them. We’re not afraid of agents leaving because this group is so unique and powerful, and people love working with us.”

Through that agent-first model, ISU Steadfast matches them with the right carrier as they know their needs from data and metrics.

Pearson adds, “We use artificial intelligence, which has sped up our processes and enhanced our offering to agents. We like the blend of traditional methods and new technologies to improve our agents.”

The Best Insurance Networks and Alliances in the USA | 5-Star Networks and Alliances

- Globex International

- Insurance Services of New England

- State Insurance Group

ALL STARS

- Globex International

- State Insurance Group

Methodology

Insurance Business America reached out to agents nationwide to find out which networks and alliances are helping them reach new heights. The survey asked respondents to rate the performance and service of their networks on a scale of 1 (poor) to 10 (excellent) against the following 10 criteria:

-

access to insurance companies and products

-

commissions and profit share

-

access to niche and non-traditional markets

-

marketing support

-

training and education

-

administrative support

-

access to technology

-

overall business consultation

-

perpetuation planning

-

vendor discounts

The networks and alliances that earned an average score of 8 or greater in at least one category were awarded a 5-Star designation. Those that received an average score of 8 or greater in all categories received an All-Star designation.

Keep up with the latest news and events

Join our mailing list, it’s free!