Independent specialist insurance and reinsurance broker BMS has launched its inaugural private equity, M&A and tax report, ‘Redefining M&A Insurance for the 2020s’. The report, which provides a holistic view of how M&A insurance interacts with the wider M&A sphere globally, also gives a first look at behaviours and trends following the onset of the COVID-19 pandemic.

Highlights include:

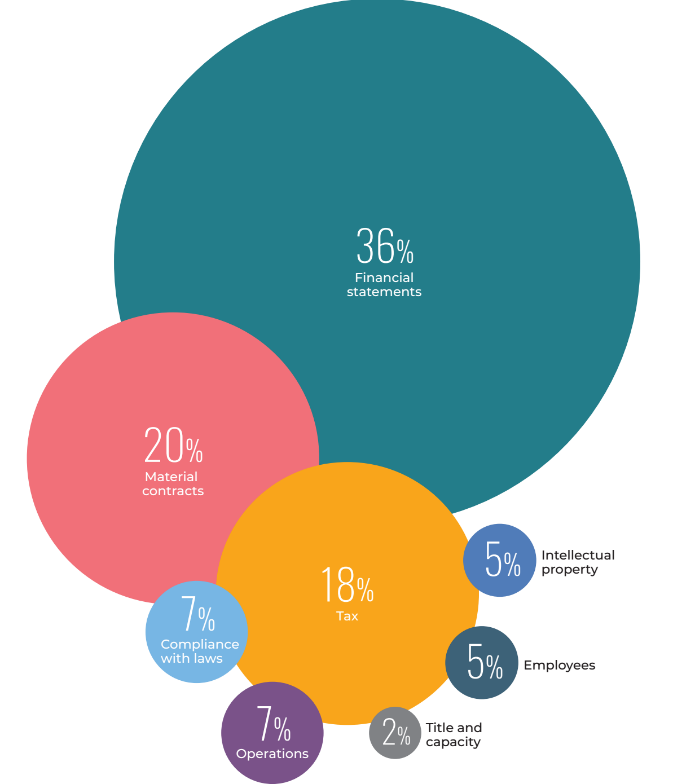

Credit: BMS

The report also provided insight into who buys and who initiates M&A insurance cover, as well as some of the broader dynamics at play when M&A insurance is used.

“2020 was an incredibly busy yet turbulent year for M&A, and our inaugural report is the first to provide a uniquely user-centric view on the way in which M&A insurance interacts with the wider transactions domain across the globe,” said Tan Pawar, MD and head of private equity, M&A and tax for BMS in London. “We believe this is critically important given the many changes in deal volume and transaction processes that have occurred in the last year given the impact of the pandemic.”

Pawar said that while claims have risen over the past few years, pricing has remained competitive, and M&A insurance has become vital to the deal process.

“M&A insurance is definitely coming of age,” Pawar said. “We believe that 80% of private equity transactions in North America now use M&A insurance, while in Europe and the UK the proportion is now firmly around two in every three deals.”