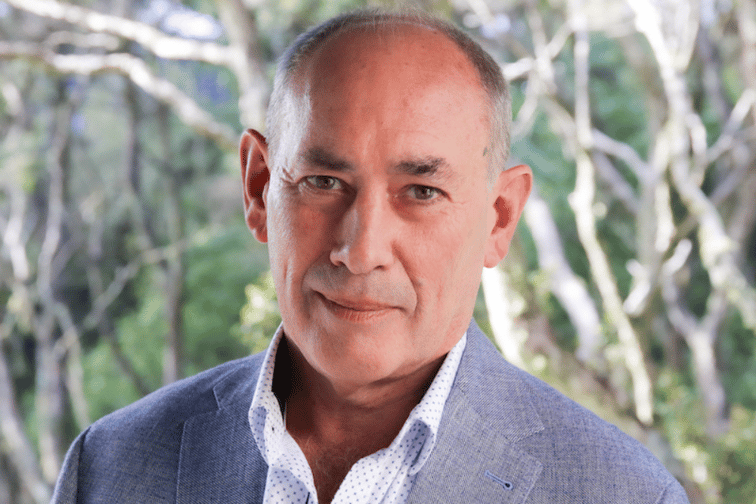

After an eight-year stint with the Royal Australian Navy, former submariner Tony Vidler (pictured) moved not only to New Zealand but also to the world of insurance as part of what he called “a very deliberate choice” to be part of the industry.

Speaking with Insurance Business, the AdviceNet Ltd owner and mySolutions director recalled how, in the 80s, he made the decision to switch to financial planning and spent time on correspondence courses during his final two years in the Navy. As a way of entry, his plan was to join a life insurer.

“When I got out of the Navy, I only applied for two jobs, and they were both with life insurance companies – AMP and Norwich Union,” he said. “Those were the only two jobs I applied for because I’d already mapped out my first 10-year career plan… So, I’d gone through and joined the life insurance company, had the training, learned how to sell and all those things, and then went off and did financial planning.”

It was during this financial planning phase that the ex-Norwich Union life insurance agent – who earned his certified financial planner, chartered life underwriter, and chartered financial consultant qualifications in the late 90s – became certain he wanted to focus on personal risk insurance, group insurance, and business owner protection.

He noted: “I did financial planning for a few years and built a big practice in Christchurch. And while I was doing the financial planning, I realised that I actually found investment management really boring. It’s dealing with the same problem and having the same conversation over and over and over. And I had no interest in getting into the lending business – that’s even more boring. So, I just stayed focussed on the insurance stuff, which I did thoroughly enjoy.”

For Vidler, being in the insurance realm is somewhat of an ego boost because of what the industry allows him to do for clients.

“I think probably the number one thing that I love about insurance as a product, regardless of what sort of product it is, is that, through the magic of legal contract, you can create vast lump sums out of thin air, which means that you can create estates,” he told Insurance Business. “And that’s fundamentally what we do – we create estates, so it’s an intergenerational impact.

“If you sit down, do a really good job with a family or business now around their personal or their business insurance, you secure the equity and the capital they’ve built up for future generations. And I think that’s a bit of a mind-blowing thing.”

He added: “In the retirement space or the financial planning or investment world, you’re basically helping people build up the pot of money that they want to spend themselves. From a career perspective, it’s not that thrilling for me. In lending, you’re helping them borrow more than they really want to in the hope they can get rid of it as fast as possible. Again, not really thrilling.

“But creating that intergenerational impact – it’s sort of ego-fulfilling, to a degree. You sort of feel like you’re making a difference on the planet, I think.”

In Vidler’s view, what fuels the best financial advisers is their ability to make a difference for others.

“Some personal insurances are very personal,” he said. “Your income protection, your medical insurance – they’re very much about covering risks for yourself; to a degree, for your family as well. But the lump sum stuff is really about creating legacy. I feel that a lot of the very best advisers – and I know a lot of really good advisers – are driven by making a difference.

“Yes, sure, they want to put food on the table and they want to have a decent livelihood, but they care more about the reaction and the interaction when they meet people down the street. They don’t want to be thought of badly; they want to do good; they want to be embedded in their community.

“One of the funny things about the personal insurance space is that you do end up actually getting really, really close to a lot of clients because you know stuff about their world that they haven’t told their best friends – all about their health, their family history, their financial position, their dreams, their aspirations. You get very close. It’s almost impossible to be a good insurance adviser or a good insurance broker in New Zealand and not have clients who have become friends.”

Vidler, who only knew three people in New Zealand when he relocated in 1990, pointed out that nearly all of his friends in the country originated from his insurance career one way or another, either as clients or as colleagues and peers.

What do you think about this story? Share your thoughts in the comments below.