Multinational risk professionals must now be prepared for virtually any type of political or economic risk threat in both developed and emerging markets, according to

Marsh’s latest political risks map.

The report, which is designed to help multinationals make smarter decisions about where and how to deploy financial resources around the world, addresses terrorism first as a growing concern.

But the report goes on to list emerging economy struggles, the 2016 US presidential election, anti-establishment parties in Europe, falling commodity prices, succession risks, centralisation vs federalisation, and rivalries among ‘great powers’ as significant political risks as well.

Referring to the terrorist attacks last year, the report projected that this would continue for at least another decade, with the US and Russia learning lessons from their historic difficulties of fighting prolonged ground wars.

“That means the most likely response from these and other governments will be an air campaign, which may not be enough to defeat the Islamic State,” the report said.

Economic struggles in China, Brazil and Russia would continue, with India being a ‘bright spot’ amongst them.

“Prime Minister Narendra Modi’s business-friendly government has launched several initiatives designed to boost economic investment, including foreign entities, and to stabilise the Indian rupee.

“Industrial production is also expected to increase as many companies have announced plans to build factories in India in 2016,” the report said.

Interestingly, the US presidential campaign had been brought into sharper focus due to the terrorist attacks in Paris and San Bernardino which had ‘intensified political rhetoric and brought these topics to the forefront’.

“With polls showing national security to be a major concern for voters, foreign policy will remain a key theme on the campaign trail in 2016 – and will be top of mind for the next presidential administration,” the report said.

There was some positivity to be gleaned – with the market for political risk insurance never being more robust and competitive than it is now, Marsh said.

“This can cover confiscation, expropriation, nationalisation, political violence, and other perils.

“According to a recent Marsh report, insurance capacity now exceeds US$2 billion for a single policy, which is nearly double the available capacity just six years ago making it an attractive risk financing tool for companies investing in emerging markets.”

The broker also said multinationals could take other steps as well as protecting their assets via insurance.

“[They] can prepare for the increasingly risky geopolitical environment by managing their credit risk; building resilient supply chains; and developing and testing crisis response plans.”

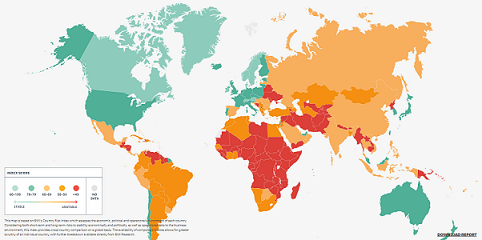

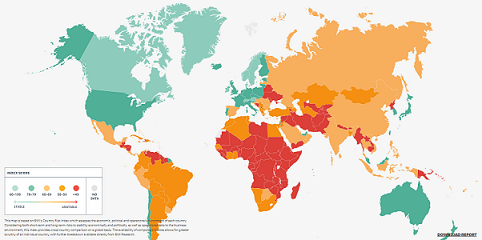

The aim of the report was also to rate countries with a risk score based on three categories of risk – political, economic and operational.

New Zealand scored an impressive 84.0 out of 100 in the short –term political risk index and 84.1 in the long-term.

“Social stability and low external threats are major contributing factors to our strong short-term score,” the report found.

“Meanwhile, maximum scores in the ‘system of government’ and ‘rule of law’ categories are particular strong points in the long-term index.

“As a mature democracy, we expect New Zealand to remain relatively stable over the long term.”

See the graphic below for an indication of the world map, with the less stable countries marked in orange to red and the more stable in dark green to light green.

Click

here for the full report.