Car insurance companies follow one simple rule when calculating premiums – the higher the risk, the higher the prices. But because each driver comes with a different profile and situation, the process of determining their risk level is far from straightforward.

It is not mandatory, however, for Kiwi motorists to take out car insurance, which has led some drivers to skip coverage. Not a smart decision, experts say, considering the financial ramifications of even just a single accident.

If the cost of coverage is an issue, then fret not as there are several ways for you to get cheap car insurance in New Zealand. Read on and find out how you can minimise your premiums with these practical tips from industry experts and read to the end to see where we recommend you look for coverage.

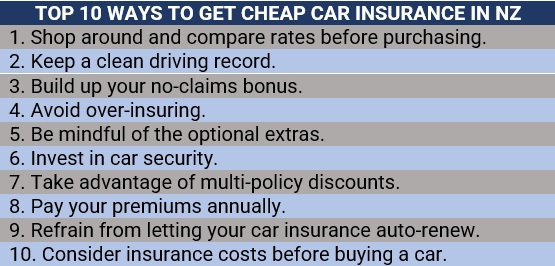

To compile this list, Insurance Business referred to the websites of several industry specialists and personal finance experts, including the Ombudsman’s Consumer Protection NZ. Here are the top premium-reduction strategies we gathered.

One of the most cost-effective ways to access cheap car insurance in NZ is to shop around and compare quotes using price comparison websites. The internet is replete with these online tools, which provide a side-by-side comparison of the different policies available from various car insurers. Apart from rates, you can examine each policy’s features and benefits, allowing you to choose the best coverage possible.

But experts warn against car insurance companies offering “ridiculously cheap” policies as these can compromise your coverage. It’s a balance of cost versus reliability and trust. We cover this more at the end of this article.

Your driving history is among the biggest factors car insurance providers consider when determining your level of risk. This means a driving record without a trace of traffic violations will definitely qualify you for lower premiums. But if you have received a traffic citation or caused an accident, it is not a good idea to hide it from your insurer as this can void your coverage and may result in fines.

Some insurers offer no-claims bonuses for policyholders who do not file any claims for a certain period, usually a year. This policy feature can significantly make your car insurance cheaper, especially if you have consecutive claims-free years.

This does not mean, however, that you need to maintain a spotless driving record to be given a discount. Although being a safe driver certainly helps, it also pays for you to be smart about what you claim. This can entail paying for minor repairs out-of-pocket in exchange for bigger discounts in the long run.

If you plan to insure your vehicle for its market value, it helps to be aware of the fact that your car’s value rapidly depreciates each year. A $15,000 car, for example, may be worth just $5,000 in less than 10 years, so your premium payments must reflect that.

To make sure that you are not over-insuring your vehicle for its market value, you should review your policy every year instead of allowing it to auto-renew (more on this later). This will allow you to find a deal that matches your coverage needs.

Optional add-ons – such as breakdown and windshield cover – extend the level of protection you receive from your policy, but these are not suited for everyone. Some motorists are better off sticking to basic coverage as this allows them to get cheap car insurance in New Zealand. Bear in mind, that these optional extras have a corresponding impact on premiums.

During application, most insurers will ask you to confirm if your vehicle has an alarm installed as this decreases the likelihood of it being stolen, earning you discounts. Other anti-theft devices such as immobilisers and steering wheel locks can also make you eligible for cheap car insurance in New Zealand.

If you have already taken out house or life insurance, you can bundle this with your car policy to access more savings. Many insurers offer multi-policy discounts, which can slash a huge chunk out of your car premiums. You may likewise be eligible for a multi-vehicle discount if your household has two or more cars, as long as these are covered by the same insurer.

Another effective way to get cheap car insurance in New Zealand is to pay for your premiums in one lump sum rather than in monthly or fortnightly instalments. This way, you can avoid being charged interest or finance arrangement fees. This strategy, however, will not work if you rely on a month-to-month budget, although some insurers may be willing to waive interest charges.

One of the costliest mistakes you can commit in the car insurance process is allowing your policy to auto-renew. This prevents you from removing unnecessary coverages, which you will continue to pay for in your renewed policy.

According to experts, it is best to review your coverage every year as your circumstances may change and your current policy may no longer fit your needs. Doing so can also enable you to find a deal that provides better coverage at a lower rate.

The type of vehicle you choose plays a crucial role in how insurance companies calculate your premiums. You can expect to get cheaper car insurance in New Zealand if you choose a popular car model as this often has parts that are easier and less costly to repair and replace. More expensive vehicles, meanwhile, may come with higher replacement costs and are more appealing to thieves, which can drive up premiums.

The table below sums up the top 10 ways for you to get cheap car insurance in New Zealand.

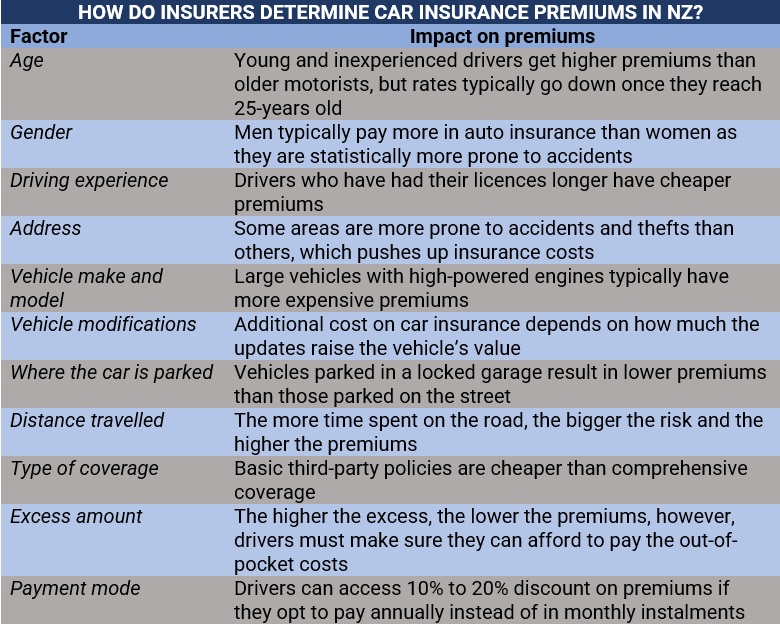

Because of the myriad factors in play, it is difficult to provide a single price point for car insurance policies across the country. Some experts even describe car insurance as a “hyper-personalised” form of coverage, which is why there is a vast cost difference between policies.

The table below lists the factors that have a major impact on car insurance premiums in New Zealand.

All things being equal, the cost of your premiums is dependent on how risky your insurer perceives you to be based on these parameters.

Unlike in other countries, drivers are not legally required to take out car insurance to operate a vehicle in New Zealand. The government already covers treatment and compensation costs for citizens and visitors who are injured in a vehicular accident through the Accident Compensation Corporation (ACC), a Crown entity under The Treasury Te Tai Ōhanga.

But this does not mean that you could get out scot-free if you caused an accident. You will still be liable for property damage, that’s why experts recommend purchasing third-party insurance, the most basic form of coverage, to provide financial protection.

Kiwi drivers have three options when it comes to car insurance policies. These are:

Apart from the three types of policies listed above, Kiwi drivers can pick between two types of cover:

The Insurance & Financial Services Ombudsman (IFSO) has provided additional guidelines on how these types of cover are implemented:

Market value. Agreed value. These are just some of the buzzwords you can encounter when taking out insurance. If you want to know the meaning behind common industry jargon, you can check out our glossary of common insurance terms.

In layman’s terms, the excess is the amount you agree to pay out-of-pocket before your insurer picks the tab. As a general rule, the higher the excess, the lower the premiums as insurers bear less financial risk.

Car insurers typically allow you to choose an excess amount, with a corresponding effect on your rates. Picking a higher amount can help you get cheap car insurance in New Zealand, but you must also think carefully before doing so to ensure that you set an excess that you can manage to pay.

If you want to learn more about how this insurance component – also called a deductible in other regions – works, you can check out our essential guide to insurance deductibles.

When taking out car insurance, you should always keep in mind that cheaper does not necessarily mean better. Focus too much on getting cheap premiums and you may find yourself lacking essential protection. At the end of the day, the best car insurance policy is one that strikes a balance between an affordable price and coverage that matches your needs.

Car premiums can be very expensive if you are a young driver who just got your licence. But that does not mean you can’t reduce your insurance costs. You can find practical tips on how to slash rates on our premium-reduction guide for young Kiwi drivers.

Our recommendation is to turn to an insurance agency that you can trust will be there for you when you need them, not folded and unreliable. We recommend that you look at our Best of Insurance for New Zealand page to find reliable, vetted, and trusted car insurance agents near you.

Companies appearing on this page are nominated by their peers, or vetted by our team, as reliable leaders in their industry. You’ll know you’re getting a great deal from a company that can be trusted during those difficult times.

Can you think of other ways to get cheap car insurance in New Zealand? Share them with us in the comment box below.