Small and micro-businesses, or those with less than 20 employees, form the backbone of New Zealand’s business population, accounting for 97% of all the country’s 563,000-strong private sector operations. But because these enterprises do not have the same level of financial resources as their larger counterparts, they are also more vulnerable when unexpected losses occur.

Business insurance can help provide these enterprises with some form of financial cushion when unforeseen accidents and disasters strike.

But how does business insurance in New Zealand work? What types of coverages does it provide and is it required by the law? Insurance Business answers these questions and more in this article. If you’re a Kiwi business owner trying to work out which insurance policies can serve your business best, this piece can serve as a handy guide. for insurance professionals in New Zealand to have clients with questions about business insurance in NZ, this could be a good article to send along to them.

There are no mandatory insurance policies in New Zealand, which means enterprises, regardless of their size, are not required by the law to take out business insurance.

The Insurance Council of New Zealand (ICNZ) Te Kāhui Inihua o Aotearoa, however, recommends that businesses, especially the smaller ones, to take out several “minimum coverages” that can protect them against common risks.

“Insurance is important for small businesses because the cost of something going wrong can be the difference between surviving and bankruptcy,” explained ICNZ chief executive Tim Grafton, in a recent interview. “Small businesses tend to run on leaner margins, so when something unexpected happens, there tends to be less capacity to absorb the cost.”

Each business comes with a different set of risks. Because of this, there is no single business insurance policy in New Zealand that can cover everything. The ICNZ, however, recommends five types of policies that are essential to protect small businesses. These are:

1. Business interruption insurance

The disruption caused by the coronavirus pandemic has given prominence to this type of coverage, which has also been the point of contention between insurers and businesses. In essence, business interruption, also called BI insurance, is designed to protect enterprises from loss of income and additional costs incurred if their operations are forced to shut down because of an unexpected event. Insurance companies, however, argue that the loss should result from “material damage caused to property.”

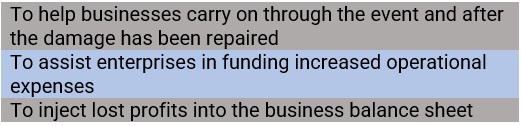

According to the ICNZ, BI insurance has three primary purposes. These are:

Business interruption policies can also be used to cover the following:

2. Commercial property insurance

If you own your business premises, this type of policy covers the damage the building sustains from a covered peril, including fire and flooding. It is one of the most common forms of business insurance in New Zealand.

Some policies may also pay out for earthquake damage, although most insurance companies impose several requirements before agreeing to provide cover. This comes in the aftermath of the 2010-11 Canterbury earthquakes, which are among the country’s costliest natural disasters. Before providing coverage, property insurers typically would want to know:

Meanwhile, if you’re a homeowner who wants to know if your home is covered under the Earthquake Commission’s (EQC) EQCover, you can find the answers in our comprehensive EQCover guide.

3. Commercial vehicle insurance

This type of policy works just like private motor insurance – both are not legally required, although the ICNZ advises vehicle owners to take out at least third-party coverage. This policy protects drivers financially from liability in the event they cause damage to other people’s property. Here are the three main types of commercial motor insurance policies in New Zealand:

Insurers also often include an uninsured motorist extension, or innocent party protection, in their policies. Under the terms of this extension, the insurance company will waive the policyholder’s excess and maintain their no claims discount if the vehicle is damaged by an uninsured driver – provided that the uninsured driver can be identified, and they acknowledge their involvement in the accident.

Commercial vehicle insurance covers company cars, business fleets, and business-use motorcycles. Another thing you should take note of is that private motor insurance will not cover a vehicle you are using for your business.

4. Cyber insurance

Cyber insurance policies in New Zealand typically provide two types of protection:

1. First-party coverage

This pays out for financial losses your business incurs due to a cyber incident, including the cost of the following:

2. Third-party coverage

This provides financial protection against lawsuits filed by third parties, including customers, employees, and vendors, for damages caused by a cyberattack on the business. Policies typically cover court and settlement fees, and regulatory fines.

With the rapid pace of digital transformation giving rise to unique and evolving cybersecurity challenges, the ICNZ is urging businesses to consider taking out a cyber insurance policy. The council reminds enterprises, however, that this type of business insurance cannot replace due diligence and good cyber hygiene as the top line of defence against cyber threats.

5. Liability insurance

Liability insurance provides financial protection against claims of injury and property damage resulting from negligence in your business activities. In New Zealand, this type of coverage takes on many forms, the most common of which are:

Learn more about liability insurance in New Zealand in this article.

Apart from the essential types of business insurance listed above, New Zealand businesses can access a range of policies tailored to their specific needs. These include:

One of the biggest misconceptions preventing many home-based businesses from taking out proper business insurance in New Zealand is the belief that their standard home insurance policy already provides the protection they need. In reality, however, insurers offer this type of coverage on the assumption that the property is solely used as a residence.

If you operate your business from your home, you must inform your insurance provider or broker, so they can adjust your coverage accordingly. According to Business.govt.nz, some home insurance companies will agree to insure a property partly used for business, depending on the following factors:

Doing so can also help you avoid these costly insurance mistakes that Kiwis often make.

Business.govt.nz also advises all businesses and self-employed people – these include sole traders – to take out the most basic liability coverage, which is general liability insurance. This type of coverage can protect you financially if you cause harm to another person or their property. If you’re a contractor, liability insurance may be included as a condition in your contract.

What types of risk do businesses in New Zealand face?

Each business in New Zealand faces a unique set of risks, which can depend on the industry it is in and where it is located. The table below shows the most common risks businesses across the country are exposed to, according to Business.govt.nz.

The government website also advises businesses that are trying to work out the risks they are exposed to, to answer two important questions before purchasing business insurance in New Zealand. These are:

While there is no law requiring enterprises to take out business insurance in New Zealand, the nation’s government and industry bodies recommend businesses purchase certain coverages – and for good reason. If you need sound advice on what types of coverage you need for your home business, an experienced insurance agent or broker can help you make the right decision.

The purpose of business insurance is to provide your business financial protection from sudden and unexpected events that could cost you a huge portion – if not the entirety or even more – of your income. Without proper coverage, these losses can adversely impact your ability to continue operations. Thus, while it will cost you money in the form of premium payments, business insurance can be a worthwhile investment in the long run, especially if an unforeseen disaster hits your business.

Other countries make certain business insurance policies a requirement for enterprises to operate. You can learn how these coverages work in our global business insurance guide.

Do you think getting business insurance in New Zealand is worth the money? What policies do you think are necessary? Chat to us in the comments section below.