Liability insurance plays an important role in keeping your business financially protected if mistakes or accidents threaten to derail your operations. This is why having this form of coverage is essential for companies regardless of the size and industry.

As the name suggests, this type of policy provides protection against claims of injuries and property damage that your business is legally liable for. Liability insurance, however, comes in various forms. The key to getting proper coverage is understanding the type of protection each policy offers.

In this client education article, Insurance Business will give you a walkthrough of the different liability coverages to help you decide which ones match your business’ needs. We also talked to an expert who will explain the factors you should consider when purchasing a policy and discuss the biggest misconceptions about this form of coverage.

Liability insurance is a broad type of coverage that protects your business against claims of bodily injury, property damage, and reputational harm resulting from your daily operations. It pays for legal and settlement costs arising from lawsuits. It may also cover a third party’s medical expense.

Even if your business implements the necessary safety precautions and risk management strategies, mistakes and accidents can still happen. These errors can lead to costly lawsuits. Sometimes, even a single mishap can have a massive impact on your finances.

“Liability insurance protects businesses and professionals against significant financial losses resulting from legal claims,” explains Sean Craigen, BizCover’s head of distribution and NZ country manager. “Without liability insurance, a small business could be bankrupted from a single claim.

“We all know someone close to us who runs their own business. As New Zealand’s a nation of small businesses, they are the backbone of our economy. Liability insurance provides that added layer of protection and peace of mind for business owners. This allows them to focus on running and growing their business.”

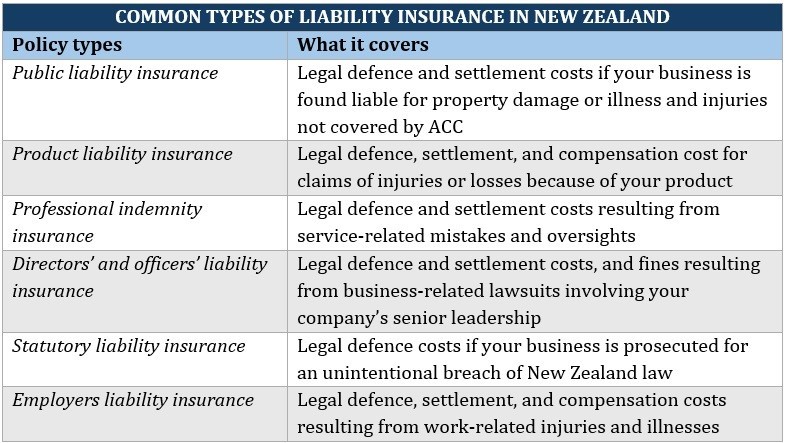

There are different types of liability insurance policies that NZ businesses can access. Each offers varying levels of protection. Here are the most common types of liability coverages that you can purchase in New Zealand:

This policy protects your business financially if you have been found liable for property damage or illness and injuries not covered by the Accident Compensation Commission (ACC). Sometimes called business liability or general liability insurance, it may also provide coverage against claims of reputational harm. These include libel and slander.

Some policies extend coverage to product liability, although you can also purchase this as standalone protection. This type of public liability coverage pays for claims resulting from a product your business manufactures or sells.

If you’re wondering about the differences between how general liability insurance works in the US and New Zealand, you can check out this guide.

This type of coverage protects your business against lawsuits from customers claiming injuries or losses because of your product. It pays for legal defence costs and third-party compensation if your business is found to be liable. If your company designs, manufactures, or sells products, then product liability insurance may be worth considering.

Professional indemnity (PI) insurance is an important form of protection if your business provides advisory or expert services. This policy pays for the legal and settlement costs you incur due to service-related oversights and mistakes, including:

Depending on the industry, professional indemnity coverage may also be called malpractice insurance or errors and omissions (E&O) insurance. If you have employees, this policy may also extend coverage to your staff.

Some professionals that may need this type of protection include:

Some NZ businesses are required, either by law or industry standards, to take out professional indemnity insurance. There are also clients who may require that your business carry this type of protection before agreeing to work with you.

Also called D&O insurance, this policy protects the directors and senior management of your company against financial losses incurred due to business-related lawsuits. Mostly designed for large businesses, it covers defence costs, settlement fees, and monetary fines.

This policy pays for the cost of legal defence if any member of your business is prosecuted for an unintentional breach of New Zealand law. This includes:

Statutory liability insurance also covers investigations of workplace injuries and those conducted by the Commerce Commission. The policy, however, doesn’t provide coverage for fines charged in relation to the Health & Safety and Employment Act, where indemnification is prohibited by law.

This policy protects your business against claims of work-related injuries that the ACC doesn’t provide coverage for. Also called EL insurance, this covers legal defence and settlement costs, and compensation for the employees’ injuries. It functions somewhat like workers’ compensation insurance in other countries.

Here’s a summary of the most common types of liability insurance policies in New Zealand.

Liability insurance is one of the most common forms of business coverage. Find out how business insurance can help you navigate challenging times in this guide.

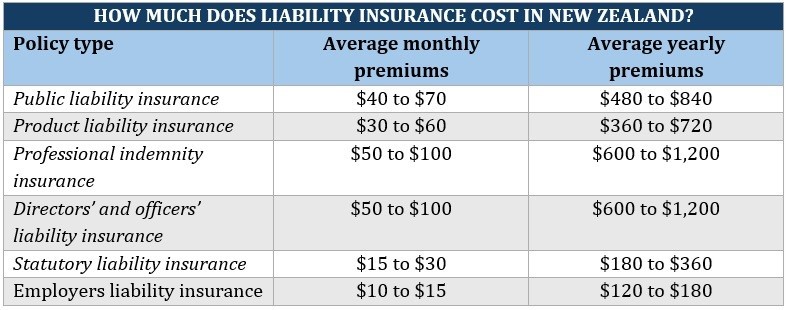

Because liability insurance policies provide different levels of protection, it’s hard to come up with a one-size-fits-all estimate of how much premiums cost. Here’s a breakdown of the average cost of coverage for the different types of liability policies the Insurance Business research team found. The figures are based on various price comparison and insurer websites we checked out.

Apart from the type of coverage, premiums for liability insurance policies are influenced by a range of factors, including:

industry: different sectors are exposed to varying levels of risks affecting the cost of liability coverage

business size: the more employees your business has, the higher the cost of liability insurance

coverage limits: this is the maximum amount the policy will pay for a certain type of risk. The higher the limit, the more expensive the premiums are

claims history: insurers see businesses that have a history of lawsuits and claims as risky and tend to charge them higher premiums to offset potential losses

business location: businesses based in areas prone to crime and accidents are more likely to have costlier premiums than those in safer locations

Find out how much small business insurance costs in this guide.

When choosing a suitable liability insurance policy for your business, there are several factors you need to consider ensuring that you’re getting the best deal. These include:

You should be aware of New Zealand laws and regulatory requirements when it comes to a minimum level of cover for various businesses. Many contracts – especially those involving construction sites or gyms – have requirements for public liability insurance. That’s why you should thoroughly investigate what is required to ensure that all parties are fully covered.

“There are several types of liability insurance, so depending on the industry they work in, there might be necessary or contractual requirements,” Craigen notes. “There are those stipulating the types of insurance they need to go on site or lease a shop, including coverage requirements needed. For example, $1 million in public liability insurance.”

Make a note of all the risks your business faces and ensure the policy is tailored to suit these specific needs. Always read the policy wordings and fine print in detail. Make sure that you’re aware of the policy exclusions.

Check to make sure that your policies do not have any exclusions or limitations that might not work for the type of business you’re in. You don't want to be in a situation where you do consulting work in Australia, but an exclusion in your contract limits you to work exclusively in New Zealand.

It's also important to look at how much the insurance costs and how that fits into your overall business expenses. Lastly, you'll want to look at the financial strength rating of the insurance company you want to work with.

Different businesses carry different risk levels. You don’t want to pay extra for coverage you don’t need. However, you also don’t want to be underinsured. And as tempting as it can be to go for the cheapest cover, you should carefully consider the level of risk before you select a policy.

There’s no degree of caution that can make your business entirely immune to lawsuits. Accidents and mistakes from your business activities can lead to costly damage and injuries. Without the proper coverage, a single lawsuit can be enough to put your business in a dire financial situation.

Some policies may cost more than others. But considering the level of protection they provide, the premiums you pay may spell the difference between keeping your business and closing operations.

“There are a number of misconceptions about liability insurance we see day to day,” Craigen says. “One of the more frequent misconceptions is that liability insurance is too expensive. The reality is the cost of liability insurance is often more affordable than the potential cost of a lawsuit or claim.”

While some types of liability insurance coverage aren’t legally required, it pays to have some form of protection once unforeseen incidents strike.

“The other misconception we see in the building and trades industry is that business owners don’t need liability insurance because they’re very careful and diligent, and they don’t make mistakes. We can all make mistakes. Even simple honest ones and the potential ramifications of these mistakes could be severe.”

Our Best in Insurance Special Reports page is the place to go if you’re looking for market leaders in New Zealand who can provide top-notch coverage. The companies and professionals we feature on this page have been nominated by their peers and vetted by our panel of experts as dependable and respected industry players.

By partnering with these insurers and individuals, you can be sure that your business gets the right coverage for the unique risks it faces.

Has liability insurance ever saved your business? Share your story in the comments