Fast Brokerages 2022

Jump to winners | Jump to methodology

Driving growth in challenging times

New Zealand brokerages have experienced a wild ride over the past two years. Aside from the COVID-19 pandemic and New Zealand’s lockdowns and border closings, the industry has faced steep competition from international corporations, Australian firms, and determined smaller operations. On top of these, there have been calls for greater transparency and accountability, as well as more competition from online brokers.

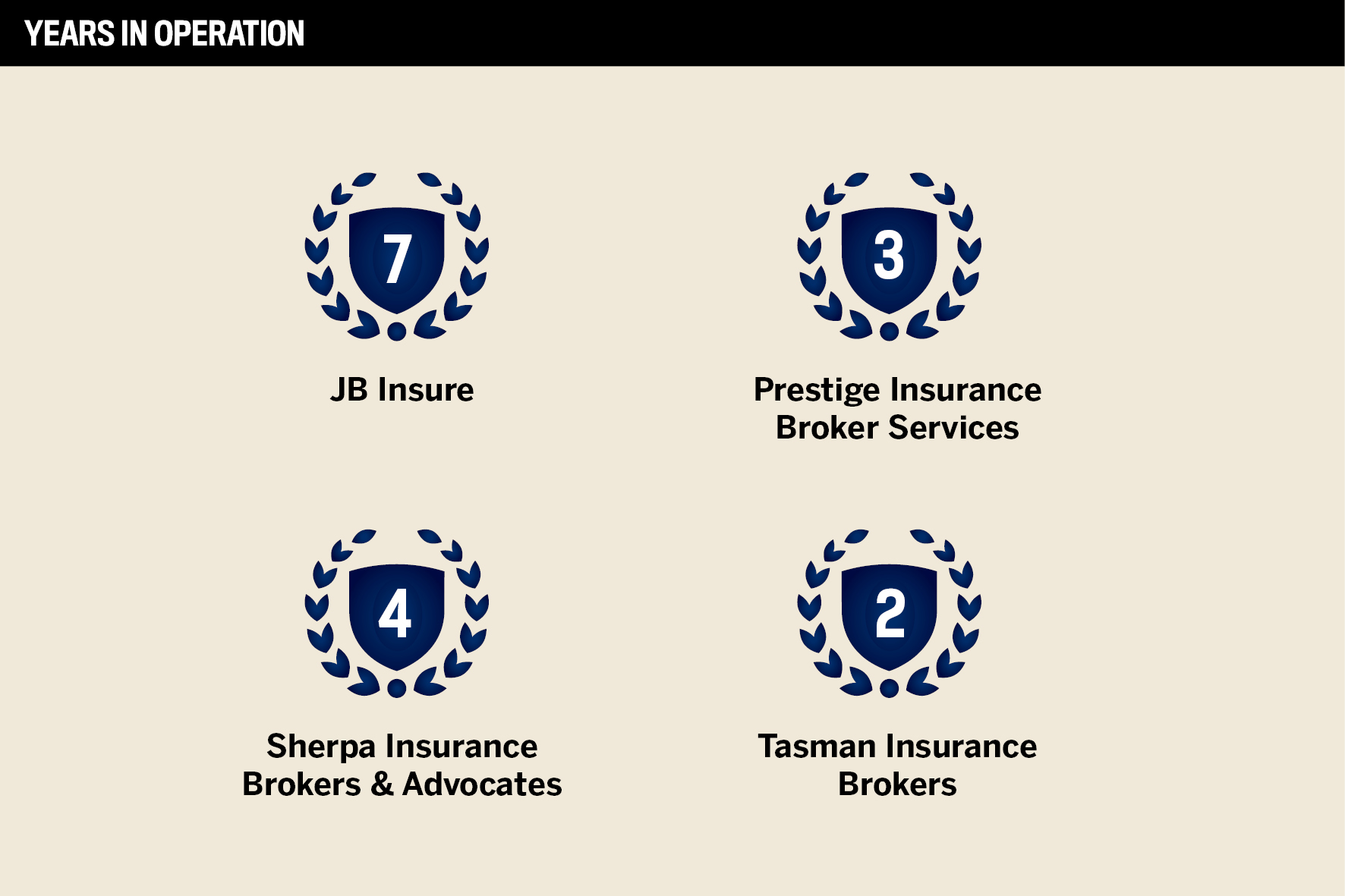

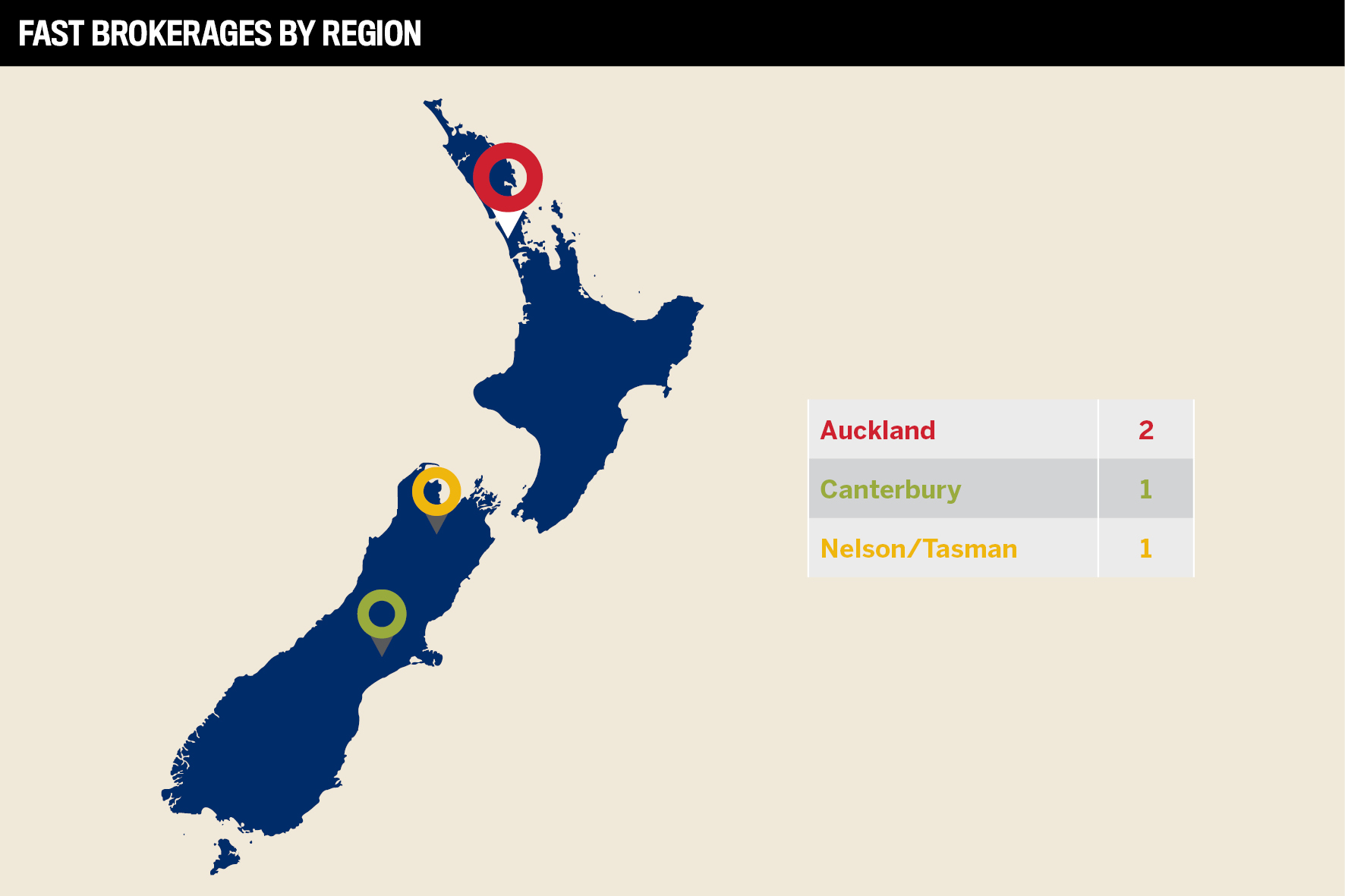

Regardless, IB New Zealand found four small brokerages that shone in 2020 and 2021. Their operations consist of two or three people who managed to achieve a combined growth in gross written premium (GWP), revenue, and broker headcount of over 50%. These Fast Brokerages are worth watching in the next few years.

“We are very patient and considerate when it comes to hiring, as company culture is incredibly important to us”

Daniel Mathieson, Sherpa Insurance Brokers & Advocates

Positive GWP, revenue, and broker headcount

Three of the four winners – Sherpa Insurance Brokers & Advocates, Prestige Insurance Broker Services, and Tasman Insurance Brokers – achieved 50%, 62%, and 21,046% growth rates in GWP, respectively. Tasman’s impressive jump in GWP and revenue were due in part to the acquisition of a local brokerage firm in 2021.

How did they achieve these numbers? “We feel that, regardless of premium spend, our clients deserve bespoke service and straight-up advice,” says Daniel Mathieson, the owner and director of Sherpa. “We consider ourselves a true open-market broker; we’re unbiased in the options we put forward to our clients, and we fight fair at claim time.” In addition, Sherpa goes out of its way to try and understand its clients’ businesses. These efforts translate into new leads from clients and referral partners.

Rick Hao, managing director of Prestige, echoes Mathieson’s sentiment. “Being client-focussed, our aim is always putting our clients’ needs as our top priority with regards to response time, claim service, and best value for money,” he says. “When you have these things taken care of, clients will follow.”

Word of mouth and client referrals have also boosted Tasman’s GWP growth, says director Karen Botica.

Sherpa, Prestige, and Tasman posted 49%, 51%, and 18,040% growth in revenue, respectively.

How did they achieve these numbers? “Our passion for our clients and their businesses – as well as an investment in our team and their professional development – has driven incredible year-on-year growth,” says Mathieson. “We’re taking the initiative of capping portfolio sizes per broker so that we can ensure an optimum standard of client service. We have reinvested profits into the business which has supported our capacity to service the needs of our clients to a high standard.”

Meanwhile, Botica says: “In my first year, it was my fabulous existing client base that spread the word, but the purchase of the new book in 2021 jumped things significantly.”

What’s more, Sherpa and Prestige achieved 50% and 200% increases in employee headcount, respectively; Tasman’s headcount stayed the same until recently.

How did they achieve these numbers? “As a small business, we know that the best possible experience – for our staff, and our clients – comes with making Sherpa a great place to work,” says Mathieson. “We pay above-market salary for experience and provide flexible working conditions so that our team has an enriching work-life balance; our team is empowered to work according to what’s best for them and their clients.”

Hao emphasizes the fact that service is always a priority with Prestige. “With a significant increase in our clients count, we need more people on deck to keep up with our service level,” he says. “The only way to achieve this is to hire more employees, such as brokers, claims consultants, and admin people.”

Botica adds: “Purchasing the new business, I had the opportunity to take on their previous domestic broker – who has been a huge bonus – and we recently employed a new [employee] to become our admin/broker support.”

Ultimately, Sherpa, Prestige, and Tasman achieved combined growth averages of 50%, 104%, and 13,029%, respectively.

“Being client-focussed, our aim is always putting our clients’ needs as our top priority with regards to response time, claim service, and best value for money”

Rick Hao, Prestige Insurance Broker Services

Challenges faced and conquered

Of course, it wasn’t easy for the Fast Brokerages to achieve their impressive growth numbers.

“The candidate market is slim, especially with increased qualification requirements in force for advisors,” says Mathieson. “We are very patient and considerate when it comes to hiring, as company culture is incredibly important to us. While it makes the search process longer, it is worthwhile investing in the right people and ensuring that the skillsets and personalities of your staff are complementary.”

Hao also notes that finding the right personnel was one of the most challenging things he faced over the past two years. “While we are trying to find experienced brokers or claims consultants, we have created our own internal training programme to try to promote from our current employees, which definitely helped us a lot with the current labour shortage,” he says.

Meanwhile, the pandemic made it more difficult for Sherpa to get in front of prospective clients, and they dealt with this issue by utilising “warmer” leaders, such as referrals from clients and partners.

What about insurer networking? “We have seen much less of the insurers and underwriters that we work with due to COVID restrictions and their workplace policies resulting in significantly less travel,” says Mathieson. “We are constantly in touch with them through phone, email, and Zoom but still find the face-to-face catch-ups at conferences, industry events, and in-office meetings so valuable for meeting those who are new to the industry and maintaining insurer partner relationships.”

At the same time, Botica faced myriad similar challenges. “The transition from just working by myself – to having staff and setting up a larger business and the associated logistics – was intimidating and sometimes frustrating, but you just have to persevere with things,” she says. “Listening to advice, then choosing what to take on board.

“Juggling the above and the associated things that come with it with family life, long hours – which I keep reminding myself won’t be forever – compliance, regulations. There is so much to cover off in this industry, but thank goodness I had the support of the Advisernet group, which helps with so much of this.

“It’s hard for clients when they get the email telling them that their insurance broker has changed, so it’s been important to make the transition for them as seamless as possible. Our main goal is to make them all feel like they matter – ‘cause they do – and I hope we are doing that.”

“Feel the fear and do it anyway. It’s hugely intimidating, but sometimes you just have to back yourself and put yourself out there. A bit of hard work never hurt anyone”

Karen Botica, Tasman Insurance Brokers

Advice for other brokers

What do the winners have to say to others striving for a Fast Brokerages award?

Mathieson advises setting goals and holding oneself accountable. “Build a reputation of trust with your clients by delivering on what you say you’re going to do,” he says. “Strive to be a trusted advisor and back up your advice with a great claims service. Ensure you continue to invest in each of your clients and their businesses while maintaining your company culture and focus. Business prospects will come in the form of referrals from clients and partners, but don’t be afraid to cold-call and network to get started.”

For Hao, “service, service, service” is key. “There is no set manual for this because every client has different needs, and we cater our service based on their needs,” he says. “This definitely helped achieve our goals.”

Botica adds: “Feel the fear and do it anyway. It’s hugely intimidating, but sometimes you just have to back yourself and put yourself out there. A bit of hard work never hurt anyone.”

Fast Brokerages 2022

- JB Insure

- Sherpa Insurance Brokers & Advocates

- Tasman Insurance Brokers

Methodology

Insurance Business New Zealand invited submissions for its Fast Brokerages awards in February 2022 as the publication sought to recognise brokerages across the country that did not just weather the COVID-19 storm but actively thrived. The research team asked brokerages to list their revenue totals for the 2020 and 2021 calendar years, in addition to other growth milestones they wanted to highlight. The team then evaluated the nominations received to determine which brokerages experienced standout growth.

The 2022 Fast Brokerages awards are given to brokerages that achieved more than 50% combined growth in GWP, revenue, and brokers headcount. Four winners made the final list of Fast Brokerages this year. These brokerages confirmed their resilience and cemented their strong positions in the New Zealand insurance industry.

Keep up with the latest news and events

Join our mailing list, it’s free!