Digital insurer OneDegree has marked its fifth year of operations by reporting its first profitable quarter and outlining a strategic push into integrated pet care services and digital insurance innovation.

The company, which entered the market in 2020 with a license from the Hong Kong Insurance Authority, disclosed that its revenue for 2024 surpassed HK$240 million. This represents a 27-fold increase from its launch year and a compound annual growth rate of 131%.

Customer numbers have grown significantly during this period, increasing more than 17 times, with a 25% rise in 2024 alone.

OneDegree’s deputy chief executive, Emily Chow, said the company’s focus on operational efficiency and diversified offerings was central to its strategy.

“With improved operational efficiency, continuous product enhancements, and new revenue streams, we are confident in achieving profitability in 2025, aiming to become Hong Kong’s first virtual insurer to record full-year profits,” she said.

The company’s pet insurance product, the Pet CEO Plan, remained a major revenue driver. Since 2020, the segment has recorded a 24-fold revenue growth and a CAGR of 124%.

In 2024, the insurer enhanced the product with higher annual limits and new benefits covering critical illnesses such as epilepsy and patellar dislocation. Following these changes, renewal rates climbed further from a base above 90%, and nearly a quarter of dog owners opted for the supplementary benefits.

Beyond insurance, OneDegree has begun developing a broader ecosystem for pet owners. This includes wellness management tools and an e-commerce platform, both launched alongside its anniversary celebrations.

The company also operates in other insurance lines, including home, fire, and appliance coverage.

Home insurance, introduced in 2022, saw a 57% year-on-year revenue increase in 2024, with strong momentum continuing into early 2025.

Fire insurance, offered since 2021, grew five times over the same period, aided by what the firm claims to be one of the lowest rates in the Hong Kong market.

Customer demographics have diversified. While younger users make up the bulk of the client base – with 67% under age 40 – the firm also noted growth in older segments. In 2024, clients over 60 rose by 62% compared to the previous year.

OneDegree’s business model integrates technology to scale operations without proportional headcount increases. With around 100 employees, nearly one-third are in technology-focused roles.

The company uses artificial intelligence to automate claims processing, with roughly 30% of claims resolved within one business day.

In a branding move, OneDegree’s parent company changed its name to AIFT in late 2024, highlighting its broader focus on artificial intelligence and cybersecurity. The rebranding reflects ambitions beyond insurance, including expanding its footprint in digital risk solutions and Web3 technologies.

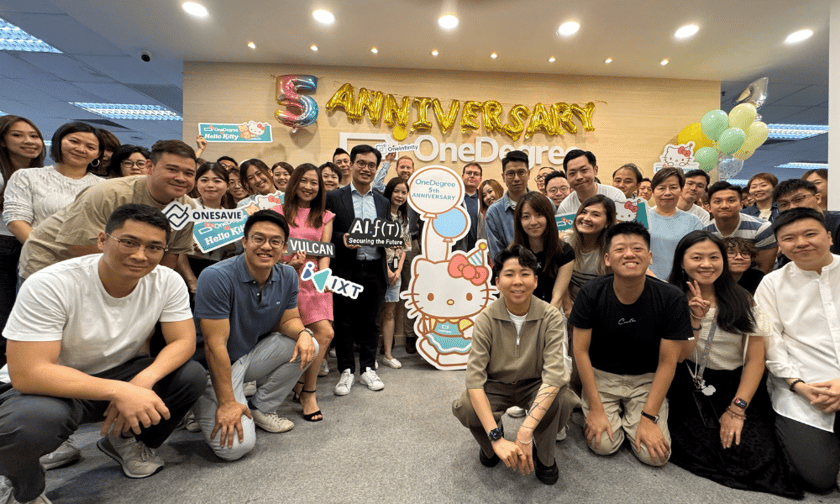

To commemorate its anniversary, OneDegree launched a consumer-facing campaign in partnership with Sanrio’s Hello Kitty brand, featuring promotions and events aimed at increasing engagement with younger and family-oriented clients.

The insurer also offered limited-time discounts across multiple product categories, including pet and home insurance, signalling an ongoing commitment to customer acquisition and retention through targeted marketing.