Updated August 29, 2024

IFRS 17 is the latest accounting standard that sets the rules on the financial reporting of insurance contracts worldwide. All listed companies using the International Financial Reporting Standards (IFRS) are required to comply with this regulation.

The standard replaced IFRS 4 on 1 January 2022, meaning it’s effective for annual reporting periods that start on or after 1 January 2023. IFRS 17, however, enforces a complete overhaul of the previous standard. This adds to the complexity of the already complicated insurance accounting standards.

In this article, Insurance Business answers the biggest questions insurance companies may have about this standard. We will give you a summary of how IFRS 17 works and dig deeper into the standard’s benefits and challenges. We also talked to an industry expert who will shed light on how insurance companies can be compliant.

Read on and gain a deeper understanding of the latest international accounting standard for insurance contracts in this guide.

IFRS 17 is the latest standard for insurance contracts implemented by the International Accounting Standards Board (IASB). It lists what items should be included in the balance and profit and losses accounts and how to calculate for these items. The standard also provides new guidelines on the financial presentation of insurance contracts.

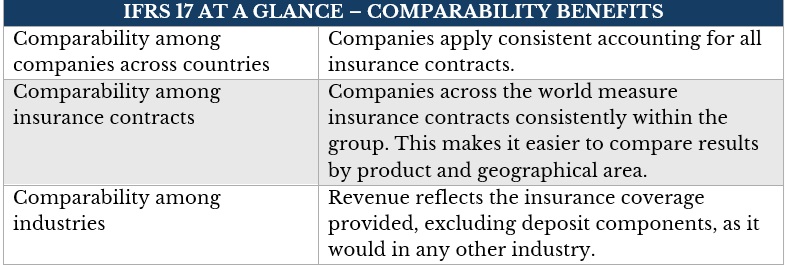

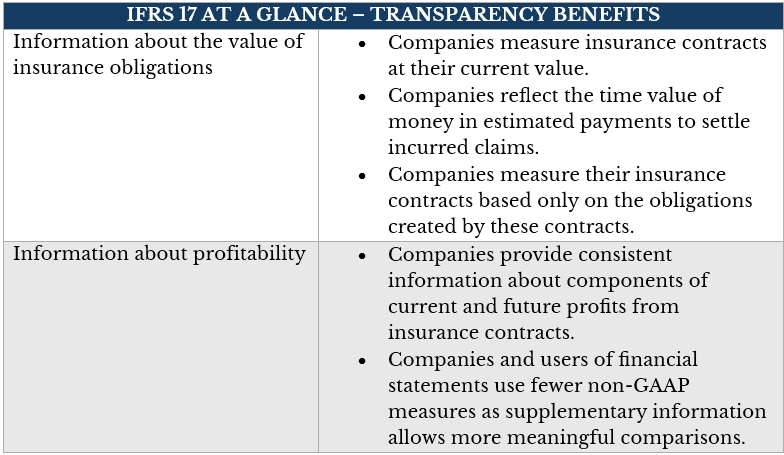

IFRS 17 is aimed at making financial statements easier to compare between insurance companies and different industries by implementing one accounting standard globally. The main challenge, however, is that it enforces major changes in actuarial calculations, data administration, and financial reporting.

“IFRS 17 is the first truly international IFRS standard for insurance contracts,” according to the IFRS fact sheet. “IFRS 17 provides consistent principles for all aspects of accounting for insurance contracts. It removes existing inconsistencies and enables investors, analysts and others to meaningfully compare companies, contracts, and industries.”

Find out how IFRS 17 can help establish a strong foundation for your company in this piece written by an industry expert.

IFRS 17 is like a hybrid of the two most common accounting approaches: the deferral and matching approach and the income statement economic value approach. The principles-based nature of the standard requires insurers to make many technical and practical decisions that will have significant consequences for both the financial and practical impacts of implementation.

Among the biggest changes implemented under IFRS 17 is the introduction of contract groupings and measurement models. These models are designed to improve transparency and consistency in the financial reporting of insurance contracts.

Under IFRS 17, insurers must disclose information on insurance contracts based on specific groupings, also considered the unit of account. These groups are based on a set of rules that are basically the function their product offerings, time, and profitability. These are the rules insurers must follow when assigning insurance contracts to a group:

Once an insurer assigns a policy to one group, it can no longer move the policy to another group. This rule is designed to improve transparency in insurance contract accounting.

IFRS 17 allows three measurement approaches for reassessing insurance contracts:

This is the standard approach that insurance companies use to calculate liabilities for an insurance contract. Also called the building block approach (BBA), this model is applicable to policies that cover a specific risk for an extended period. Such policies include life insurance. GMM focuses on providing information on expected cash flows and profitability.

This approach, however, requires technical actuarial expertise to come up with an accurate estimate. Insurance companies need to make complex calculations, extensive assessments of the results, and access to a reliable database containing comprehensive data.

If done correctly, GMM can provide valuable insights into an insurance contract’s performance. This is because the model allows the tracking of loss component and contractual service margin (CSM), and an analysis of period experience adjustments.

This model is a simplified approach for measuring insurance contract revenue and expenses but suits short-term policies or those that provide coverage for less than a year. In this measurement model, liability is measured based on premium, also called liability for remaining coverage (LRC).

PAA can also be used for long-term contracts. If insurers choose to do so, however, they must show results that are similar to those when using GMM.

This approach is a modified version of the GMM. It suits insurance contracts with direct participation features, where the policyholders share in the profits and losses of the insurers. Under this model, companies invest the policyholders' money in assets that are predicted to increase in value. The insurer then charges a fee in managing these assets, aptly called a variable fee. The fee can go higher or lower depending on the asset’s value.

The VFA provides investment managers with greater clarity and consistency in reporting the fee they charge. It is also a way to ensure that the insurer’s liability values are connected to the underlying asset values. This approach helps companies avoid accounting inconsistencies. It also allows a more accurate calculation of profits and losses over time.

In 2019, former Insurance Business senior editor Bethan Moorcraft sat down with Kamran Foroughi, senior director at WTW to talk about the potential business implications of IFRS 17. Her discussion with the global IFRS 17 advisory leader included the standard’s impact on business strategy, key metrics, asset liability management, and investor communication.

Here are the highlights of the interview:

IFRS earnings can be seen as quite a good proxy for dividend paying capacity. According to Foroughi, the fundamental question insurers need to ask themselves goes beyond whether the new standard remains a good proxy for dividend paying capacity. Companies must be looking at whether IFRS 17 could impact a firm’s ability to pay dividends.

“That might vary depending on whether you’re talking at the holding company level or at the subsidiary level,” he said. “I think one question companies have to ask themselves is: does IFRS 17 as a metric make sense at a subsidiary level, or can we perhaps use some sort of local accounting standard to help maintain existing accounting at that more subsidiary level?”

About a quarter of the IFRS 17 standard relates to disclosure of new information and explanations. Under the standard, not only will the main accounting statements look very different, but the notes with those statements will also be quite alien.

“Until Solvency II came along, we had a number of years where there was close alignment between the IFRS earning calculation, the solvency calculation, and what I call cash (or what’s really driving dividend-paying capacity),” the WTW advisory leader said. “It became much more important post-financial crisis when listed insurers realised they needed to really articulate their ability to pay dividends to get buy-in from key investors.

“When Solvency II came along, a wedge was driven between those metrics. It was a lot more complicated and was not closely linked to IFRS. Most insurers kept their old IFRS earnings definition, which was more closely aligned to Solvency I, and from there it became quite unclear what actually drives dividend paying capacity. Suddenly, there was a lack of clarity around the external disclosures around all of this.”

He added that IFRS 17 would make this problem worse.

“This will be a new metric coming along, further driving apart the behaviour of the metrics, and making this explanation and linking of the metrics a much more challenging process.”

If insurance firms are juggling multiple metrics, this can sometimes create complications from an operational standpoint. For example, when an insurer is faced with asset liability management, they must decide which metric to manage to.

There are two ways insurance companies can go about this:

“What we see with both IFRS 17 and Solvency II coming along is that the metrics are getting driven further apart, so the question of which metric insurers want to manage to will become more important,” Foroughi said. “Insurers are going to have to make key decisions about assets management, [and they’re going to have to] try and explain volatility that’s naturally going to occur in a coherent way.”

When something new comes along, it can be difficult to know where to start and what to prioritise with regards to implementation strategy. Foroughi explained that IFRS 17 is a principles-based standard that gives firms many options. Because of this, it is helpful for firms to work out what the potential business implications might be before finalising any business decisions.

“We see a number of firms already starting on this journey of [trying to figure out what sort of firm they are] and feeding that back into some of the technical thinking that they’re developing,” he said. “That’s why we encourage firms to think about the business implications of IFRS 17 as soon as practically possible.”

Learn more about IFRS 17-compliant insurers in our Best in Insurance Special Reports Page, where we recognise the industry’s best and brightest. The companies featured in our special reports were nominated by their peers and vetted by our panel of experts as trusted and dependable market leaders. By partnering with these insurers, you can be sure that your processes are in compliance with the latest industry standards.

What are your thoughts on IFRS 17? Let us know in the comments.