The first quarter of 2017 has been a busy one – with 185 deals in the US and Canada and a substantial 135 in the second quarter according to the latest figures from Chicago based Optis Partners. The huge first quarter insurance M&A figures were boosted in part by the formation of the Alera Group – a massive PE backed deal that closed 24 deals on January 1st.

Private Equity deals are nothing new in our industry – their activity has been close to 50% of all insurance broker M&A acquisition activity over the last two years – although as numbers of deals have risen, privately-owned agency acquisitions have set new records with Optis Partners’ figures showing a record 152 agency acquisitions over the last twelve months.

Private equity activity in the insurance agency M&A space first started its surge in late 2014 – in the preceding 5 years activity by insurers, agencies and banks had been relatively on par. Since Q4 in 2014, PE activity has outstripped all other acquirers by a considerable margin.

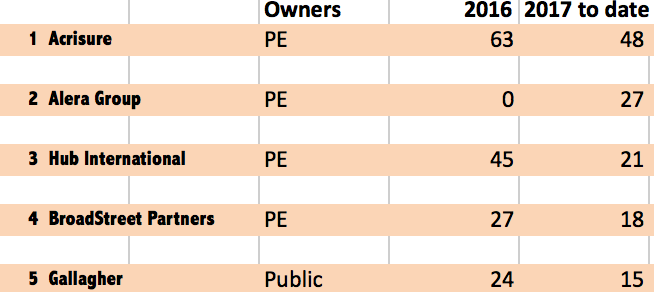

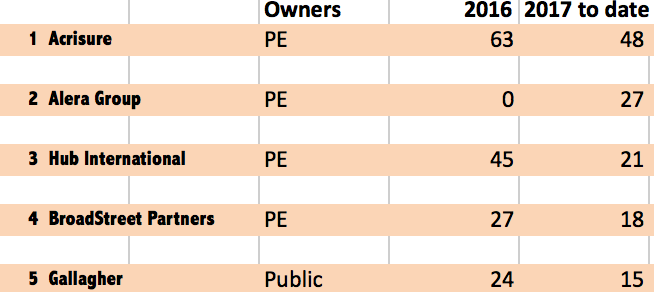

So who are the most active buyers?

(figures from Optis Partners LLC)

(figures from Optis Partners LLC)

It looks like this year will set more records for insurance agency M&As – there appears to be continued appetite (and funds) flowing into the private equity industry, and there appears to be a steady pipeline of agency owners prepared to sell their insurance businesses.