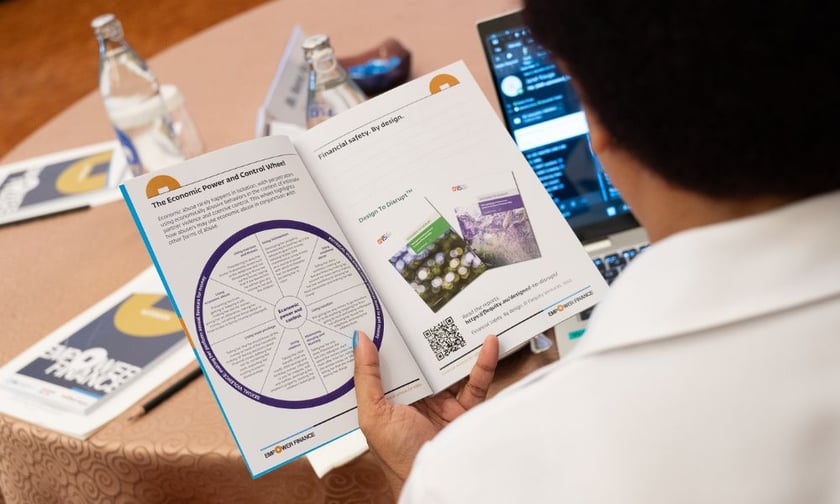

The International Finance Corporation (IFC), a member of the World Bank Group, has introduced “Empower Finance,” an 18-month program designed to help financial institutions combat financial abuse.

Backed by the Australian government, this program will bring together nine financial institutions from five countries across Asia and the Pacific, covering more than 30 million customers.

The initiative aims to foster collaboration between these institutions and global experts, promoting the sharing of information and best practices, and equipping them with tools to enhance customer protection and institutional safeguards.

IFC emphasised that financial abuse – which involves the exploitation of financial products such as bank accounts, loans, and consumer credit to harm others – disproportionately affects women and marginalised communities.

This form of abuse can undermine financial inclusion efforts, lead to financial losses, damage credit ratings, and erode trust in financial institutions.

“Financial abuse directly opposes efforts to enhance women’s access to and control over finance and financial services,” said Nathalie Akon Gabala, IFC’s global director for gender and economic inclusion. “The prevalence and cost of such abuse are only now being understood. Through Empower Finance, we are providing financial institutions with the necessary tools and knowledge to recognise, prevent, and create a safe environment for financial activities.”

The program includes financial institutions from Nepal, Papua New Guinea, Sri Lanka, Vanuatu, and Vietnam. It will promote universal principles to guide the creation of banking products and services designed to minimise the risks of financial abuse.

Allen Forlemu, regional industry director for IFC’s Financial Institutions Group in Asia Pacific, said addressing financial abuse requires a coordinated effort across the financial sector.

“Through ‘Empower Finance,’ we aim to strengthen the integrity of banking products and the banking sector in Asia and the Pacific. We hope that this unique program will help financial institutions create a resilient and secure financial ecosystem that protects the interests of individuals and businesses, specifically for underserved groups such as women,” he said.

Stephanie Copus Campbell, Australia’s ambassador for gender equality, emphasised the critical role that financial institutions play in mitigating financial abuse.

“Gender equality is essential for security, stability, and sustainable development,” she said. “This initiative recognises the critical role that financial institutions can play in mitigating the risk of financial abuse to women and other marginalized groups, which not only compromises their security but also impedes the advancement of financial inclusion.”

In fiscal year 2024, IFC committed $56 billion to private sector projects in developing countries, working to mobilise private capital and create solutions to global challenges.