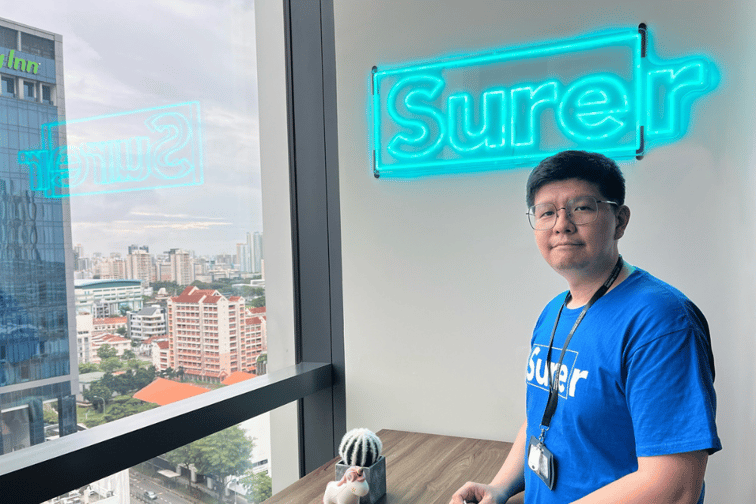

Last month, Yue Mei Yuan (pictured above) joined insurance technology firm Surer as chief technology officer, making the jump from the media industry, where he was technical business partner at SPH Media, to insurance.

Insurance Business caught up with Yue recently, and he talked about his career path as well as digital transformation issues encountered by both media and insurance industries.

Yue began his career as a web developer, working for various firms, such as OgilvyAction Digital, Ribbet and Ascentis, with projects for brands such as Starbucks, Changi Travel and OCBC. At Ascentis, he rose to the role of assistant vice president for engineering, where he led a team of 20 developers.

“The opportunity to join SPH Media presented itself about two years back,” Yue said. “One of the driving factors for me to join was to test and experience a different culture – that of a huge organisation – and further honed my soft skills working with multiple parties and departments. My last held role was that of a technical business partner, which enabled me to do so.”

Yue’s first exposure to the insurance industry was a project with Direct Asia, and this was a turning point in his career.

“It was something that stayed with me through my career – how the insurance industry, which is something I consider to be very important, has so much room for tech improvement and digital transformation,” he said. “When the co-founders of Surer approached me and shared their vision of creating a digital ecosystem for key parties in the industry to work more seamlessly together, it struck me as an opportunity to not only work on something that I consider to be game-changing for this important industry, but also the opportunity to be part of a journey of a growing company.”

According to Yue, there are a couple of key issues that are present in both media and insurance industries.

“First – which may not directly be technical – would be the complexities when it comes to convincing and finding a solution that works for the human enablers, who may have different goals,” Yue said. “While the tech may be available, I am always of the belief that human enablers are still core to many functions that leverage this tech (though I acknowledge the growing usefulness of AI).”

Yue said this complicates the process of driving buy-in towards digital transformation.

“What excites me with Surer is that the vision is not to build siloed, piecemeal solutions but the creation of this digital ecosystem for multiple functions to interact with and in so, solve each other’s problems while being supercharged by tech,” he said.

The second issue Yue identified was leveraging technology to make processes and workflow simpler and more efficient.

“I have seen some technical solutions that have been implemented that ended up being more of a hindrance than help, where tech is implemented for the sake of tech,” he said. “At Surer, we definitely aspire to be a practical solution first and foremost.”

Yue said that the Singaporean insurance market’s adoption of technology has been more gradual that larger markets such as China, Europe and the US. However, the COVID-19 pandemic has accelerated this, making insurers and intermediaries more receptive to digital transformation.

“We are seeing a mindset shift, where technology is now sought to be used complementarity with human enablers instead of being used to disrupt and shake up the entire industry,” Yue said. “Many insurtech firms, insurers and even intermediaries are more open to collaborations to essentially work together to deliver a better proposition to the end customer.”

With many companies are talking about digital transformation, Yue said that this is not a one-time effort and is not a “magic bullet” that solves all problems at one go.

“Management teams are now savvier to the idea that this is something that takes time and should be done in well-thought-out steps,” Yue said. “First is looking at technology to support and supercharge an existing process – the process that has been built over many years – instead of rethinking the entire process. I believe the industry in general will be a lot more collaborative, and we are already seeing big traditional insurers working with more insurtech firms to drive mutually beneficial goals. These goals should bring greater satisfaction to the end customer, the policyholder.”