Insurance premium tax (IPT) is one of those elements that those within the industry know a lot about, but consumers aren’t necessarily aware of – assuming that when their premiums rise it’s just because of ‘the big, bad insurer’.

As such, the Association of British Insurers (ABI) has attempted to address this issue by highlighting what it sees as the true impact of IPT – including the fact that it could be adding more than £100 a year to household bills.

Ahead of the autumn statement, scheduled for November 23, the ABI is calling on the Government to freeze IPT pointing out that since November 2015 the tax has been increased by two-thirds – from 6% to 10%.

The impact, of course, hits everything from car, home and pet insurance to most commercial lines – with the ABI calculating that the combined impact of the rises in IPT could have added an extra £109 to the annual insurance bill of a ‘typical’ household. Its calculations are as follows:

-More than

£32 to the average comprehensive motor policy, assuming two cars.

-Over

£12.50 to the price of the average combined buildings and contents policy.

-More than

£12 to the cost of the average pet insurance policy.

-A further

£52.50 to the cost of the average private medical insurance policy.

According to the ABI, the consequences may be going far beyond simply adding to consumer’s bills too. It believes that it may even be discouraging people from maintaining their vital insurance cover.

“It is time to stop this raid on the responsible,” said James Dalton, ABI’s director of general insurance policy.

“IPT is penalising millions of households and businesses throughout the UK who are doing the right thing by taking out insurance to protect themselves against many of life’s expensive uncertainties. The Prime Minister has said she wants to help those who are just managing. This tax impacts hardest on those least able to afford it, and often in greatest need of the protection that insurance provides. Any further hike in IPT could not only affect millions of people directly in their pocket, but result in some people reducing or dropping their insurance cover completely.”

The ABI suggests any further rise in IPT could put a further strain on many household budgets. For example:

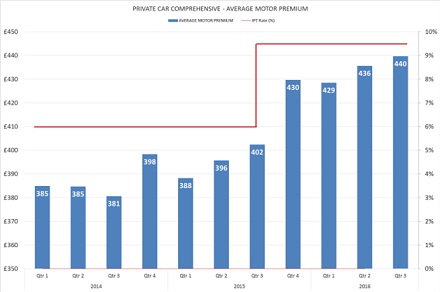

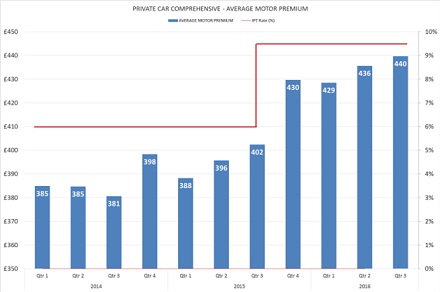

-Motor insurance. The price paid for the average comprehensive motor policy is £440 a year. This has risen 9% over the last year, as a result of rises in IPT, the cost of settling the average personal injury claim, and higher average vehicle repair bills.

-Pet insurance. Many pet owners do not have pet insurance, and any rise in the cost of cover could discourage more owners from taking out cover. Only one in four dog owners and one in seven cat owners are thought to have pet insurance, despite the average insurance claim being around £720.

-Health insurance. Any Government action that could increase the cost of private health insurance runs contrary to the desire to help relieve pressure on the NHS.

What is your opinion on IPT? Should it be frozen? Or is its impact exaggerated? Leave a comment below with your thoughts.

Related Stories:

ABI reveals plans to tackle car insurance premiums

Insurance premium tax hike deemed “indefensible”